Swiss Crypto Valley soars 132%, now home for nearly 1,750 blockchain firms

A new report shows Crypto Valley’s five-year compound growth rate hit 18.8%, with Zug remaining the hub of Switzerland’s 1,749 blockchain firms.

Crypto Valley, the blockchain hub covering Switzerland and Liechtenstein, has grown by 132% since 2020 and now includes 1,749 active companies, according to the latest CV VC Crypto Valley Company & Industry Report shared with crypto.news.

The report shows that the number of blockchain firms in Zug grew 14% over the past year, bringing its share to over 40% of all web3 companies. Zürich is next with 15%, while regions like Ticino, Geneva, and Luzern are also seeing steady growth.

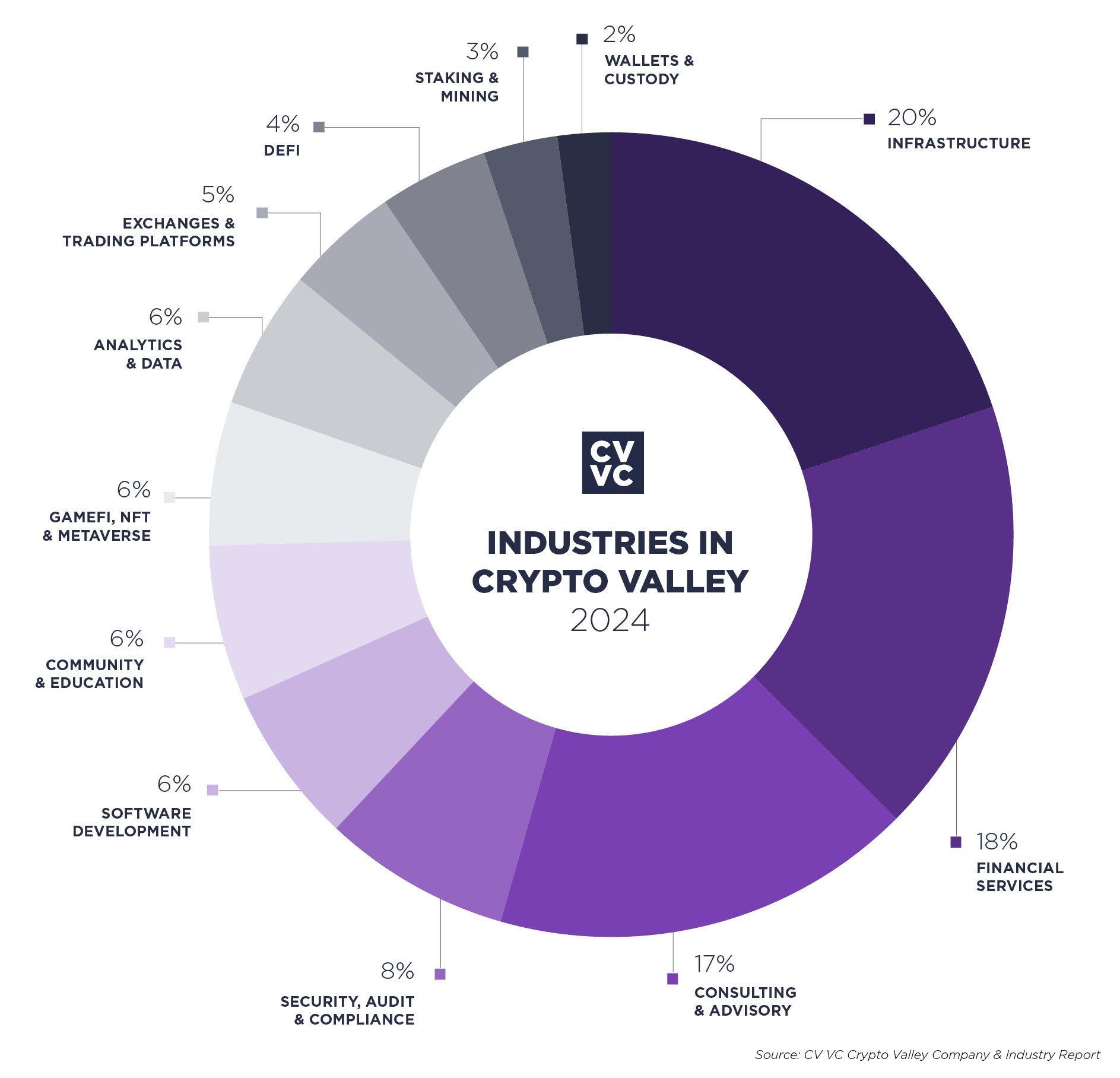

Crypto firms in Switzerland by category | Source: CV VC

Crypto firms in Switzerland by category | Source: CV VC

Mathias Ruch, chief executive of CV VC, says the latest figures “highlight how Crypto Valley maintains its leading role in the global blockchain sector,” adding that “over the past five years, Crypto Valley has weathered global challenges, evolved, and diversified while growing at a CAGR of 18.8%.”

Infrastructure and financial services are the largest sectors in Crypto Valley, accounting for 20% and 18% of firms respectively, followed by consulting and advisory at 17%. Commenting on the report’s findings, Heinz Tännler, president of the Swiss Blockchain Federation, said the data “proves that the Swiss blockchain industry is not only nationally relevant but also of global strategic importance.”

Legal structures are also shifting. While most firms are still corporations or LLCs, associations and foundations made up over 20% of new filings in 2024.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!