-

Bitcoin remains resilient above $100,000, marking a 7% increase this week, but whale movements signal a cautious market approach.

-

Despite key indicators showing bullish potential, recent whale activity indicates a mixed sentiment among large holders.

-

As noted by COINOTAG, a significant price breakthrough is needed for BTC to maintain its upward trajectory.

This article analyzes Bitcoin’s current market position, key whale activities, and the technical indicators influencing its price trajectory.

Whale Dynamics: Caution Amid Accumulation

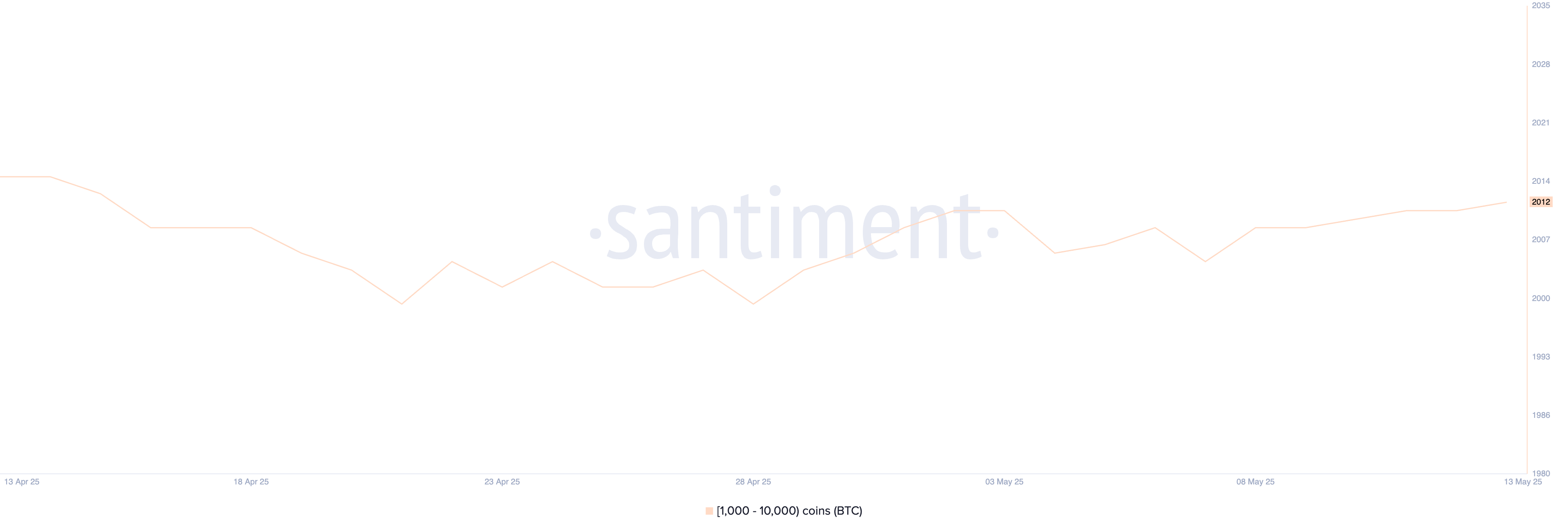

The presence of Bitcoin whales—wallets holding between 1,000 and 10,000 BTC—has increased slightly to 2,012 today, reflecting a cautious accumulation trend in the face of ongoing market volatility.

Even though this surge seems minimal, the activity of whales is crucial as it often dictates price movements. Analysts closely watch these accumulations, as increased whale holdings can reflect growing confidence in Bitcoin’s potential.

Nevertheless, the recent uptick in whale numbers presents a mixed picture. These large holders are exhibiting an inconsistent trend, alternating between periods of accumulation and profit-taking, especially as macroeconomic uncertainties persist.

Whale activity recently mirrored broader market behavior, contributing to $96 million in outflows from Bitcoin ETFs, indicating cautious investor sentiment.

Technical Indicators: A Bullish Yet Indecisive Outlook

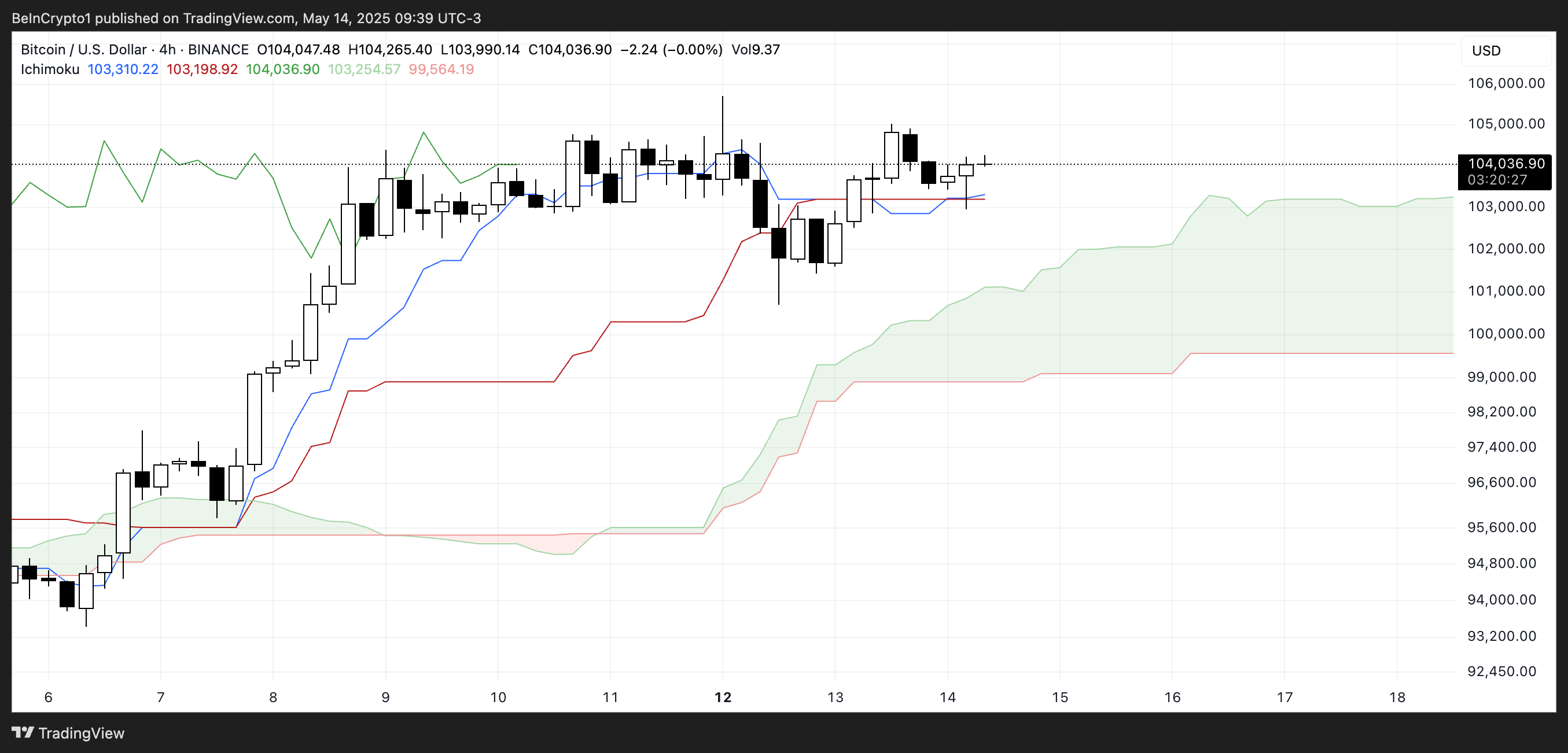

The Ichimoku Cloud for Bitcoin displays a neutral-to-bullish trend, where current price levels remain above critical support lines, despite signs of indecision in the market.

The position of the Senkou Span A above Span B suggests that the overall trend remains positive, yet the price’s sideways movement raises questions about the strength of this bullish sentiment.

For Bitcoin to regain a stronger uptrend, it is essential for the short-term averages to decisively cross above longer-term averages, alongside a significant cloud formation.

Strategic Price Levels: Navigating Resistance and Support

Holding above the critical level of $100,000 for six consecutive days, Bitcoin’s price action now hinges on breaking through immediate resistance levels. The EMA indicators suggest this bullish momentum could persist if certain thresholds are surpassed.

A successful breach of the $105,705 resistance could catalyze a journey toward $110,000, a pivotal milestone for Bitcoin’s price history.

However, if momentum falters, the first line of defense lies at $101,296, with potential further corrections to $97,766 looming on the horizon. Investors are keen to monitor these movements closely as the market develops.

Conclusion

In summary, Bitcoin remains above the crucial $100,000 mark, buoyed by cautious whale accumulation and supportive technical indicators. However, the mixed sentiment among larger holders presents a challenge for bullish continuation. Observing key resistance and support levels will be crucial for traders as they navigate this complex market landscape.