-

XRP’s recent decline of 3.3% raises eyebrows as analysts predict potential market corrections in the cryptocurrency space.

-

Market sentiment reflects caution, with XRP hitting a peak of $2.65 before retracing, indicating investors are re-evaluating their strategies.

-

Crypto analyst “Man of Bitcoin” warns that XRP’s current Elliott Wave structure suggests an impending price correction.

Explore XRP’s recent price movements and expert analysis predicting market corrections, highlighting critical resistance and support levels.

Understanding XRP’s Current Price Dynamics

Recently, XRP faced a 3.31% decline in its price, settling at $2.50. This drop follows a rally that saw the altcoin peak at $2.65. Analysts are closely monitoring the Elliott Wave analysis, which indicates a potential wave 2 correction. The critical level to watch is $2.33, acting as a validation point for further downside movement.

The Role of Market Sentiment and Technical Indicators

Analysts emphasize that the market’s current sentiment, as indicated by the MVRV at 2.9, remains in a neutral zone. This suggests that the conditions are not yet ripe for a strong market top, which typically appears above 3.5. The recent price movements can be attributed to profit-taking by investors amid speculative buying, as the altcoin’s support for a correction is forming between $2.19 and $1.79.

According to expert sources, if XRP breaks below the key descending trend line, this could confirm the beginning of the expected correction, emphasizing the importance of risk management for investors.

Is XRP’s Price Rally Sustainable?

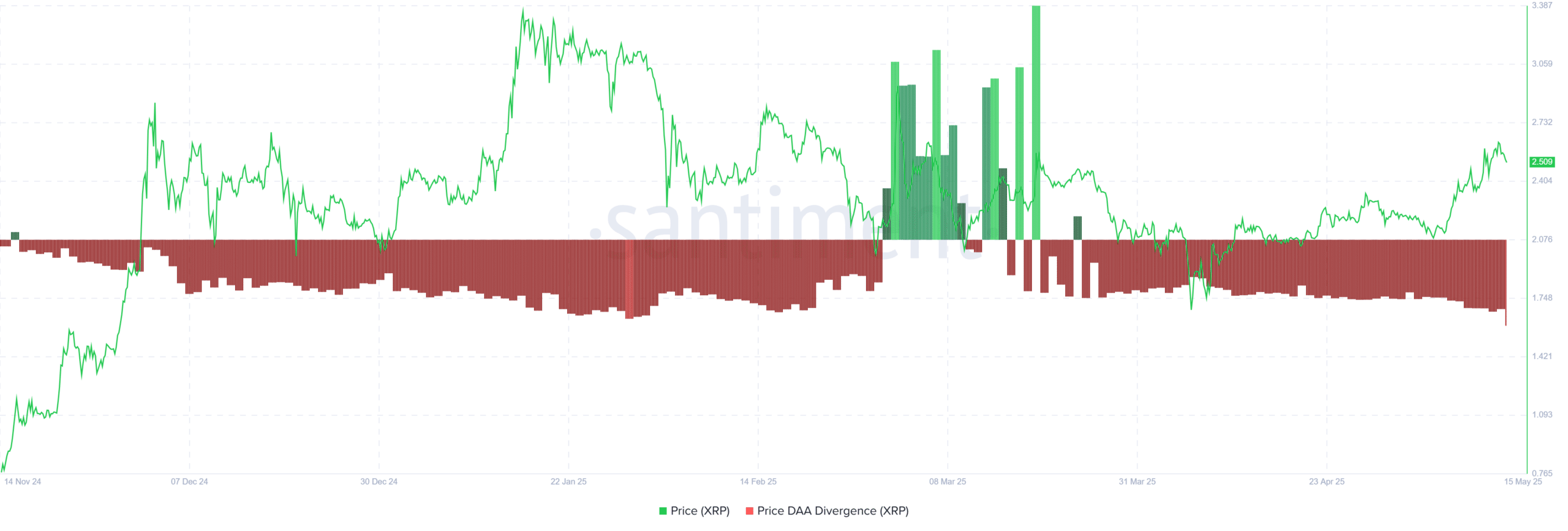

Recent analyses reveal that XRP’s rally was largely speculative, with a lack of genuine demand propelling prices. The Price–DAA Divergence has remained negative, indicating that price increases are not supported by a growing user base. Such a divergence typically signals an unsustainable price movement that could lead to future corrections.

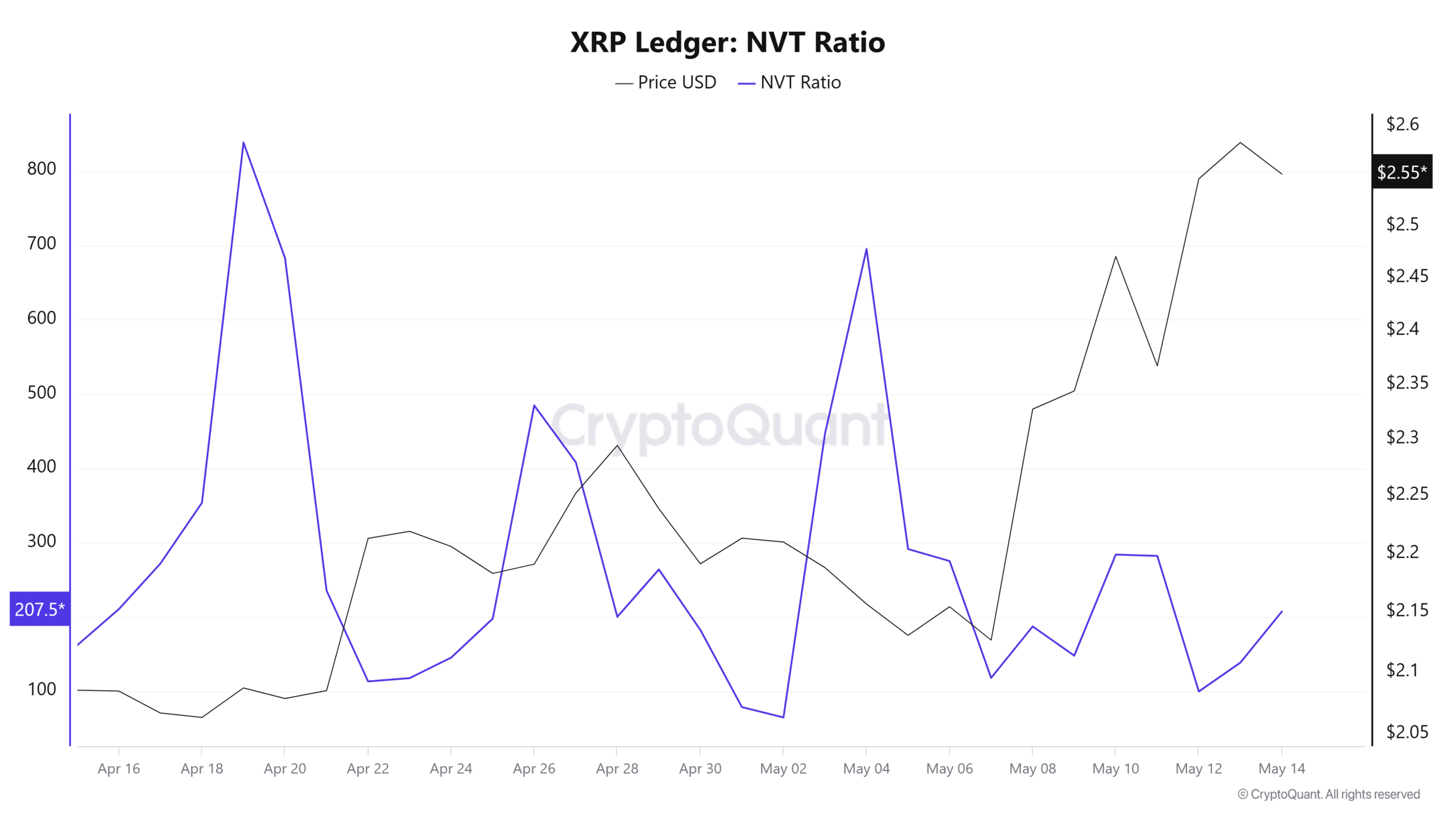

The NVT Ratio has also surged from 99 to 207, further confirming that the recent price uptrend lacks strong backing from transaction volume. A higher NVT Ratio typically warns that valuation is outpacing actual network activity, which can precede a price correction.

Future Outlook for XRP

As XRP contemplates its next moves, the current downward retracement shows correlation with broader market trends. While further decline, such as a drop to $2.19, seems unlikely at this point, technical indicators suggest a potential support level at $2.34. Conversely, if market sentiment shifts positively, XRP could aim to reclaim the key resistance at $2.56.

Conclusion

In summary, while XRP’s recent price drop may seem concerning, the overall market sentiment and technical indicators suggest that significant losses are not imminent. The current MVRV indicates that a strong market top is unlikely, providing a silver lining for investors looking to navigate these volatile conditions.