Blockchain Tech Firm Chooses Ethereum Over Bitcoin with $57.8 Million Investment Plan

BTCS is taking a strategic step to acquire $57.8 million in Ethereum, positioning itself for growth in the blockchain space. The initiative aims to increase Ethereum holdings, boost staking rewards, and potentially influence corporate digital asset strategies.

BTCS, a blockchain infrastructure technology firm, announced that it plans to acquire $57.8 million worth of Ethereum (ETH). It intends to leverage its increased ETH holdings to expand its node deployment, boost staking rewards, and optimize block production economics.

The company seeks to raise the necessary funds for this purchase by issuing convertible notes under an agreement with investment manager ATW Partners.

BTCS Makes Bold $57.8 Million Ethereum Bet

In the latest press release, BTCS revealed that it had issued the first batch (or tranche) of convertible notes worth $7.8 million. There is also scope for issuing more notes up to an additional $50 million.

Nonetheless, this requires mutual approval from BTCS and ATW Partners. The notes are convertible into common stock at a price of $5.85 per share, a 194% premium to BTCS’s stock price of $1.99 on May 13.

They have a two-year maturity, with a 5% discount on the original issue and a 6% annual interest rate. Investors also received warrants for the purchase of nearly 1.9 million shares of common stock at $2.75 per share.

BTCS CEO Charles Allen contributed $95,000 to the initial offering, with an additional $200,000 provided by a trust from which he benefits.

“Similar to how MicroStrategy leveraged its balance sheet to accumulate Bitcoin, we are executing a disciplined strategy to increase our Ethereum exposure and drive recurring revenue through staking and our block building operations—while positioning BTCS for meaningful appreciation should ETH continue to rise in value,” Allen said.

He believes this decision to acquire ETH comes at a crucial moment in the altcoin’s growth. BeInCrypto reported that the recent Pectra upgrade implementation boosted the Ethereum network, catalyzing an increase in the number of active addresses and the burn rate.

Moreover, the price also jumped to two-month highs, but a modest correction followed. According to BeInCrypto data, over the past day, ETH has dipped by 3.8%. At the time of writing, it traded at $2,545.

ETH Price Performance. Source:

TradingView

ETH Price Performance. Source:

TradingView

While Ethereum didn’t benefit from BTCS’ news, its own stock did. This reflected investor confidence in the company’s strategic pivot.

Google Finance data showed that the stock price jumped 5.5%. However, year-to-date, its value has declined by 14.9%.

BTCS Stock Performance. Source:

TradingView

BTCS Stock Performance. Source:

TradingView

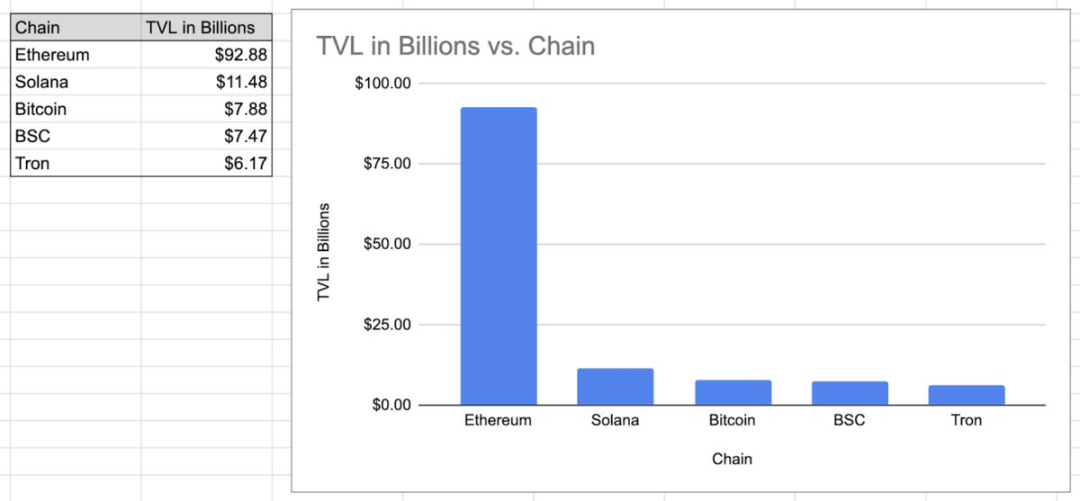

Meanwhile, the announcement comes amid a broader trend of publicly traded companies diversifying their balance sheets with digital assets. However, BTCS’s approach positions it as a contrarian player in the space, diverging from the Bitcoin (BTC)-focused strategies adopted by firms like Strategy (formerly MicroStrategy), Metaplanet, and 21 Capital.

While these firms have benefited from BTC holdings, BTCS’s initiative, if successful, could influence other firms to explore alternative digital assets beyond Bitcoin. This could potentially reshape corporate treasury strategies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AiCoin Daily Report (September 11)

Cboe to debut bitcoin and ether Continuous futures in November

Cboe Futures Exchange aims to introduce long-dated crypto contracts under US regulatory oversight

The Internet is building a native financial system, and the key to success or failure still lies in user experience.

Infrastructure provision is possible, but user experience wins everything.

Why are perpetual contracts inevitably part of general-purpose blockchains?

The future trend is that perpetual contracts (and all "killer applications") will make leading general-purpose blockchains even more powerful.