Parsing the data for hints of US tariff impacts

Tariffs are now live and being collected. But what does data say about their initial impacts on the economy…and who’s footing the bill?

This is a segment from the Forward Guidance newsletter. To read full editions, subscribe .

We’re entering the phase where we can see the impact of tariffs on the economy and gauge how companies are responding to these price increases.

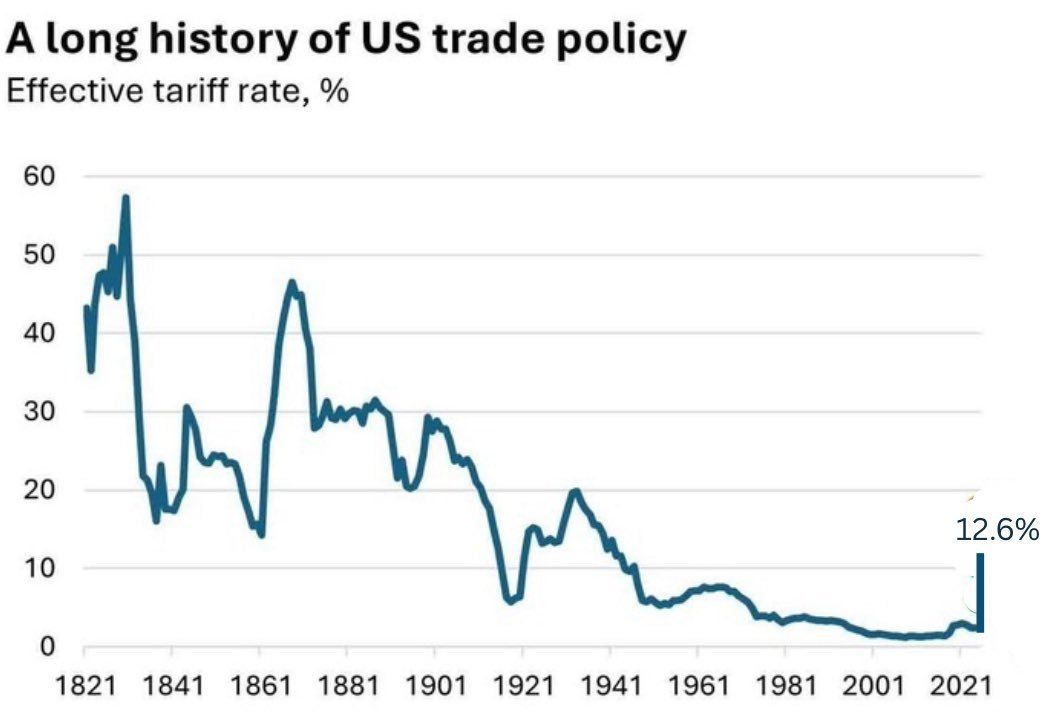

We’d forgive you for not knowing what the current tariff rates are, considering they change quite frequently. As for the China 90-day pause agreement , the aggregated effective tariff rate is somewhere around 12.6%:

We’re now also seeing tariff revenue actively being collected:

We’re now well within the phase where corporations must decide to either absorb cost increases or pass them onto consumers. The result of this calculus will set the stage for how the economy navigates the next 12 months and who bears the brunt of it.

Some of the economic data released today hints at the answer:

PPI

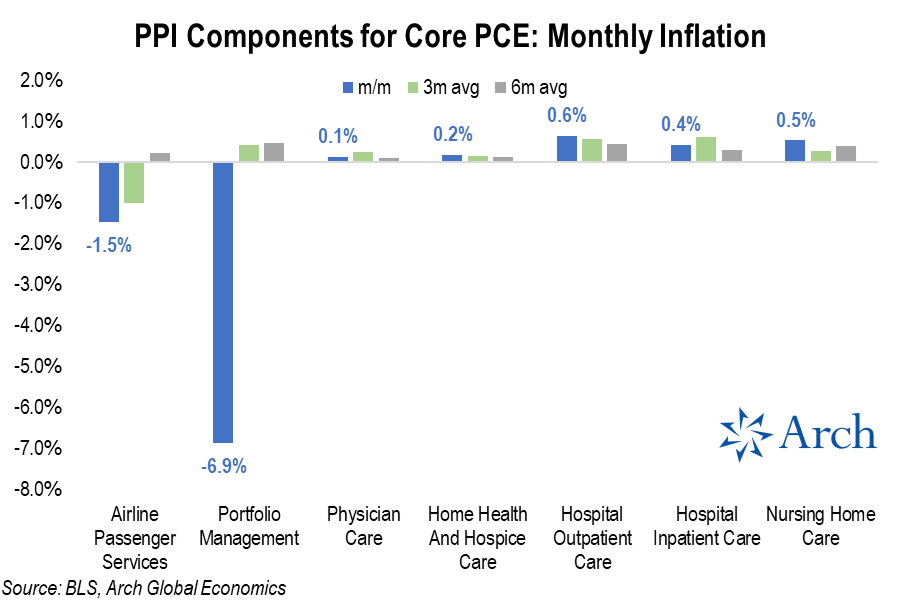

We saw a huge downside miss in PPI today. When you dig into the data, it becomes apparent that the miss was largely caused by a big decrease in portfolio management fees.

This was due to the market crash in April:

This downtick masked interesting insights into how much price increases are being passed to consumers vs. being absorbed by corporations.

Economist Parker Ross outlined how most of the increases are being absorbed by corporations, for now:

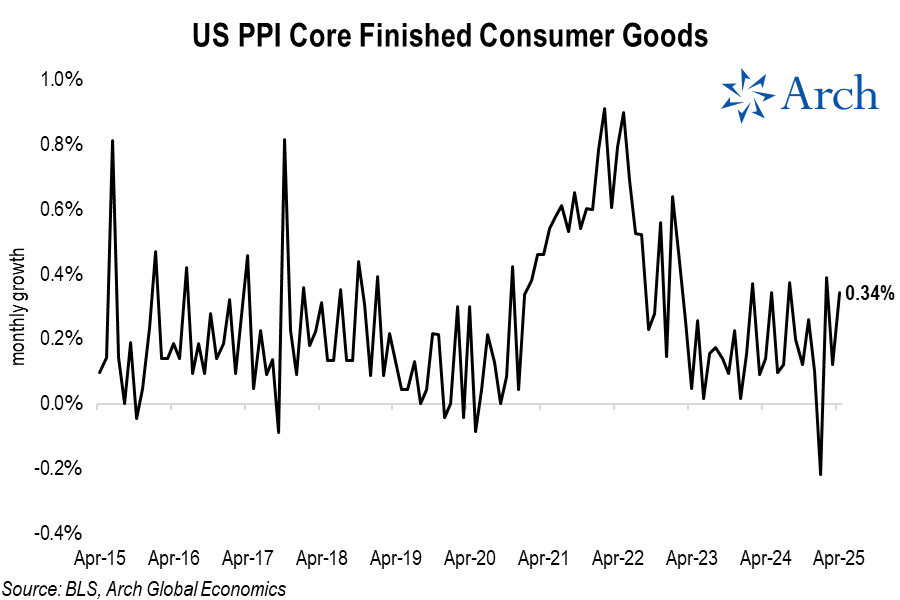

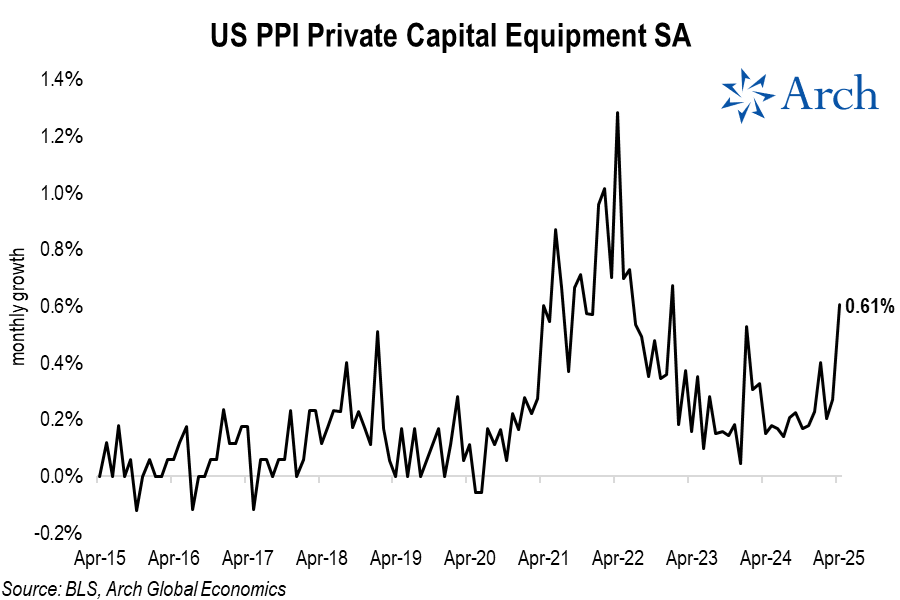

“So far, it looks like the impact of tariffs is generally not being meaningfully passed on to consumers, but they do appear to be getting passed on to businesses.”

“We see this in the limited acceleration in PPI for core finished consumer goods contrasted against the sharp acceleration in PPI for private capital equipment to 0.61%, the strongest monthly gain outside of the pandemic since 2008.”

Retail sales

We also received the retail sales print today, which illuminates how consumption habits are shifting based on the tariff implementation.

Categories not impacted by tariffs (like food services) surged. On the other hand, categories heavily impacted by tariffs, such as big box retailers and sporting goods — where a lot of frontrunning occurred before the tariffs went live — are now cratering:

This dynamic is a small example of what is likely to happen as the economy digests tariffs: frontrunning before the tariffs, then a singular price level increase, then demand destruction as higher prices lead to decreased demand.

As we navigate the next few months, the economic data will be extremely noisy.

As we can see from these two prints, it’s essential to dig beneath the topline numbers to better understand what’s driving the numbers.

Get the news in your inbox. Explore Blockworks newsletters:

- The Breakdown : Decoding crypto and the markets. Daily.

- Empire : Crypto news and analysis to start your day.

- Forward Guidance : The intersection of crypto, macro and policy.

- 0xResearch : Alpha directly in your inbox.

- Lightspeed : All things Solana.

- The Drop : Apps, games, memes and more.

- Supply Shock : Bitcoin, bitcoin, bitcoin.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!

Bitget Live Trading Competition: Share 20,000+ USDT Prize Pool