Analyst: Recent Ethereum Rebound Driven by Short Covering, Not Entirely Due to New Demand

BlockBeats reports that on May 16, according to CoinDesk, CF Benchmarks CEO Sui Chung stated in an interview: "The recent rise in Ethereum is mainly due to short covering—traders closing bearish positions—rather than a strong bullish sentiment in the market."

During the process of short covering, short sellers repurchase the futures contracts they previously sold. This operation increases market demand in the short term, thereby exerting upward pressure on prices.

Chung pointed out that the premium (also known as the basis) of CME Bitcoin futures remains at a low level, which indicates that the current rise is primarily driven by short covering.

Chung added: "In more typical market scenarios, if traders start using leverage to establish new long positions, we usually see the basis level rise. This phenomenon reminds us that not all rallies are driven by new demand; sometimes they merely reflect position adjustments and risk reduction."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

American Federation of Teachers: Senate cryptocurrency bill will endanger pensions and the overall economy

U.S. stock market opens with the Dow Jones flat

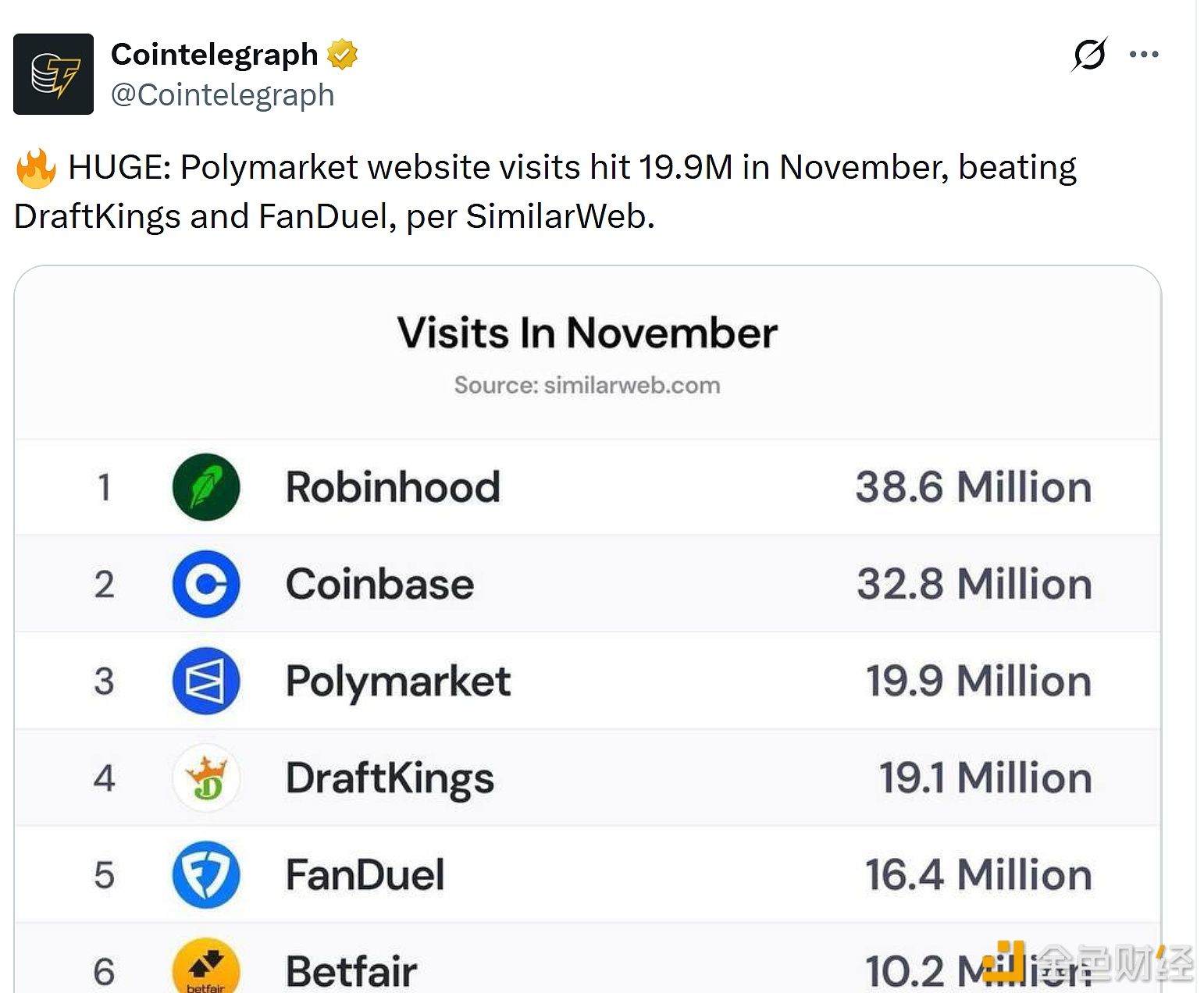

Polymarket website received 19.9 million visits in November