Russia-focused darknet crypto sales jump 68% as global revenue falls: Chainalysis

While global darknet crypto sales fell by double digits over the past year, Russia’s darknet market Kraken still saw a big jump in crypto trade, Chainalysis says.

Global cryptocurrency sales on darknet markets dropped by 15% in 2024, though Russia ‘s darknet market scene tells a different story with one platform bucking the trend, according to new data from blockchain forensic firm Chainalysis .

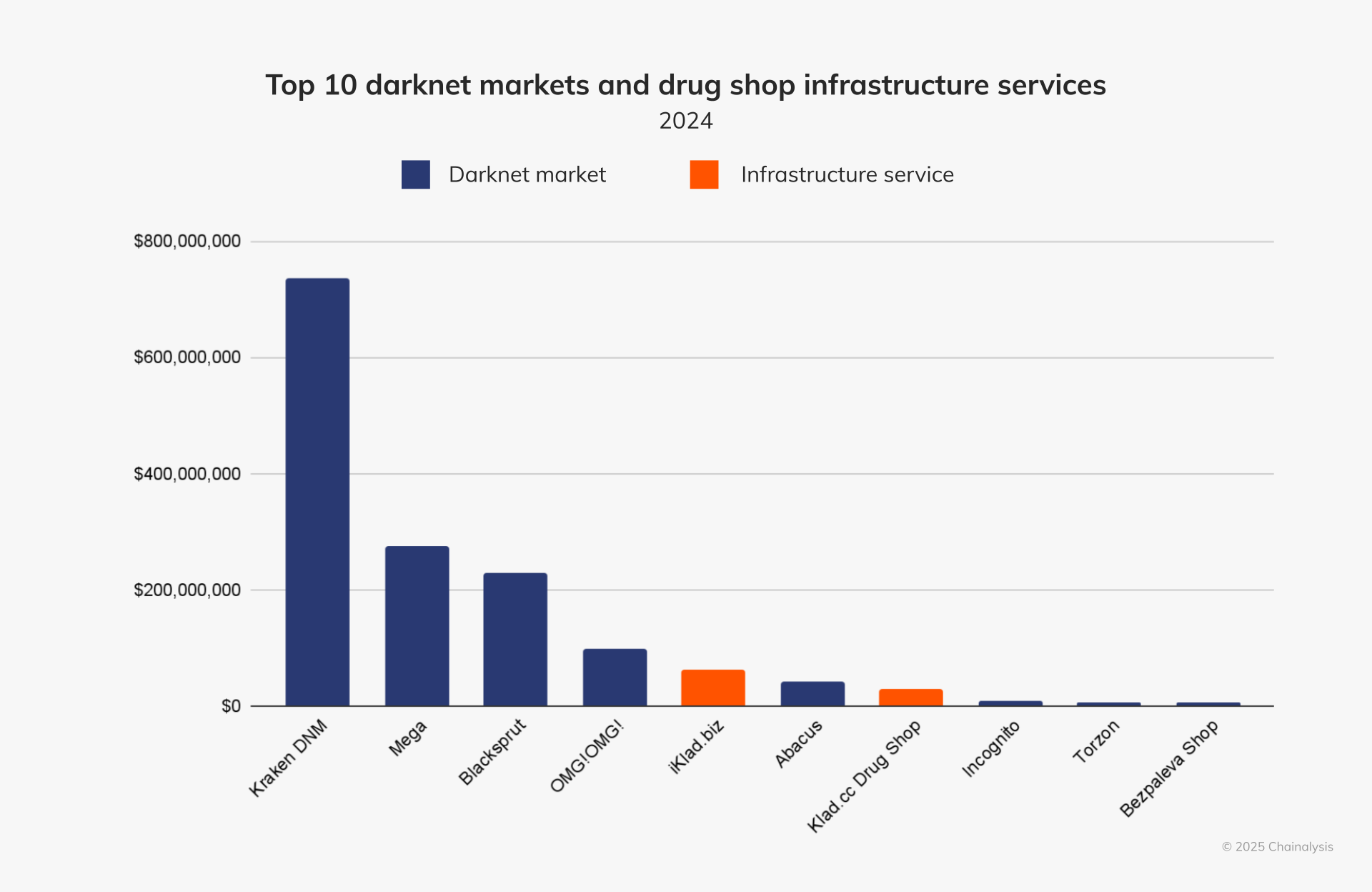

In a blog post, Chainalysis revealed that while total revenue on darknet markets dropped 15% in 2024 due to years of international law enforcement efforts, crypto sales on a Russia-focused darknet market still jumped 68%. The platform, known as Kraken, has become “the leading darknet market by annual revenue” since the closure of Hydra, Russia’s largest darknet market, in April 2022.

Top darknet marketplaces by revenue | Source: Chainalysis

Top darknet marketplaces by revenue | Source: Chainalysis

While Mega, once the main drug supplier for vendors on other darknet sites, saw its inflows drop by over 50% year-over-year, Kraken grew nearly 68% YoY, handling $737 million on-chain in 2024, Chainalysis noted.

Despite the global downturn, Chainalysis noted that darknet markets still process hundreds of millions of dollars in crypto each year. But law enforcement crackdowns and blockchain transparency have pushed many operators to move away from Bitcoin ( BTC ) due to its inherent transparency.

Many operators have since “moved to accepting only Monero” ( XMR ), a privacy coin with features designed to boost anonymity and reduce traceability, Chainalysis noted.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!