-

Bitcoin’s accumulation trend strengthens as whales and retail investors position for a potential bullish breakout amidst market resistance.

-

While Bitcoin faced resistance at $106K, with RSI nearing overbought conditions, signs of renewed buying interest create a tense yet optimistic atmosphere for investors.

-

“The market is showing a remarkable resilience, suggesting that both whales and retail are betting on upward momentum,” according to an analysis from COINOTAG.

Bitcoin sees renewed accumulation trends as investors ready for potential bullish breakout, while market pressures create high-stake scenarios.

Bitcoin wallets enter buy mode, signaling bullish interest

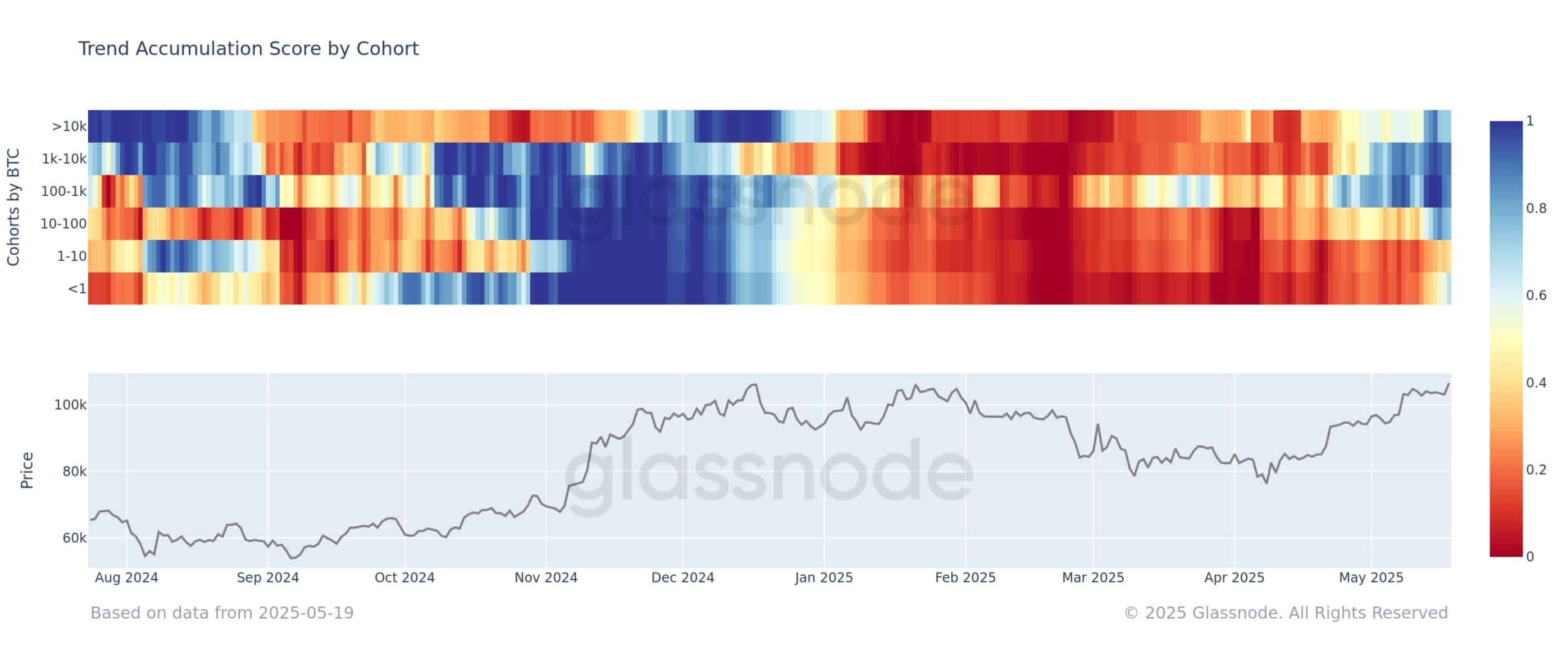

Recent data from Glassnode revealed a clear change in market behavior, with accumulation trends now increasingly evident across varying wallet sizes. Smaller holders, defined as those possessing less than 1 BTC, have transitioned from distribution to accumulation, evidenced by an accumulation score of approximately 0.55. This suggests a shift in sentiment toward a more positive outlook.

Source: Glassnode

In contrast, larger wallets holding between 100–1,000 BTC and 1,000–10,000 BTC are also exhibiting significant accumulation behaviors. Interestingly, the only segment demonstrating net distribution is the 1–10 BTC range, which reinforces a broader resurgence in investor confidence toward Bitcoin’s price action.

Clustered long positions pose risks of volatility

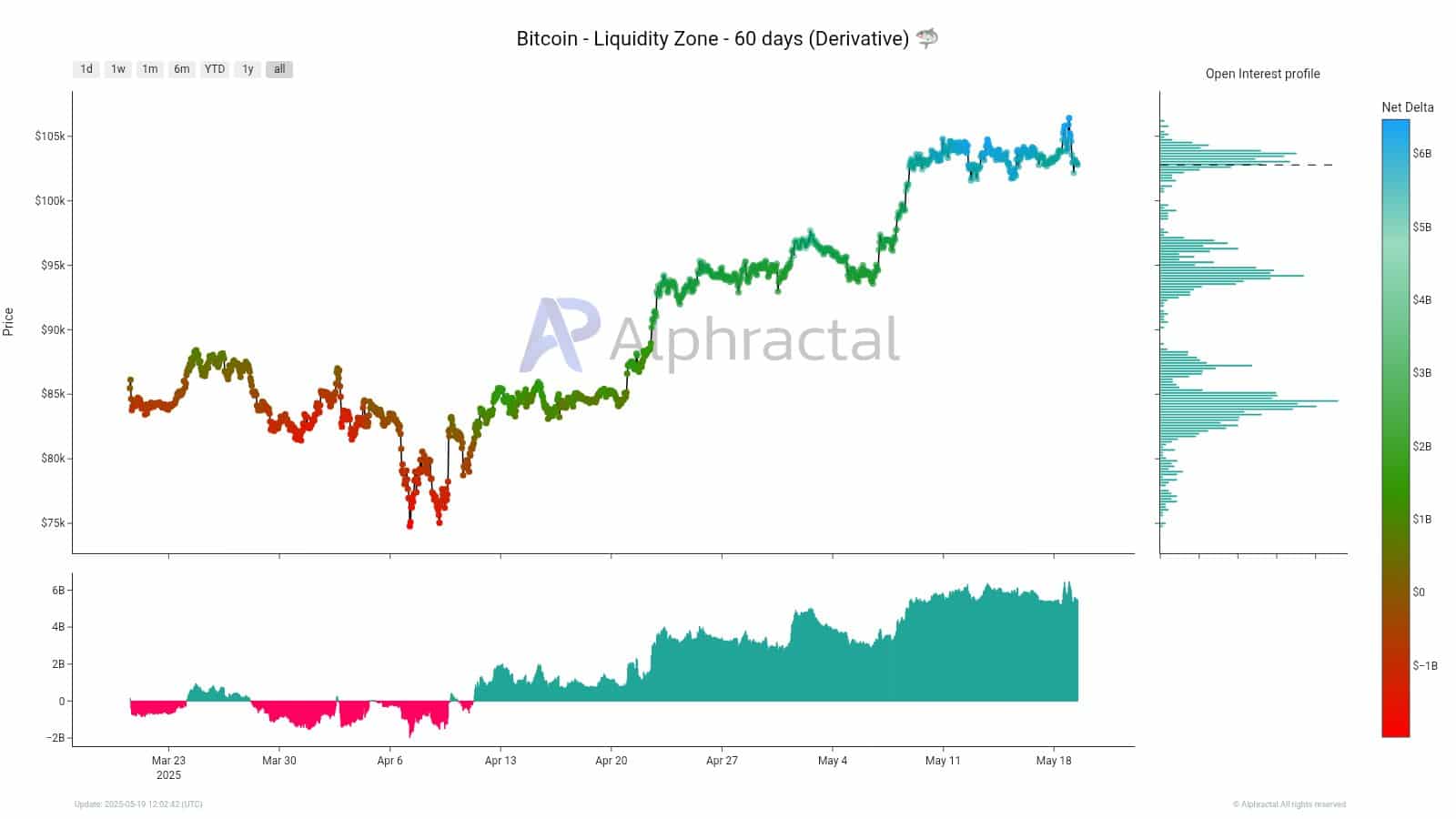

A significant concentration of long positions between $101K and $106K has emerged, creating a high-risk liquidity zone. According to Alphractal data, this setup substantially increases the market’s susceptibility to rapid liquidation events, particularly if Bitcoin’s price descends below the $100K threshold.

Source: Alphractal

Conversely, the potential for short liquidations during upward price movements appears limited. Given the heavy concentration of long positions within this liquidity zone, any sign of weakness in Bitcoin could quickly lead to forced selling and elevated volatility.

Price stalls as market tests resistance levels

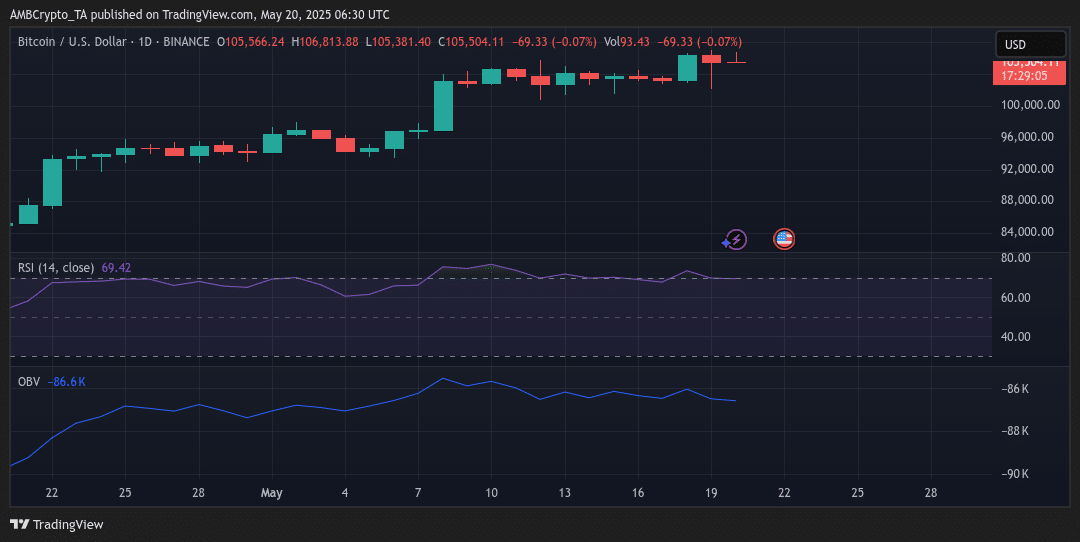

As illustrated on the daily chart, Bitcoin exhibited signs of exhaustion just under the $106K mark. It briefly touched $106,813 but failed to maintain a daily close above this critical resistance, retreating to $105,504 at the time of writing.

Source: TradingView

As of now, the RSI is positioned at 69.42, indicating it hovers just below overbought conditions—signaling a potential slowdown in bullish momentum. Furthermore, the OBV has stagnated around -86.6K, suggesting a pause in buying pressure.

If Bitcoin can maintain support above $105K, a breakout toward $110K appears plausible. However, a drop below $101K could ignite long liquidations and accelerate downside volatility.

Conclusion

The current landscape suggests that while there are signs of renewed interest in Bitcoin, the accumulation trends and concentrated long positions present a double-edged sword. The market dynamics could favor bullish moves if the critical resistance levels are surpassed; however, any bearish developments could lead to significant volatility, emphasizing the need for cautious trading strategies going forward.