Will FTX’s $5 Billion Repayment Trigger an Altcoin Season in June 2025?

Altcoin momentum is slipping as Bitcoin reclaims dominance, with the Altcoin Season Index falling sharply despite hopes pinned on FTX’s upcoming $5 billion payout.

Altcoin Season expectations are fading as recent indicators point to weakening momentum. While FTX’s upcoming $5 billion repayment on May 30 could inject fresh liquidity into the market, capital is shifting back into Bitcoin.

BTC dominance has rebounded, and the ETH/BTC ratio has declined, both suggesting altcoins are losing strength. The Altcoin Season Index has dropped to 25, confirming that Bitcoin remains firmly in control for now.

FTX’s $5 Billion Repayment Could Fuel June Altseason — But Momentum Is Fading

FTX will distribute over $5 billion to approved creditors on May 30, marking one of the largest single-day payouts in crypto bankruptcy history.

Many analysts believe this sudden liquidity injection could reignite altcoin momentum in June, as recipients may look to reinvest in the market.

BTC Dominance (%). Source:

TradingView.

BTC Dominance (%). Source:

TradingView.

That optimism briefly aligned with market structure—between May 7 and May 13, Bitcoin dominance dropped sharply from 65.5% to under 62.2%, a nearly 5% decline that fueled speculation that an altcoin season was underway.

However, that sentiment has since cooled: from May 14 to May 20, BTC dominance climbed back 3%, reversing much of the prior week’s shift and suggesting capital is rotating back into Bitcoin.

Another key signal, the ETH/BTC ratio, tells a similar story. Between May 7 and May 13, Ethereum gained significantly against Bitcoin, with the ratio climbing almost 38%, further amplifying the belief that a broader altcoin breakout was beginning.

ETH/BTC Ratio. Source:

TradingView.

ETH/BTC Ratio. Source:

TradingView.

But in the following week—May 14 to May 20—that same ratio dropped 8.7%, indicating weakening relative strength for ETH and dampening altseason expectations.

These shifts suggest that while the FTX payout may inject fresh capital, the altcoin season narrative is losing momentum—at least for now.

Altcoin Momentum Fades as Index Hits 25 — Will FTX Liquidity Change That?

The total crypto market cap, excluding Bitcoin, is currently at $1.17 trillion, up from $1.01 trillion on May 7 but down sharply from $1.26 trillion on May 13.

This trend suggests that while altcoins saw a brief wave of inflows in early May, the momentum has weakened, with nearly $90 billion exiting the space in just one week. The pullback highlights a lack of sustained confidence in a full-scale altcoin rally.

Crypto Total Market Cap (Excluding BTC). Source:

TradingView.

Crypto Total Market Cap (Excluding BTC). Source:

TradingView.

However, the upcoming $5 billion liquidity injection from FTX repayments on May 30 could restore the capital altcoins need to reignite momentum and possibly spark an altcoin season in June.

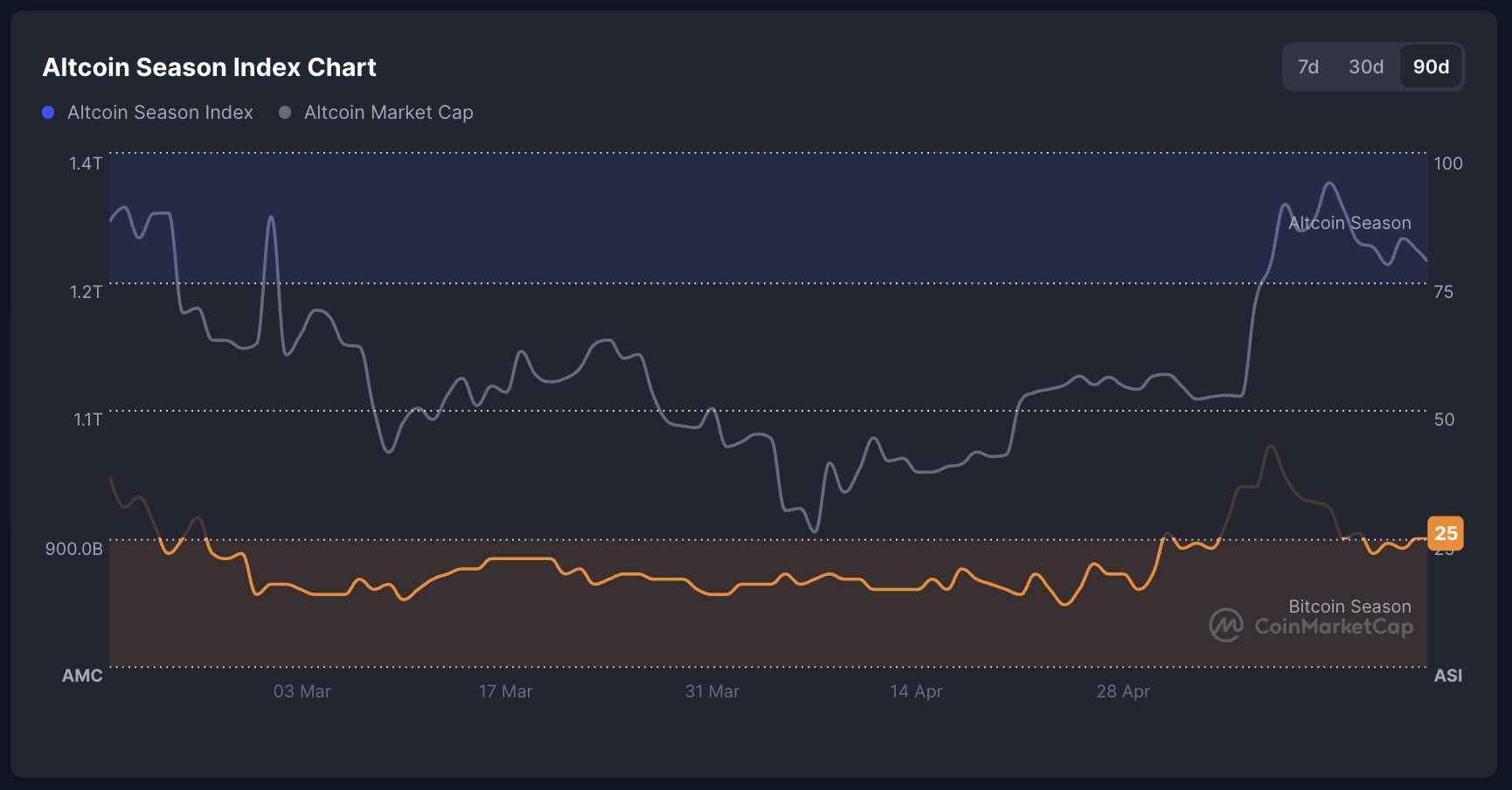

Meanwhile, the Altcoin Season Index, tracked by CoinMarketCap, has dropped from 43 on May 9 to 25—officially entering Bitcoin Season territory.

Altcoin Season Index. Source:

CoinMarketCap.

Altcoin Season Index. Source:

CoinMarketCap.

The index measures how many of the top 100 coins (excluding stablecoins and wrapped assets) have outperformed Bitcoin over the last 90 days. A score above 75 signals Altcoin Season, while below 25 indicates Bitcoin dominance.

With only a quarter of top coins outperforming BTC, the index confirms that Bitcoin is currently back in control, though the upcoming liquidity surge could still flip the trend.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitget Spot Margin Announcement on Suspension of SANTOS/USDT, MYRO/USDT, DUSK/USDT, PHB/USDT, ALPINE/USDT Margin Trading Services

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US