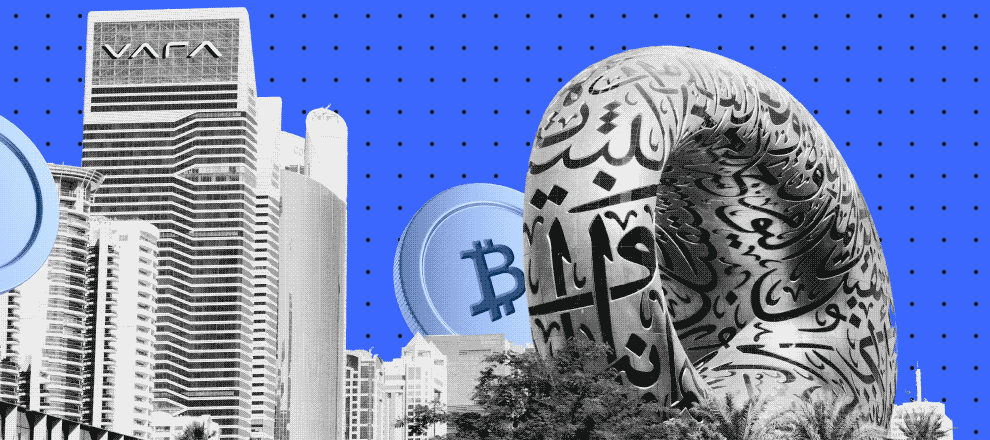

All licensed companies in Dubai must comply with the updated regulations from the Virtual Assets Regulatory Authority (VARA) by June 19, 2025.

Dubai’s financial regulator, VARA, issued an updated version of its regulatory framework governing margin trading, token distribution, and collateral management for companies offering virtual asset services in the region.

The updated rules apply to seven core types of virtual asset activities:

- crypto transfers;

- brokerage and exchange services;

- custody and asset management;

- lending involving digital currencies;

- advisory services.

VARA places particular emphasis on strengthening market protection mechanisms and risk management, especially in the area of margin trading. Under the new rules, crypto margin trading in the region is allowed only for qualified and institutional investors. Retail clients are prohibited from accessing such services. Service providers are also required to ensure sufficient collateral to meet client obligations and comply with strict initial and maintenance margin requirements.

Moreover, companies must provide clients with monthly reports on the movement of funds in margin accounts and promptly notify them if collateral levels fall below the set threshold. If a client fails to replenish the required margin, the service provider is obliged to liquidate part of the assets to restore the necessary collateral level.

VARA’s new regulations also clarify several definitions related to digital asset collateral agreements and unify compliance requirements for all licensed activities involving virtual assets. The initiative aims to increase transparency and enhance oversight of cryptocurrency operations in the UAE.

All companies in the region must comply with the new regulatory requirements within a 30-day transition period. VARA is ready to actively engage with licensed organizations, providing necessary support to help them adapt to the new rules. Companies that fail to comply by June 19, 2025, may face sanctions, including fines and license suspensions.

In 2024, Dubai adopted a legislative framework for digital assets, tightening control over crypto license applicants. Additionally, UAE financial regulators agreed that supervision of crypto companies in the country would be conducted jointly.