Should You BUY Bitcoin Now, or SELL?

Bitcoin Breaks $108K: Is Now the Time to Buy?

Bitcoin (BTC) has surged beyond $108,000, reigniting excitement across the crypto market. With momentum picking up and institutional investors doubling down, many are asking the same question:

Should you buy Bitcoin now—or wait for a dip?

A perfect storm of institutional adoption, shrinking supply, and technical strength powers the latest price rally. And perhaps the biggest news of all is coming from the world’s largest asset manager: BlackRock .

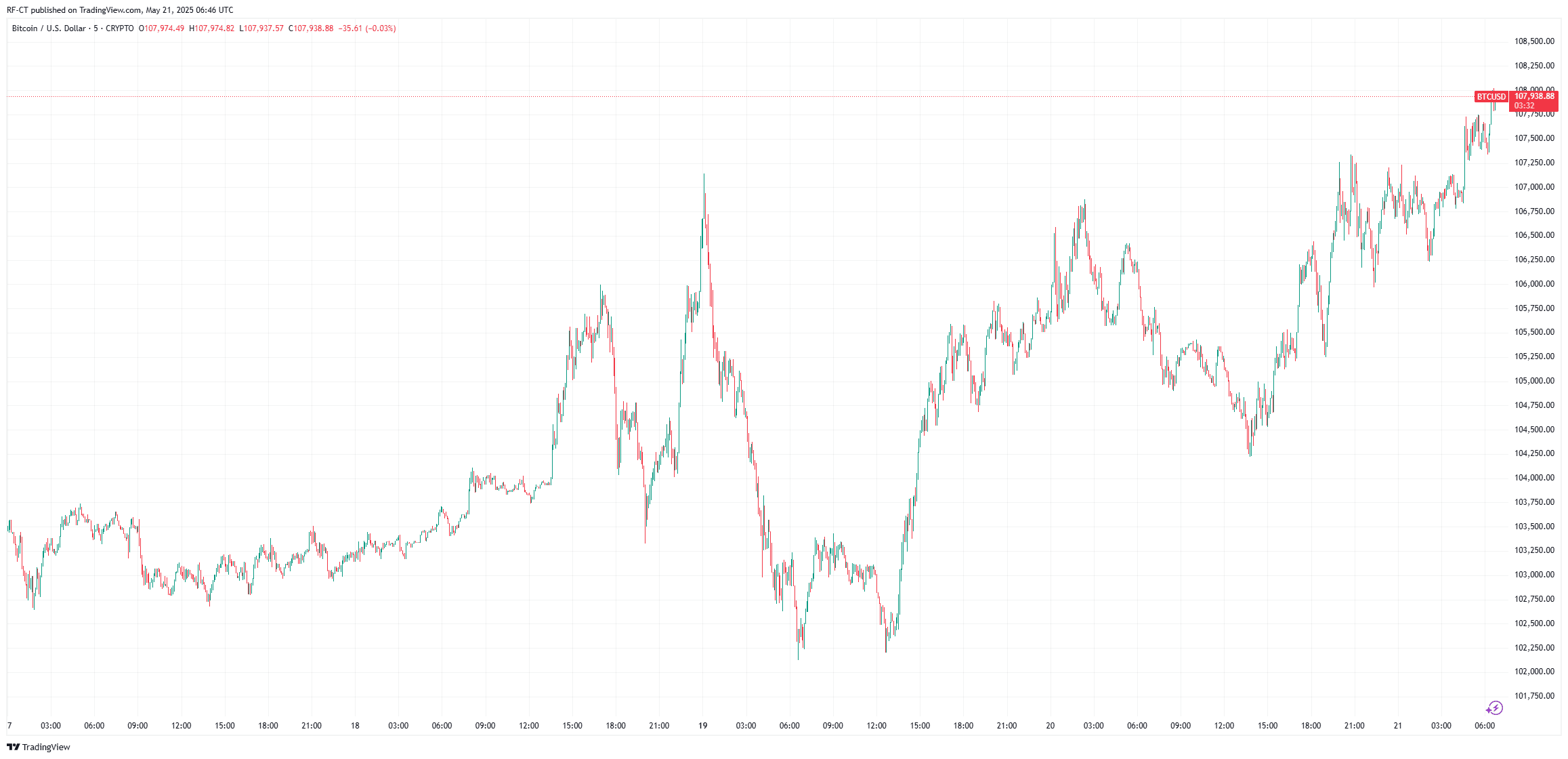

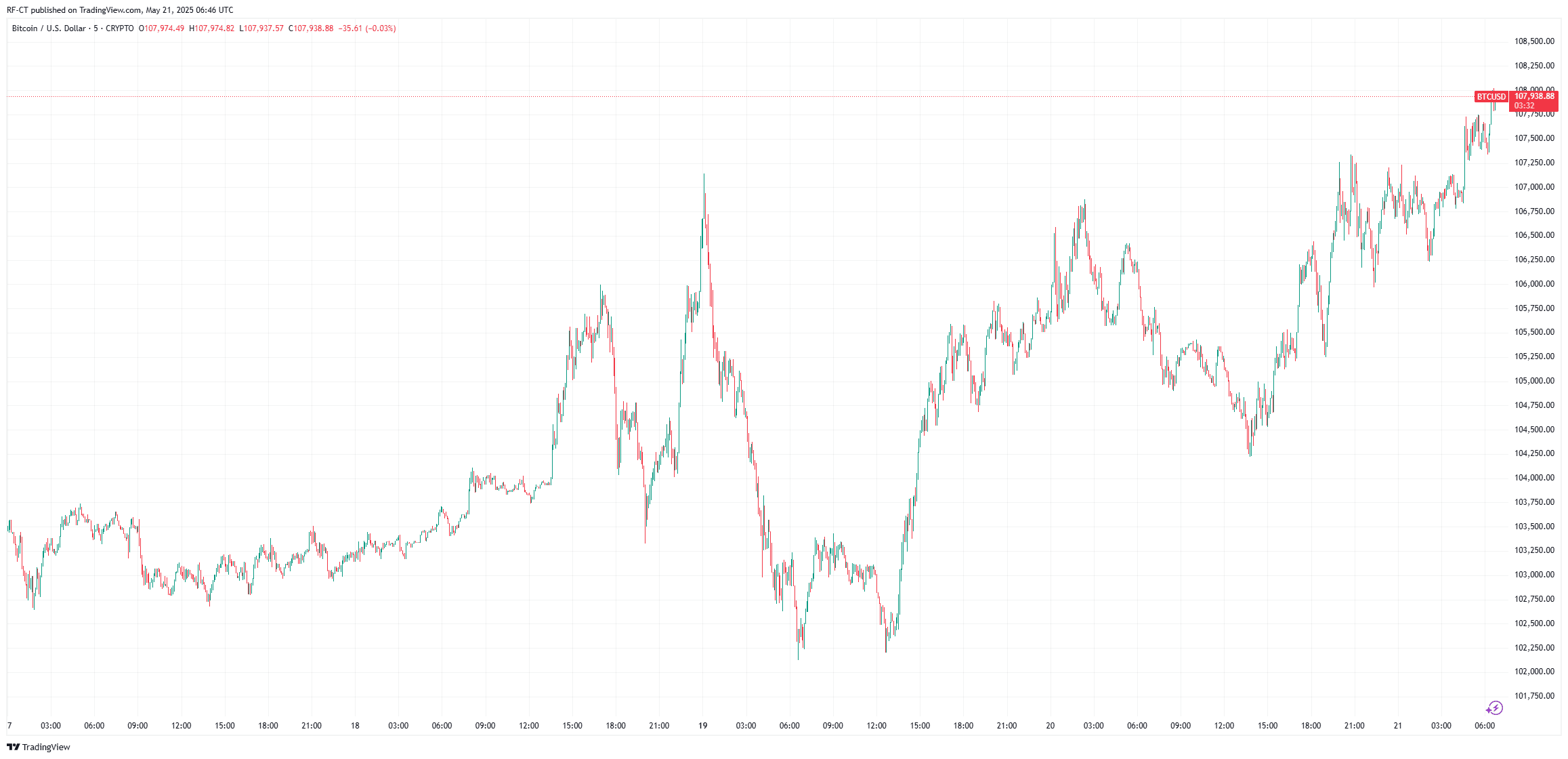

By TradingView - BTCUSD_2025-05-21 (5D)

By TradingView - BTCUSD_2025-05-21 (5D)

BlackRock’s IBIT Set to Surpass Satoshi’s BTC Holdings

BlackRock’s iShares Bitcoin Trust (IBIT) now holds over 636,000 BTC, putting it on a trajectory to overtake Satoshi Nakamoto’s estimated 1.1 million BTC holdings by summer 2025. That’s more than 57% of the way there.

This institutional milestone marks a shift in Bitcoin’s ownership landscape—from anonymous origin to Wall Street giants. With over $46 billion in inflows and ETF demand accelerating, the move validates Bitcoin’s role as a serious asset class.

ETF analyst Eric Balchunas noted that if Bitcoin hits $150K, IBIT’s BTC stash could surpass Satoshi’s even sooner.

Should You Buy Bitcoin Now? Pros and Cons

✅ Why Buying BTC Now Makes Sense:

- ETF Accumulation Is Relentless: BlackRock and other issuers continue to scoop up BTC, reducing available supply.

- Bullish Momentum: The breakout above $105K is technically significant, clearing major resistance.

- Long-Term Potential: Macro trends, institutional interest, and halving impact all point to higher long-term value.

- Narrative Shift: The fact that BlackRock may soon become the biggest BTC holder signals growing institutional belief in Bitcoin.

⚠️ Why You Might Wait:

- Short-Term Overbought: Technical indicators like RSI suggest a correction could follow.

- Profit-Taking Ahead: Early investors may sell around psychological levels like $110K–$115K.

- Potential Dip Zones: If BTC pulls back, levels around $102K–$104K could offer better entries.

BTC Price Prediction: What’s Next?

Bullish Target: If ETF flows stay strong, BTC could push toward $115K–$120K in the next few weeks.

Correction Zone: A healthy pullback to $98K–$102K would not break the bullish structure and may offer a buy-the-dip opportunity.

Mid-Term Outlook: If Bitcoin closes above $110K consistently, a rally to $130K–$150K could follow by summer.

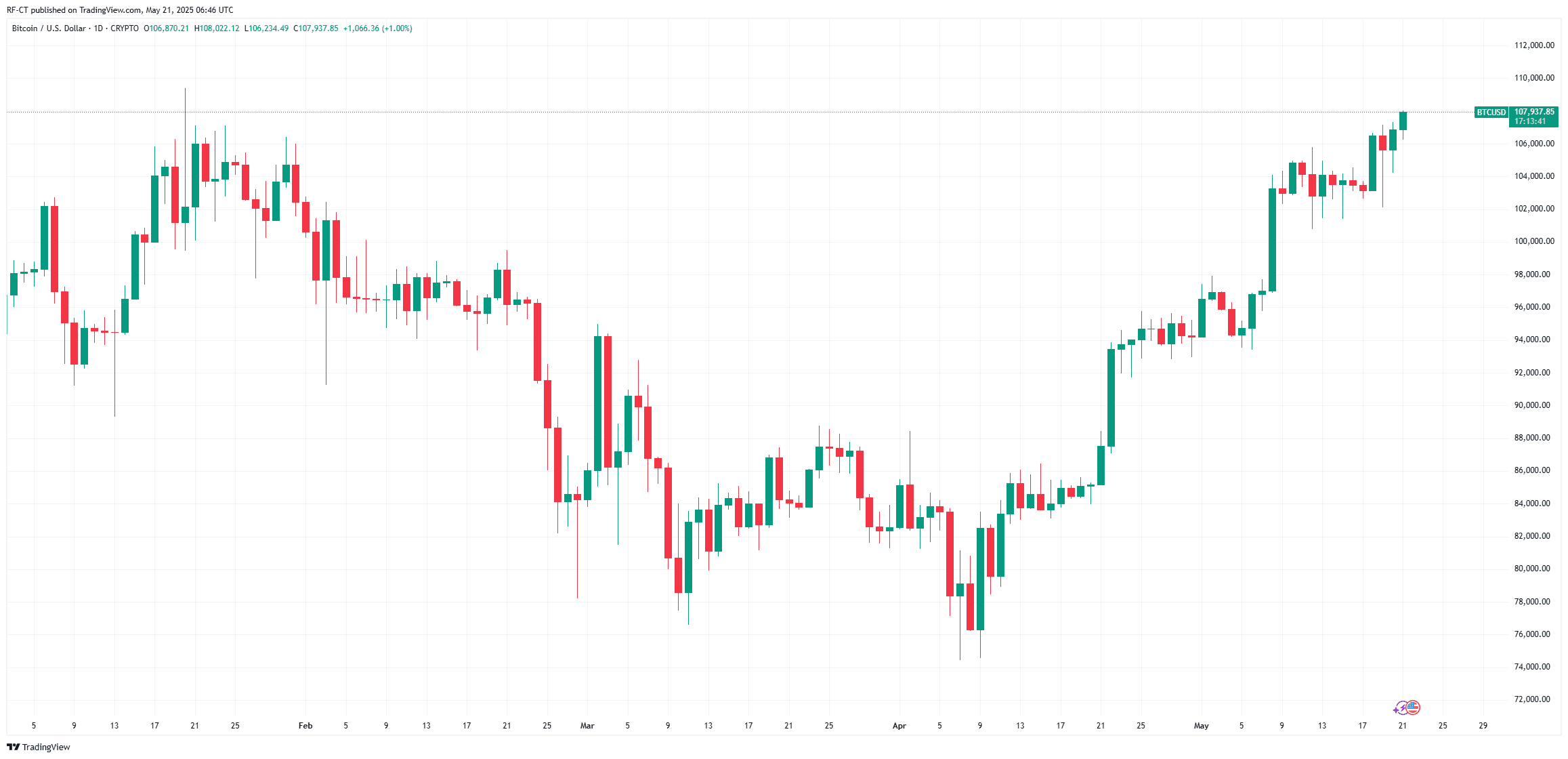

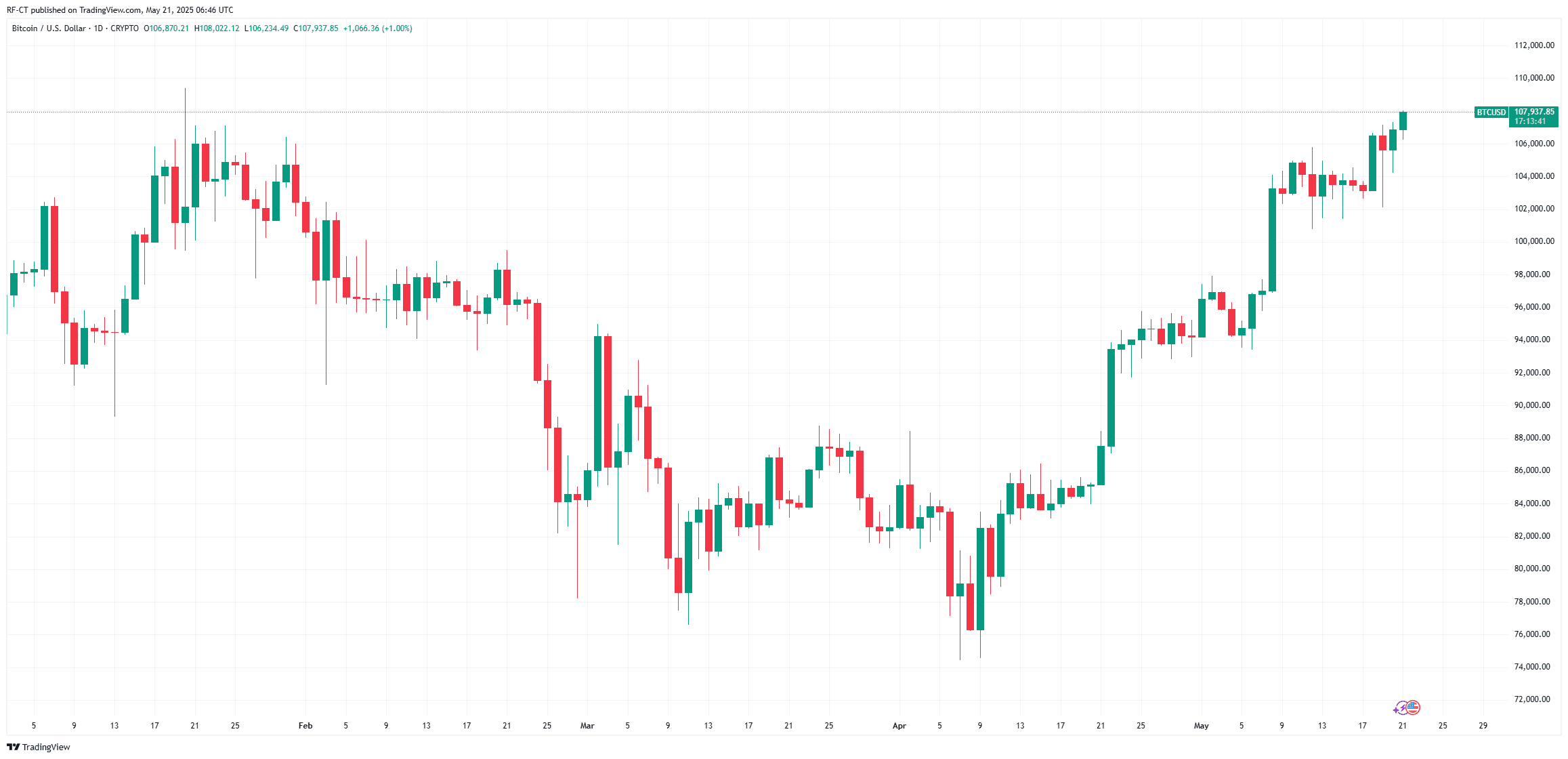

By TradingView - BTCUSD_2025-05-21 (YTD)

By TradingView - BTCUSD_2025-05-21 (YTD)

Final Verdict: Buy Now or Wait?

If you're in for the long term, buying Bitcoin now still makes sense , especially as institutional players like BlackRock reshape the demand landscape. However, if you’re a short-term trader, consider waiting for a dip—or setting limit orders around key support zones.

Either way, the key is to stay informed and manage your entry with a clear plan.

📈 Want to Trade Bitcoin?

Start now on Bitget: Sign Up Here

Check Live BTC Chart: BTC/USDT on Bitget

Bitcoin Breaks $108K: Is Now the Time to Buy?

Bitcoin (BTC) has surged beyond $108,000, reigniting excitement across the crypto market. With momentum picking up and institutional investors doubling down, many are asking the same question:

Should you buy Bitcoin now—or wait for a dip?

A perfect storm of institutional adoption, shrinking supply, and technical strength powers the latest price rally. And perhaps the biggest news of all is coming from the world’s largest asset manager: BlackRock .

By TradingView - BTCUSD_2025-05-21 (5D)

By TradingView - BTCUSD_2025-05-21 (5D)

BlackRock’s IBIT Set to Surpass Satoshi’s BTC Holdings

BlackRock’s iShares Bitcoin Trust (IBIT) now holds over 636,000 BTC, putting it on a trajectory to overtake Satoshi Nakamoto’s estimated 1.1 million BTC holdings by summer 2025. That’s more than 57% of the way there.

This institutional milestone marks a shift in Bitcoin’s ownership landscape—from anonymous origin to Wall Street giants. With over $46 billion in inflows and ETF demand accelerating, the move validates Bitcoin’s role as a serious asset class.

ETF analyst Eric Balchunas noted that if Bitcoin hits $150K, IBIT’s BTC stash could surpass Satoshi’s even sooner.

Should You Buy Bitcoin Now? Pros and Cons

✅ Why Buying BTC Now Makes Sense:

- ETF Accumulation Is Relentless: BlackRock and other issuers continue to scoop up BTC, reducing available supply.

- Bullish Momentum: The breakout above $105K is technically significant, clearing major resistance.

- Long-Term Potential: Macro trends, institutional interest, and halving impact all point to higher long-term value.

- Narrative Shift: The fact that BlackRock may soon become the biggest BTC holder signals growing institutional belief in Bitcoin.

⚠️ Why You Might Wait:

- Short-Term Overbought: Technical indicators like RSI suggest a correction could follow.

- Profit-Taking Ahead: Early investors may sell around psychological levels like $110K–$115K.

- Potential Dip Zones: If BTC pulls back, levels around $102K–$104K could offer better entries.

BTC Price Prediction: What’s Next?

Bullish Target: If ETF flows stay strong, BTC could push toward $115K–$120K in the next few weeks.

Correction Zone: A healthy pullback to $98K–$102K would not break the bullish structure and may offer a buy-the-dip opportunity.

Mid-Term Outlook: If Bitcoin closes above $110K consistently, a rally to $130K–$150K could follow by summer.

By TradingView - BTCUSD_2025-05-21 (YTD)

By TradingView - BTCUSD_2025-05-21 (YTD)

Final Verdict: Buy Now or Wait?

If you're in for the long term, buying Bitcoin now still makes sense , especially as institutional players like BlackRock reshape the demand landscape. However, if you’re a short-term trader, consider waiting for a dip—or setting limit orders around key support zones.

Either way, the key is to stay informed and manage your entry with a clear plan.

📈 Want to Trade Bitcoin?

Start now on Bitget: Sign Up Here

Check Live BTC Chart: BTC/USDT on Bitget

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!