Bitcoin (BTC) is standing below an all-time high, with short positions setting up a trade as high as $109,000. The recent price moves show BTC may be ready to move into the higher price zone, liquidating short traders.

Based on the accumulation of short positions, BTC showed signs of rallying to its all-time high above $109,000. The leading coin already posted its highest daily close at $106,928.64, and may post a higher close after its latest highly active day. The coin is also one jump away from an intraday record, which may happen at any moment.

Bitcoin traded at over $107,600 during Asian and European hours, extending its recent recovery. Dominance returned to 60.9%, once again canceling an altcoin season. BTC remains in the lead when it comes to the direction of the entire market. Later, BTC showed the recent gains were shaky, as the price fell toward $107,170. Bitcoin still awaits the US opening hours, where more active trading could define the direction.

The tension of leveraged positions arrived as BTC open interest expanded in a single day, from its long-running range of $31B to over $35B. This time around, the long to short ratio also took a sharp turn, with a predominance of short positions.

The accumulation of short positions often precedes a breakthrough for Bitcoin through a short squeeze. Over 54% of all positions on crypto exchanges are short, with a shift in the past two days. The short positions will either signal potential selling and erase the price recovery, or serve as a signal to attack bearish traders.

BTC all-time high or rejection?

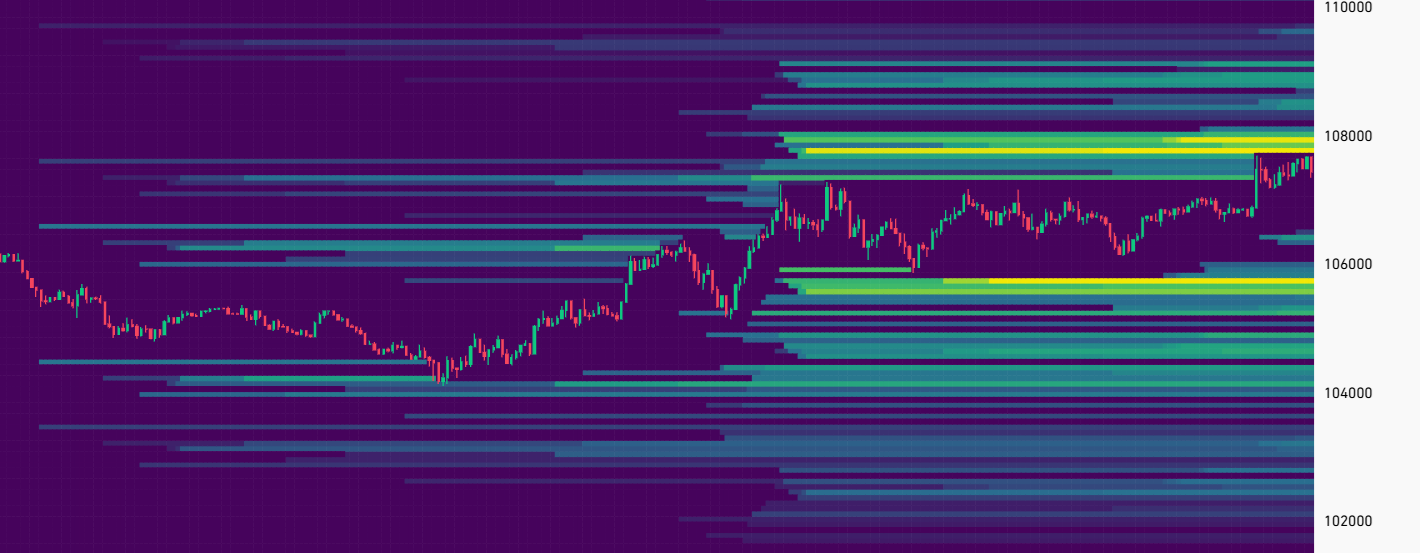

BTC derivative trading set up a new range of positions, putting the price between $105,000 and $109,000. The question remains whether traders would break through the short positions all the way up to $109,000, or return to liquidate long positions.

Bitcoin moves at a higher range, with expectations of liquidating short positions at $109,000, while breaking out to a new price record. | Source: CoinGlass

Bitcoin moves at a higher range, with expectations of liquidating short positions at $109,000, while breaking out to a new price record. | Source: CoinGlass

The crypto fear and greed index has been stuck at around 70 points for more than a week, so far avoiding the extreme greed range. Retail crowd money is more bullish, while smart money is neutral to cautiously bearish.

In the past week, Bitcoin moved its short and long positions to a new range, for now remaining near its all-time peak and potentially achieving a breakout to a new price record.

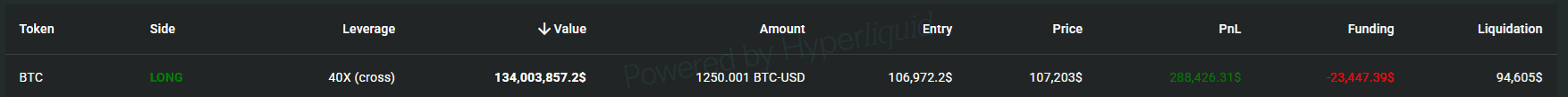

Hyperliquid whale bets on BTC expansion

The recent BTC hike benefitted high-risk bullish traders on Hyperliquid. One whale still holds a position with a liquidation price of $94,605. The whale entered just below $107,000 and shifted to a loss within hours.

One of the early bullish whales stood on unrealized gains above $800K, but erased some of the gains after Bitcoin moved down to $107,000 again. | Source: Hyperliquid

One of the early bullish whales stood on unrealized gains above $800K, but erased some of the gains after Bitcoin moved down to $107,000 again. | Source: Hyperliquid

The whale’s position brought above $800K of unrealized gains, but that quickly shrank to as low as $55,000.

On-chain data shows three significant whale positions on Hyperliquid are the most bullish on BTC. One of the whales longed BTC at over $107,000 , currently facing losses.

Bitcoin has seen a mix of profit-taking and new inflows, with spot demand from ETF and corporate treasuries . The Bitcoin volatility index remains relatively low at 1.35%, as BTC traded in a tight range for the past month.

KEY Difference Wire : the secret tool crypto projects use to get guaranteed media coverage