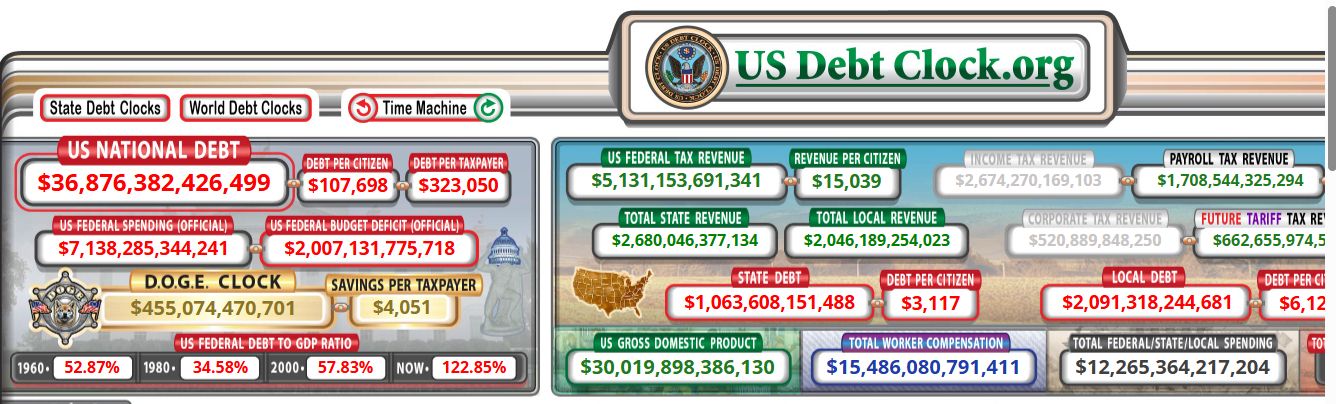

A senior International Monetary Fund (IMF) official warned the United States of its ballooning fiscal deficit. According to the US Treasury fiscal data website, the country has accumulated a $36.8 trillion national debt, and the federal debt to GDP ratio currently stands at 122%.

Gita Gopinath, the IMF’s first deputy managing director, sent a statement to Washington late Tuesday to use more sustainable fiscal policies that would bring the debt down.

“The US fiscal deficits are too large and they need to be brought down,” she told the Financial Times, adding that the country’s debt-to-GDP ratio was a matter of concern. “It should be that we have fiscal policy in the US that is consistent with bringing debt to GDP down over time.”

US credit rating downgrade prompts IMF warnings

Gopinath’s warning follows last week’s decision by financial institution Moody to downgrade the US credit rating, removing its last remaining triple-A score. The agency said the low credit rating is due to the increasing US debt and political brinkmanship in Washington.

According to the Congressional Budget Office, thee federal government debt held by the public reached 98% of GDP in fiscal year 2024, up from 73% a decade earlier.

US Debt Clock. Source: USDebtclock.org

US Debt Clock. Source: USDebtclock.org

Moody’s estimated that if Trump’s proposed legislation is enacted, the federal deficit could rise from 6.4% of GDP in 2023 to nearly 9% by 2035.

Bessent dismisses Moody’s downgrade as ‘Lagging’

White House officials, including Treasury Secretary Scott Bessent are claiming that they had inherited large deficits from former US President Joe Biden.

Speaking to NBC on Sunday, Secretary Bessent lambasted the Moody’s downgrade as a “lagging indicator,” and blamed the deficit problem on the previous administration.

He reiterated that the Trump administration will eventually reduce the budget shortfall, adding that the White House could cut the deficit to 3% by the end of Trump’s current term.

“The administration is determined to bring the spending down and grow the economy,” Bessent said.

Gopinath said she understands Bessent’s “clear call” may address the deficit, but the structural issues that have led America’s debt trajectory are still unresolved. The IMF previously predicted a decline in the US fiscal deficit this year, contingent on increased tariff revenues.

Yet that projection did not account for Trump’s proposed tax bill, which is currently under debate in Congress.

On financial markets, the dollar index has dropped below the 100 mark, while Treasury yields on the 30-year US Treasury bond climbed to 5.04%, its highest level since 2023. The government could be forced to issue more bonds to finance its spending at a time when both foreign and domestic buyers are questioning the long-term stability of US finances.

Trade policies could make or break the US

Beyond fiscal concerns, Gopinath talked about the indecisiveness of US trade policies, specifically President Trump’s decision to press play-pause-play on tariffs.

“There is a very high level of uncertainty, and we have to see what the new [tariff] rates will be,” she said.

In April, the IMF lowered its US growth forecast for 2025 by nearly a full percentage point to 1.8%, also it revised its global growth predictions down to 2.8%.

Trump has temporarily eased some trade tensions, particularly with China. Under a 90-day agreement, both countries committed to cutting tariffs by a combined 115 percentage points. “The tariff pause with China is a positive development,” Gopinath said. She also welcomed progress in US-UK trade talks.

Still, the IMF is cautious about a more permanent agreement, noting that while the average tariff rates may have fallen slightly, underlying trade friction could stifle growth.

Your crypto news deserves attention - KEY Difference Wire puts you on 250+ top sites