Bitcoin Beats Gold as America’s Top Asset — What’s Driving the Shift?

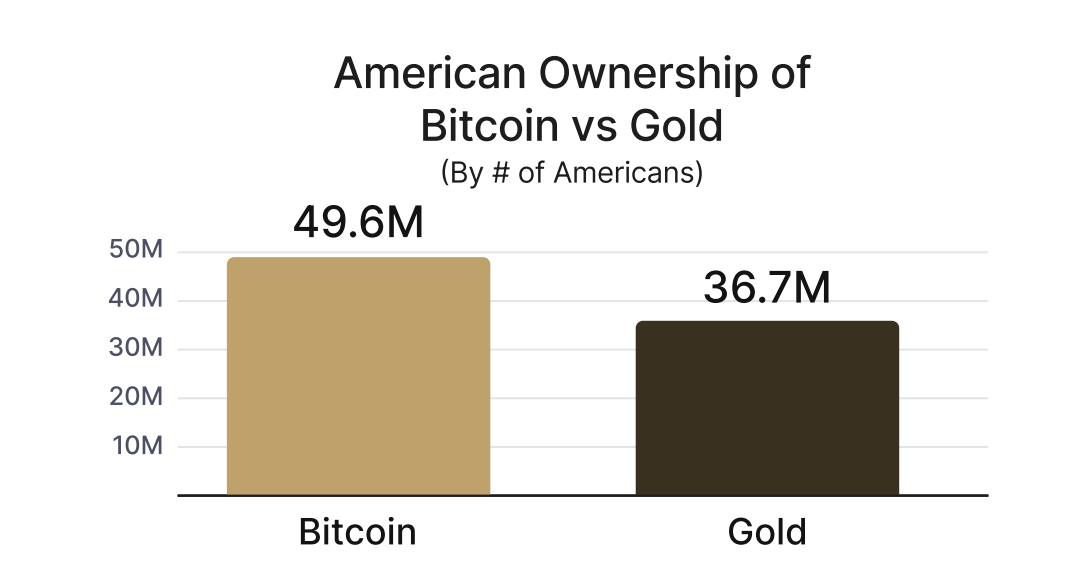

Bitcoin is now more widely held than gold in the US, reflecting a nationwide shift toward digital assets as strategic financial tools.

Americans now own more Bitcoin than gold, with approximately 50 million Americans holding Bitcoin compared to 37 million owning gold.

The trend of viewing Bitcoin as a reserve asset alternative to gold is growing. Bitcoin is becoming integral to the US’s economic plans, purchasing policies, and financial systems.

Bitcoin Surpasses Gold in US Ownership

A May 20 report from Bitcoin investment firm River emphasizes that the US is leading the way in Bitcoin adoption, with significant investments and infrastructure supporting its dominance. Bitcoin’s outperformance over gold in American ownership marks a significant milestone, signaling a major shift in public perception of investment assets.

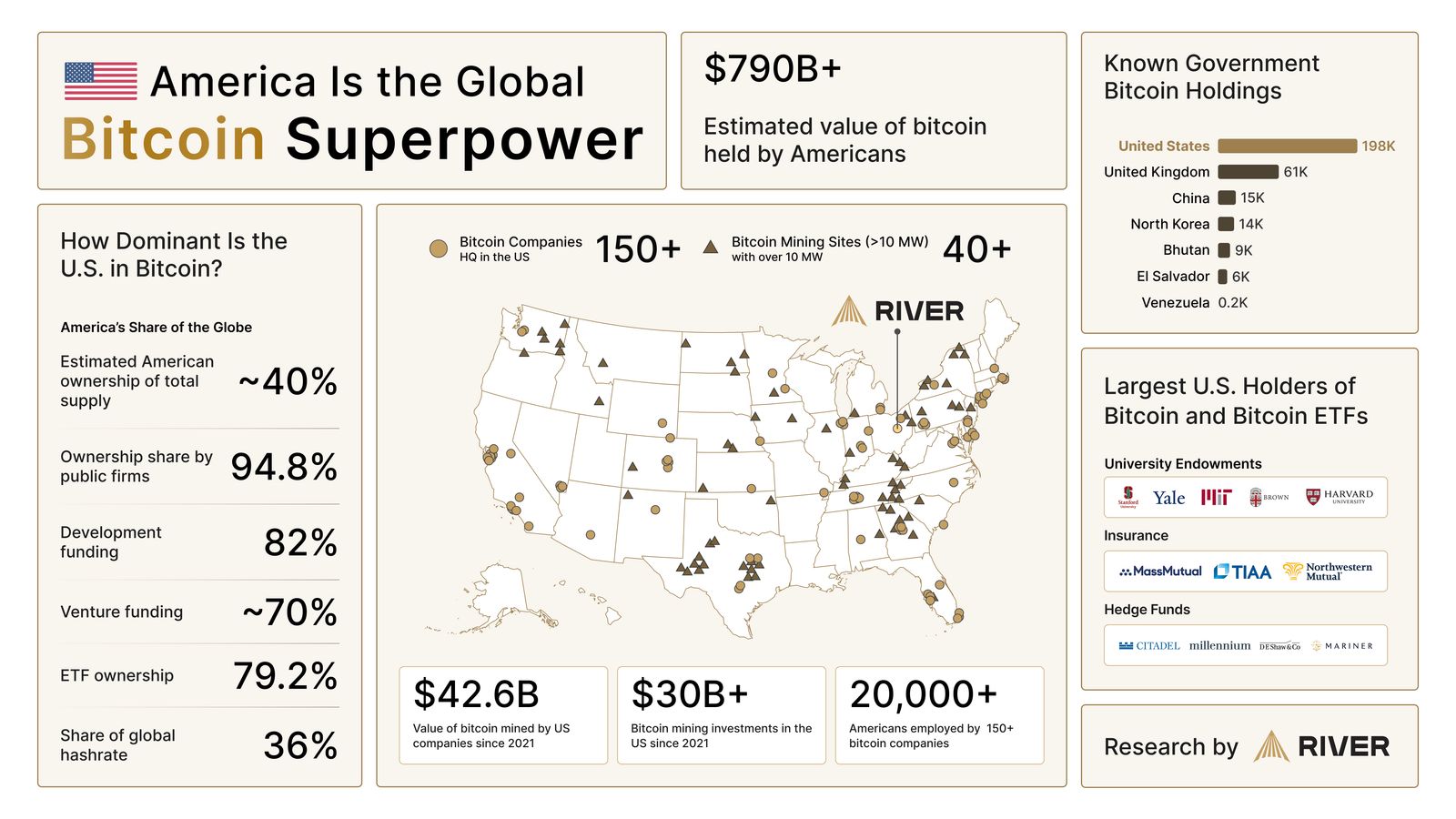

America is the global Bitcoin superpower. Source:

River

America is the global Bitcoin superpower. Source:

River

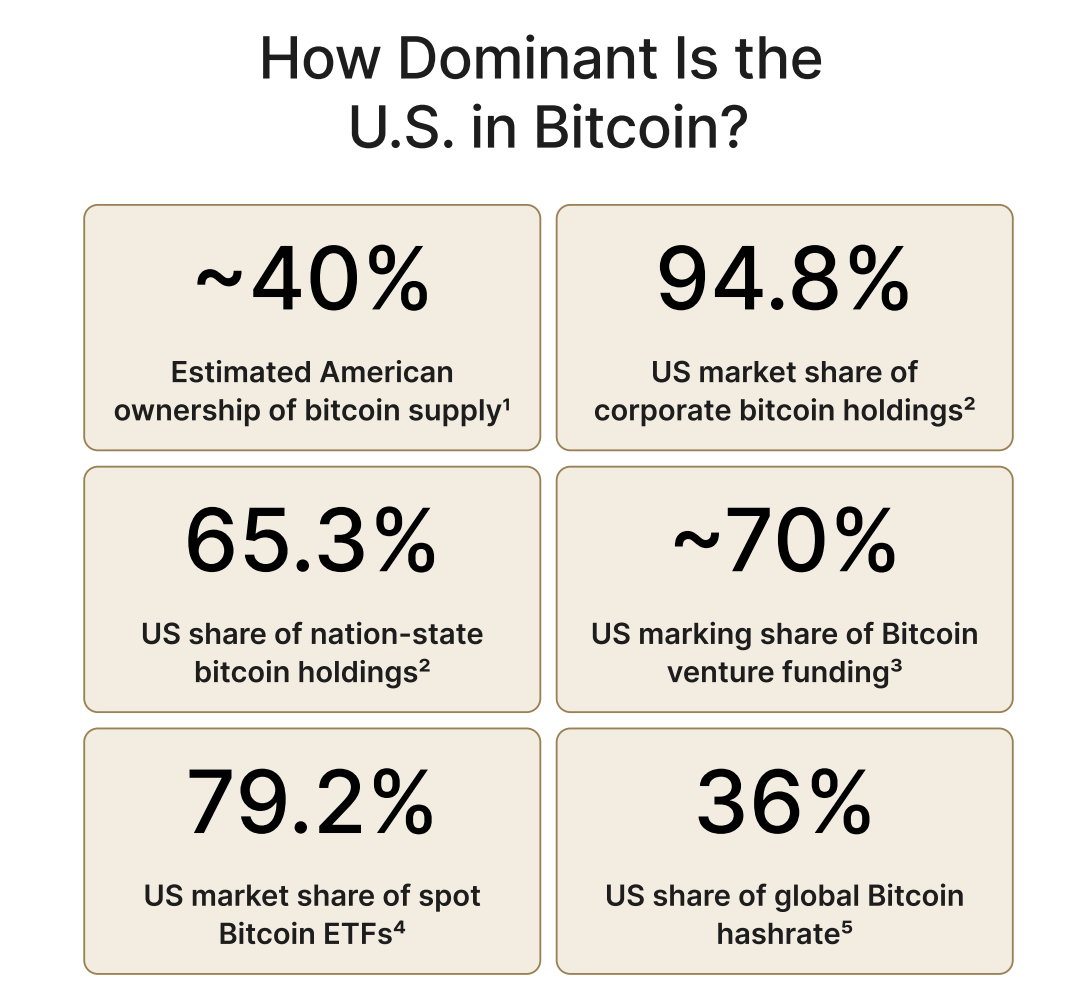

The report also highlights that the US is at the forefront globally in adopting Bitcoin, with 40% of global Bitcoin companies headquartered there. Also, American firms account for 94.8% of all Bitcoin owned by publicly traded firms worldwide.

This reflects the US’s strong investment in Bitcoin infrastructure, from startups and ETFs to policies supporting cryptocurrency.

US dominance in Bitcoin. Source:

River

US dominance in Bitcoin. Source:

River

Another noteworthy point is the trend of considering Bitcoin as a modern reserve asset alternative to gold. River’s report shows that Bitcoin is becoming an “underestimated pillar” of American economic dominance.

With 790 billion USD worth of Bitcoin held by Americans, Bitcoin is not just an investment asset. It is also integrated into the nation’s economic plans and financial systems.

“Bitcoin is an underestimated pillar of American dominance. Americans have a larger estimated share of the bitcoin supply than of global wealth, GDP, or gold reserves.” River stated

Nearly 50 million Americans own Bitcoin, while the number of gold owners is almost 37 million. Source:

River

Nearly 50 million Americans own Bitcoin, while the number of gold owners is almost 37 million. Source:

River

Growing confidence in Bitcoin is reinforced by factors such as the ease of digital storage and transfer and expectations that the US might establish a strategic Bitcoin reserve, as proposed by some politicians. This indicates that Bitcoin is gradually reshaping how Americans perceive safe-haven assets during economic uncertainty, surpassing the traditional role of gold.

Moody’s US credit downgrade ends a century of top ratings, boosting Bitcoin’s appeal as a hedge against fiscal instability.

However, this shift also raises questions about sustainability and risks. While Bitcoin is considered a safe haven asset, its price volatility may make some investors cautious.

Nevertheless, with support from major financial institutions like BlackRock and an increasingly clear regulatory framework, Bitcoin is solidifying its position in the US.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone