Ethereum Price Surges 60%, Driving $3.4 Billion ETH Accumulation in 30 Days

Ethereum has surged 60% in the past month, driven by significant accumulation, but long-term holders are beginning to sell, sparking concerns about the altcoin's potential. With resistance at $2,654, Ethereum’s price trajectory depends on continued bullish market sentiment and Bitcoin’s performance.

Ethereum has experienced a remarkable surge in price, up 60% over the past month, reaching $2,543. This rally is largely driven by significant accumulation by investors, totaling 1.34 million ETH worth over $3.42 billion.

Despite the growth, some critical investors are beginning to exit, aiming to secure their profits before potential risks arise.

Ethereum Investors Gobble Up Supply

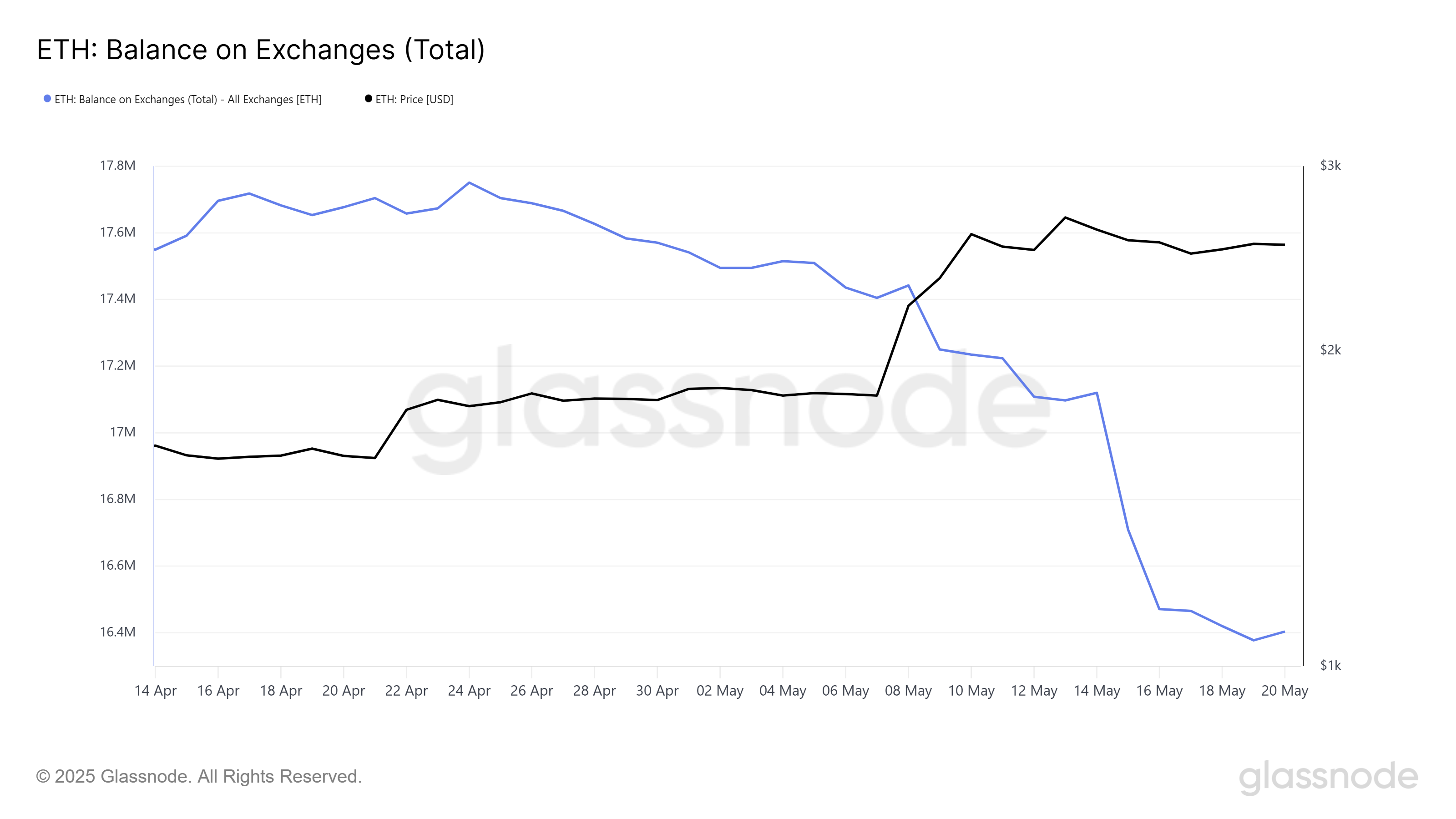

Ethereum’s balance on exchanges has dropped by 1.34 million ETH in the past month (April 21 to May 21), marking a significant shift in market conditions. This supply reduction is valued at over $3.42 billion and is largely due to the Pectra upgrade, which has boosted investor confidence in Ethereum’s long-term growth.

The drop in exchange supply reflects a growing belief that Ethereum could continue its upward trajectory. This rush to acquire Ethereum has created a FOMO (fear of missing out) effect, contributing to the price rise.

Ethereum Balance On Exchanges. Source:

Glassnode

Ethereum Balance On Exchanges. Source:

Glassnode

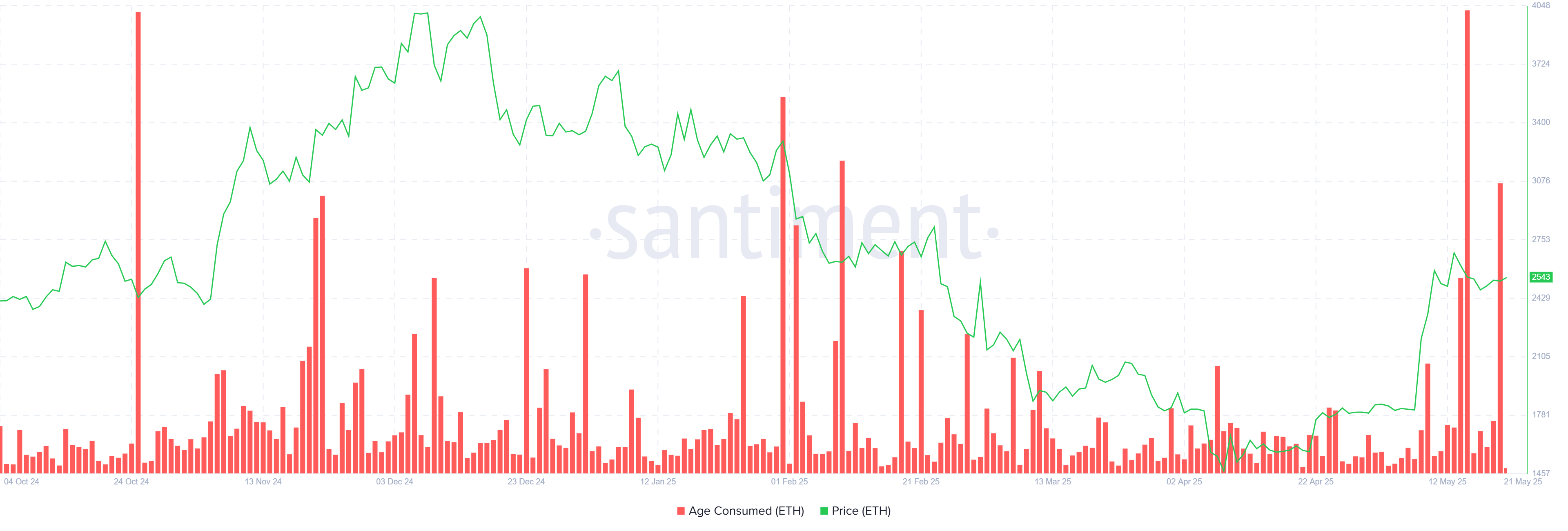

However, the macro momentum surrounding Ethereum is mixed, with long-term holders (LTHs) exhibiting behavior that suggests caution. The Age Consumed metric has spiked twice this week, indicating that significant portions of ETH are being sold by LTHs to lock in profits.

This is the largest wave of selling in the past seven months, which suggests that these holders believe Ethereum may have reached its market top. The sell-off by LTHs is drawing attention to potential risks that could affect Ethereum’s future performance. If this trend of profit-taking continues, it could hinder the cryptocurrency’s growth prospects.

Ethereum Age Consumed. Source:

Santiment

Ethereum Age Consumed. Source:

Santiment

ETH Price Rallies

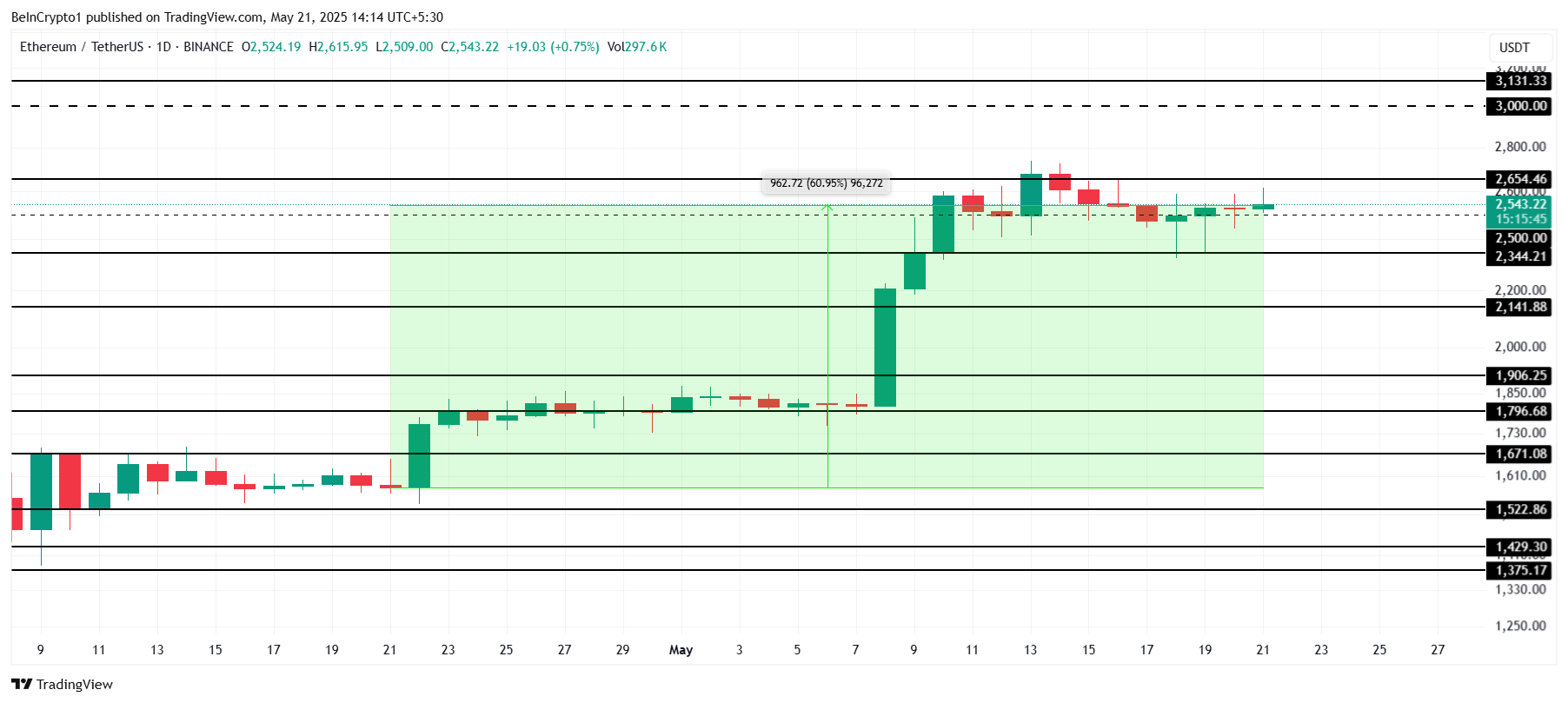

Ethereum price is currently trading at $2,543, marking a 60% rally over the past month. However, the price faces resistance at the $2,654 mark. Breaching this resistance is crucial for Ethereum to continue its rise.

The price will likely surge beyond this level if Bitcoin forms a new all-time high (ATH), as Ethereum has a strong correlation with Bitcoin. This move could push Ethereum closer to $3,000, further solidifying its bullish outlook. If the broader market remains positive, Ethereum’s price could see continued upward momentum.

Ethereum Price Analysis. Source:

TradingView

Ethereum Price Analysis. Source:

TradingView

However, the market comes with its risks. If the selling pressure from LTHs intensifies and the accumulation phase halts, Ethereum’s price may struggle to maintain its upward trajectory. Losing support at $2,344 would likely lead to a decline towards $2,141, invalidating the current bullish thesis and creating a bearish outlook for the cryptocurrency.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK