-

The cryptocurrency market is abuzz as Canary Capital pushes for a spot Solana (SOL) ETF with an innovative staking feature, aiming to enhance investor returns.

-

While the idea of a staking ETF garners attention, skepticism remains high among analysts, with many doubting the approval likelihood.

-

James Seyffart from Bloomberg noted, “Unlikely, particularly with staking. SEC isn’t ready for staking in the ETF Grantor Trust wrapper … at least not yet.”

Canary Capital proposes a spot Solana ETF with staking, amidst skepticism from analysts about SEC approval, paving the way for potential profit gains.

Canary Capital’s Bold Move in the ETF Market

Canary Capital is making waves in the financial sector with its recent application for a spot Solana ETF, officially named the Canary Marinade Solana ETF. This unique fund aims to incorporate a staking mechanism as a core feature, a step that could significantly boost investor returns if greenlit by regulators.

According to the amended S-1 filing with the Securities and Exchange Commission (SEC), Canary Capital plans to partner with Marinade Finance as a staking provider. This collaboration is expected to generate revenue through both direct SOL exposure and staking rewards, presenting a more attractive investment vehicle for crypto enthusiasts.

The Uncertain Path to Approval

Despite the innovative proposition, analysts remain cautious regarding the SEC’s stance on such products. The Commission has historically withheld approval for similar requests, raising doubts about whether they will green-light staking ETFs anytime soon. Seyffart remarked, “Unlikely, particularly with staking.”

While the SEC recently engaged in roundtable discussions with industry stakeholders regarding ETF staking and tokenization, the future remains uncertain. Other recent applications, like those for spot ETH ETFs, have faced delays, contributing to a subdued outlook among market participants.

Market Trends and SOL’s Performance

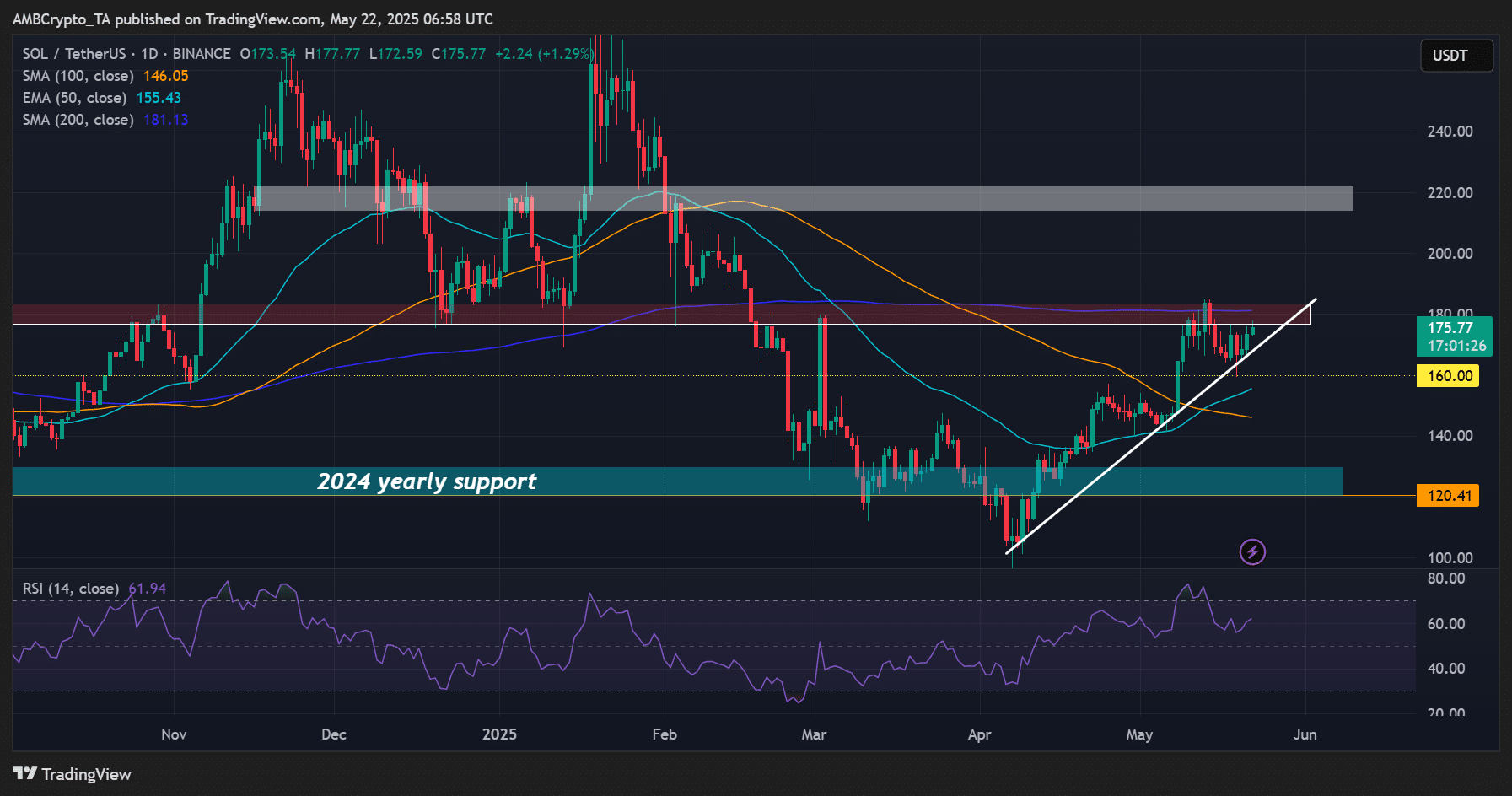

The cryptocurrency market is witnessing fluctuations, with SOL recently encountering resistance at the $180 level, a critical threshold that aligns with the 200-day SMA (Simple Moving Average). This price point has served as a significant barrier in 2024 and early 2025.

Historically, crossing this hurdle could open the door for bulls to target the $220 mark, representing a potential 23% gain—an enticing prospect amid relatively low profit-taking activity in the SOL market.

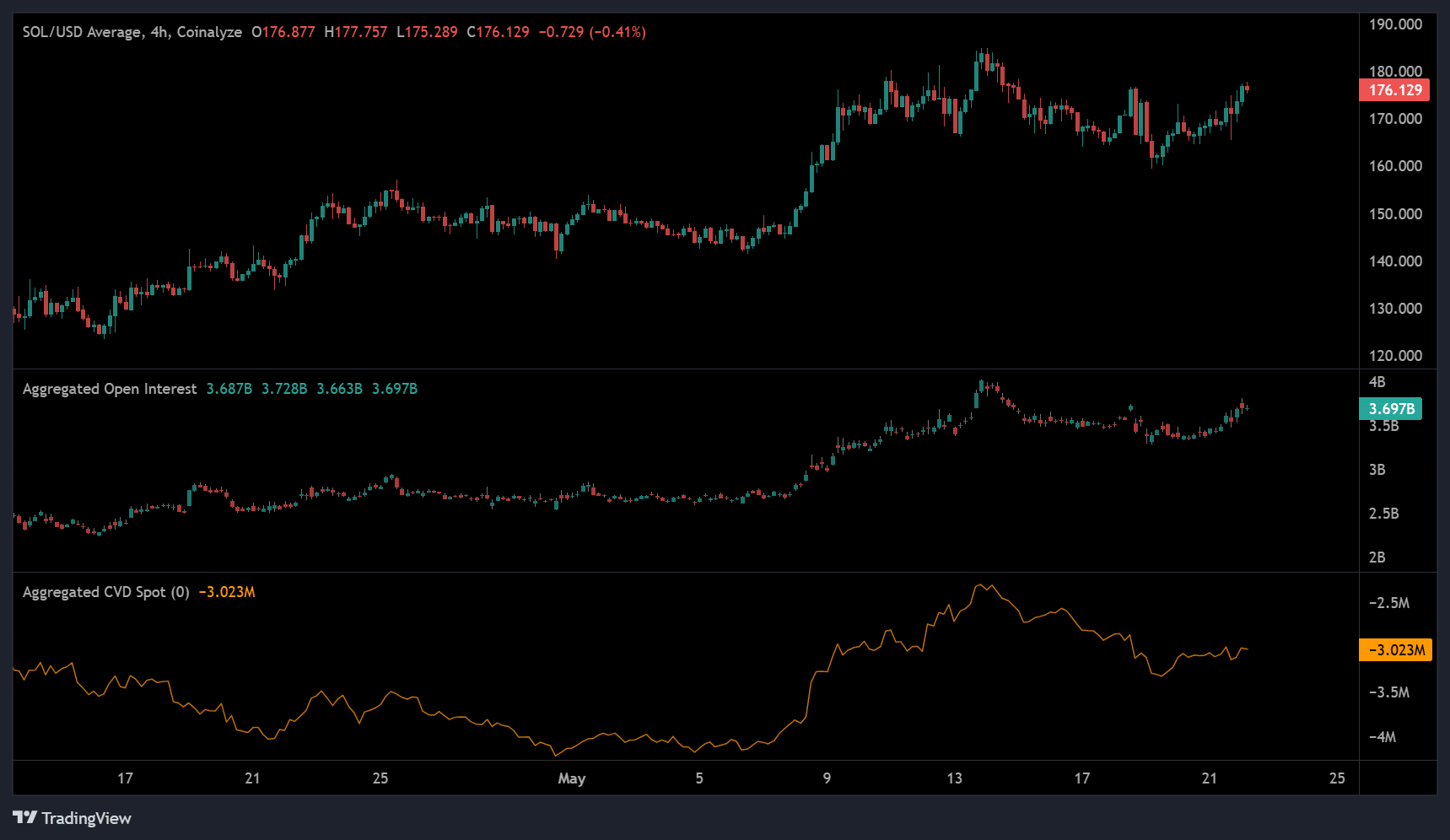

Recent data shows spot Cumulative Volume Delta (CVD) and Open Interest (OI) have declined from mid-May, indicating reduced spot market demand and speculative interest. However, a recent stabilization in spot CVD suggests a resurgence in market confidence, allowing traders to anticipate potential recovery.

Looking Ahead: The Potential Impact of the ETF

If the SEC were to approve the Canary Marinade Solana ETF, it could instigate a surge in investor interest in SOL, boosting its adoption and potentially increasing its price. The landscape for ETFs is shifting, and successful launches could lead to a change in how stakeholders view altcoins within the market.

Furthermore, the relative strength of SOL’s network, along with the anticipated rewards from staking, could incentivize new investors, leading to overall market expansion.

Conclusion

In conclusion, while the prospect of Canary Capital’s Solana ETF with a staking feature presents an innovative approach to cryptocurrency investing, the uncertainty surrounding regulatory approval remains a critical point of concern. As market dynamics continue to evolve, stakeholders are left contemplating the implications of such ETFs on the altcoin ecosystem.