XRP Slips to 3-Month Low Against Bitcoin as Bearish Signals Mount

XRP's price is under pressure, as weak network activity and a negative Price-DAA divergence point to unsustainable momentum. The token may drop further if demand doesn't pick up.

Ripple’s XRP is losing ground against leading coin Bitcoin, with the XRP/BTC trading pair slipping to its lowest point in three months.

This downward trend comes amid BTC’s recent rally, which pushed it to a new all-time high of $111,888 earlier today, widening the performance gap. With lingering bearish sentiment, XRP risks reversing recent gains and resuming its decline.

XRP/BTC Pair Hits New Low Amid Weak Network Activity

As of this writing, the XRP/BTC trading pair is at 0.000021 BTC, plunging 29% since it began its downward trend on March 2.

XRP/BTC Trading Pair. Source:

TradingView

XRP/BTC Trading Pair. Source:

TradingView

When the XRP/BTC pair drops like this, XRP is underperforming relative to BTC. This indicates a loss of investor confidence, leading to a relative outflow from XRP into BTC.

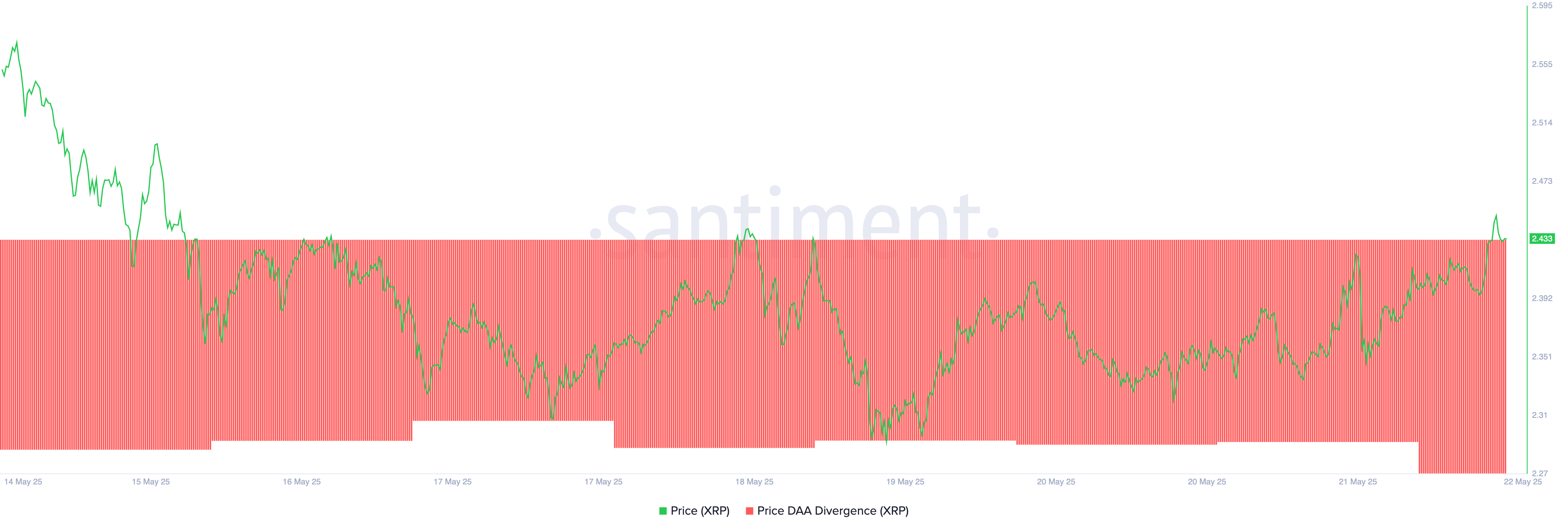

It also reflects bearish sentiment toward XRP in the current market, especially as it faces weak network activity. Despite its 4% price surge, the token’s Price Daily Active Addresses (DAA) Divergence remains negative, indicating weak demand behind the rally. As of this writing, it is at -58.2%.

XRP Price DAA Divergence. Source:

Santiment

XRP Price DAA Divergence. Source:

Santiment

This on-chain metric compares an asset’s price movement with its network activity by analyzing the relationship between price trends and the number of unique addresses interacting with the blockchain daily.

When price rallies are not matched by a corresponding rise in daily active addresses, it signals speculative buying.

Conversely, strong DAA growth alongside price gains suggests healthy network usage and more sustainable market momentum.

Therefore, XRP’s negative Price-DAA divergence signals that its recent price gains are not backed by increased user activity on the XRP Ledger. In other words, the rally lacks strong network demand, suggesting the momentum may be unsustainable.

XRP Hovers at $2.43 as Demand Cools

At press time, XRP trades at $2.42. With waning underlying demand for the fourth-largest crypto by market capitalization, the token is poised to lose some of its recent gains. In this scenario, XRP could fall to $2.29.

If this level fails, the altcoin could extend its decline to $2.11.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

On the other hand, a resurgence in new demand could drive XRP above $2.50.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Mars Morning News | The Federal Reserve is expected to cut interest rates on Wednesday, S&P Global assigns a "B-" credit rating to Strategy

S&P Global has assigned a "B-" credit rating to bitcoin treasury company Strategy, classifying it as junk debt but with a stable outlook. The Federal Reserve is expected to cut interest rates by 25 basis points, with a possible split in the voting. The Hong Kong Securities and Futures Commission has launched a tender for a virtual asset trading monitoring system. Citi is partnering with Coinbase to explore stablecoin payment solutions. ZEC surged significantly due to halving and privacy topics. Summary generated by Mars AI. The accuracy and completeness of this summary are still being refined and updated by the Mars AI model.

BTC Volatility Review (October 6 - October 27)

Key indicators (4:00 PM Hong Kong time on October 6 -> 4:00 PM Hong Kong time on October 27): BTC/USD -6.4...

Cathie Wood warns: As interest rates rise next year, the market will be "chilled to the bone"

AI faces adjustment risks!

2025 Trading Guide: Three Essential Trading Categories and Strategies Every Trader Must Know

Clearly identify the type of transaction you are participating in and make corresponding adjustments.