Genius Group Resumes Bitcoin Purchases After US Court Lifts Ban

Genius Group has restarted its Bitcoin accumulation strategy after a US court lifted a temporary ban.

Genius Group has restarted its Bitcoin accumulation strategy after a US court lifted a temporary ban.

On May 22, the company announced it resumed purchasing Bitcoin (BTC) following a favourable ruling from the US Court of Appeals, which previously restricted its ability to expand Bitcoin holdings.

With the ban lifted, Genius Group has increased its Bitcoin treasury by 40%, acquiring an additional 24.5 BTC, valued at approximately $2.7 million. This brings the company’s total Bitcoin holdings to 85.5 BTC, acquired at an average price of $99,700 per coin, for a total investment of $8.5 million.

Roger Hamilton, CEO of Genius Group, expressed optimism about the court’s decision, stating,

“We are pleased to be able to begin the task of rebuilding shareholder value from the damage caused by the legal actions of third parties, and delivering on our 2025 plan.”

Hamilton also emphasized the company’s broader mission:

“Genius Group is committed to educating students on the ABCs of the Future: AI, Bitcoin, and Community.”

He highlighted that building a robust Bitcoin treasury is integral to preparing the next generation for the digital economy and workforce.

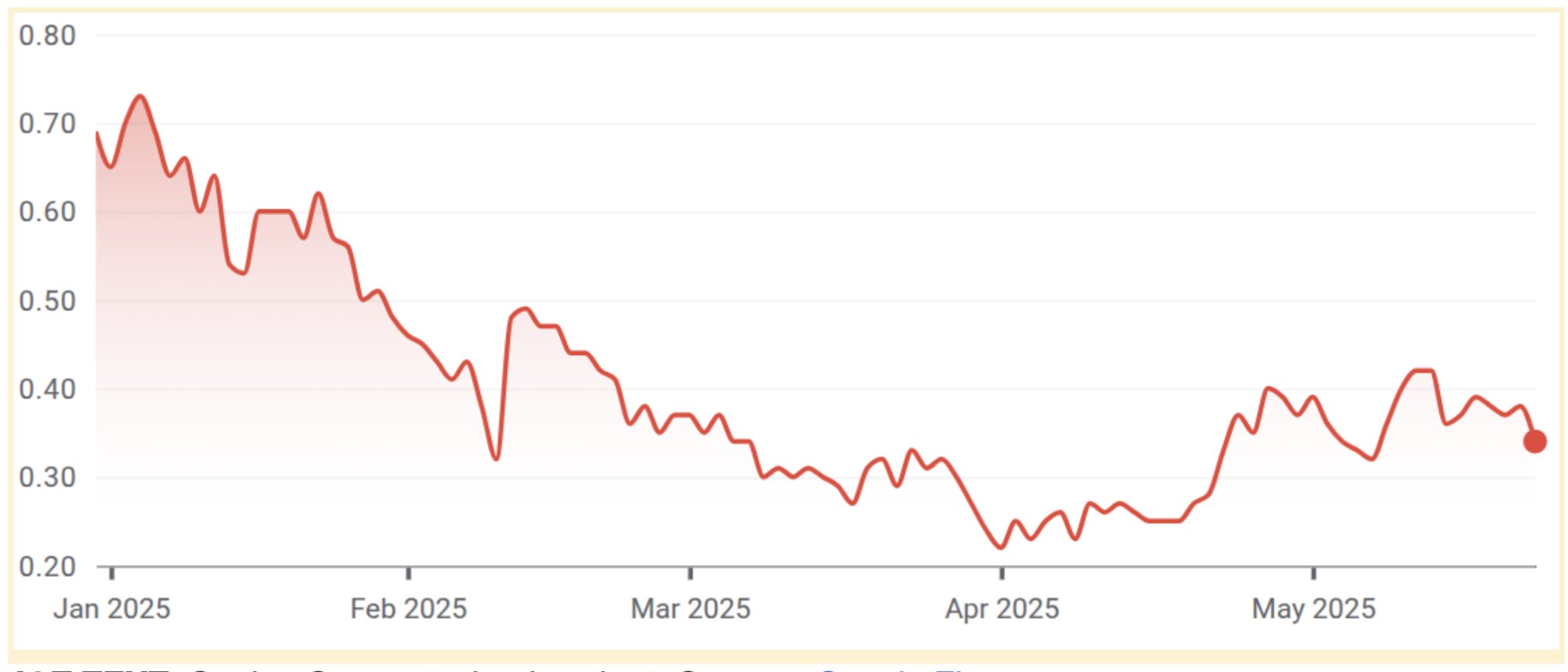

Genius Group’s strategy resembles that of MicroStrategy (now known as Strategy), which holds over 2% of all Bitcoin. Recently, Strategy purchased nearly $765 million in Bitcoin, reflecting a trend of public companies adopting Bitcoin as a treasury asset. Genius Group, also listed on the NYSE with a market cap of $24.34 million, saw its stock price decline over 8% last trading day, currently trading at $0.34, less than half its value at the start of the year.

Source:

Google Finance

Source:

Google Finance

Meanwhile, Blackstone, traditionally cautious about crypto, acquired over 23,000 shares of IBIT valued at approximately $1.08 million, along with smaller stakes in other crypto-related holdings. While this is a modest investment relative to Blackstone’s overall portfolio, it is a significant indicator of increasing institutional interest in digital assets.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter , LinkedIn , Facebook , Instagram , and CoinMarketCap Community .

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!