-

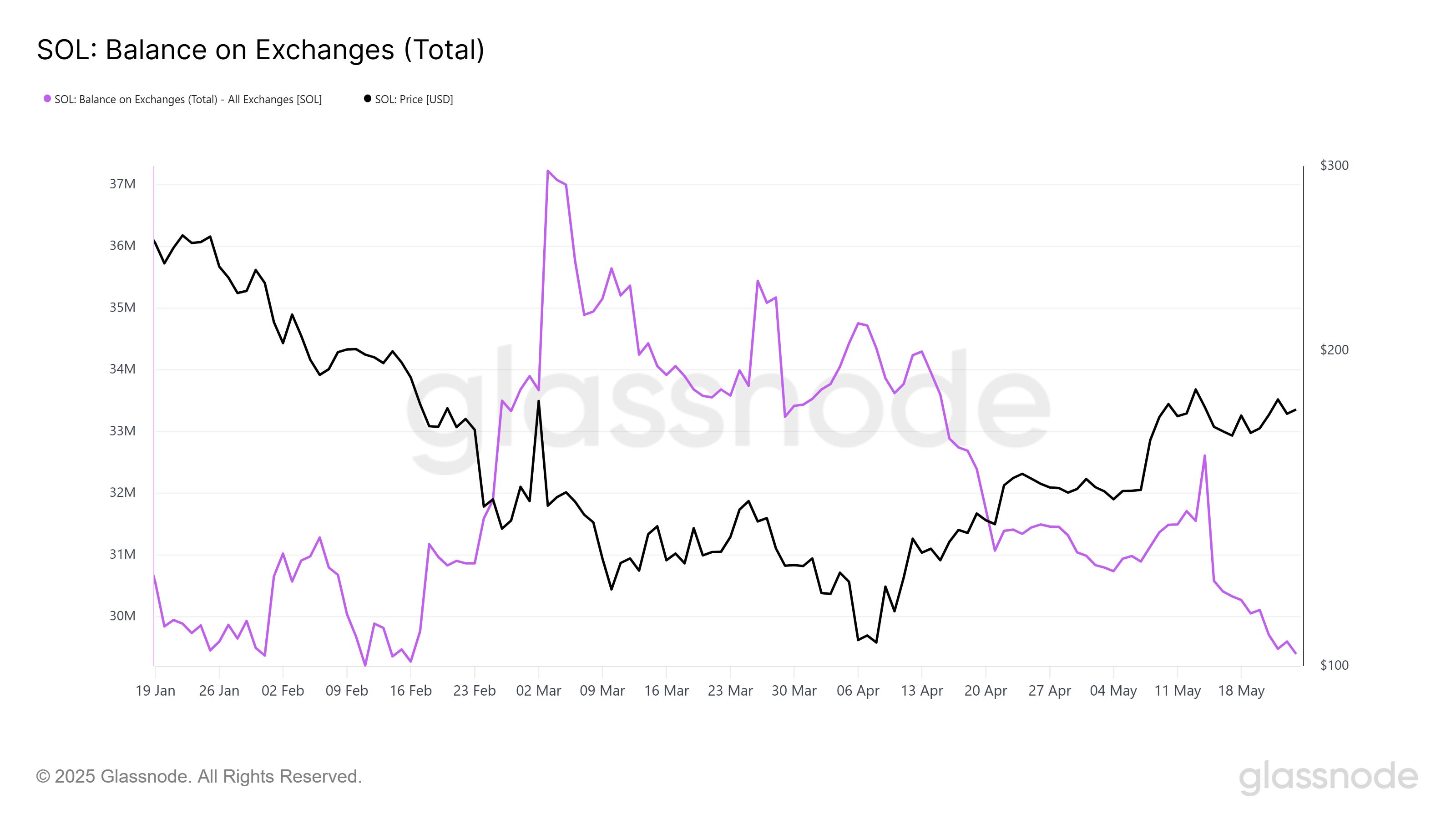

As Solana (SOL) continues its recovery, investor confidence is demonstrated by a significant accumulation of the token, with over $381 million exiting exchanges.

-

Market indicators reveal a tightening of Bollinger Bands, signaling potential volatility and a critical juncture for price movement.

-

According to COINOTAG, Solana must overcome $178 to maintain its bullish stance; failing to do so could lead to a drop below $168.

Solana sees a surge in investor accumulation amid market optimism, analyzed through key support levels and potential volatility indicators.

Solana Sees Record Accumulation Amid Market Optimism

In a notable trend, the accumulation of Solana has accelerated sharply, with 2.2 million SOL, valued at around $381 million, leaving exchanges in just the last 10 days. This rapid decline in available supply suggests that investors remain highly optimistic about the asset’s future.

Such accumulation often indicates a broader bullish sentiment in the market, fueled by a combination of fear of missing out (FOMO) and expectations of upward price movements. As more tokens leave exchanges, this decreases supply and may elevate prices in the long run.

As illustrated in the graph from Glassnode, the diminishing exchange balances signify a potential trend reversal that could benefit long-term holders.

Furthermore, technical indicators suggest that Solana’s recent price stability might be a precursor to significant market volatility. The Bollinger Bands, a staple indicator for gauging price volatility, are converging, traditionally indicating a breakout could be near.

As this volatility approaches, a bullish breakout could lead to price increases; however, consolidation remains a possibility in the interim as market stability is assessed.

Critical Price Levels for Solana's Next Move

As Solana navigates its current price environment, it has encountered a fundamental test around the $173 mark. Establishing robust support at $178 is crucial for the continuation of a positive price trajectory.

A successful breach of the $188 resistance level could signal the commencement of a new uptrend. Conversely, should Solana fail to hold above $178, it may face a downward trend, dropping beneath the critical $168 level, which would pose challenges for bullish sentiment.

This analysis aligns with broader market trends; as Solana aims to break through these critical resistance points, investors will be keenly watching how the price interacts with these levels.

The price action observed over the coming days could be pivotal. If Solana manages to sustain momentum above $178, it could enhance market confidence. On the contrary, falling below $168 might prompt caution among investors, leading to a reevaluation of bullish expectations.

Conclusion

The ongoing accumulation of Solana reflects an optimistic outlook among investors, underscored by recent market trends. With critical price levels set for upcoming decisions, traders will watch closely for signs of breakout or potential declines. The actions taken by SOL investors in the near term will significantly influence its trajectory.