-

Ethereum’s recent surge past $2,700 has ignited discussions about sustainability amidst rising exchange reserves and a weakening correlation with Bitcoin.

-

Despite the initial surge, analysts are concerned that the increasing exchange reserves indicate declining momentum within the Ethereum ecosystem.

-

As noted by CryptoQuant, the recent shift in Ethereum’s correlation with Bitcoin could disrupt traditional investment strategies.

This article delves into Ethereum’s recent price actions, the implications of rising exchange reserves, and its evolving relationship with Bitcoin.

Short squeeze ignites as ETH breaks $2.7K

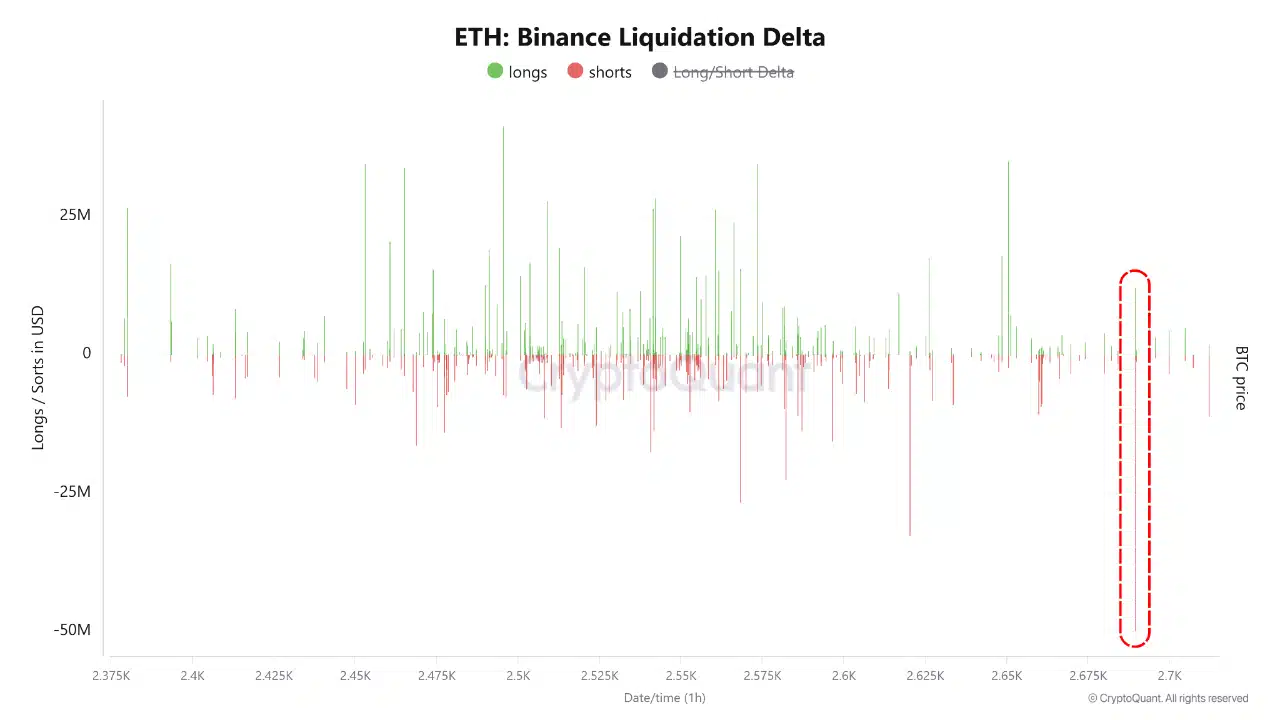

Ethereum’s ascent beyond the $2,700 resistance prompted a sharp liquidation event on exchanges like Binance, leading to the closure of over $50 million in short positions, as per CryptoQuant’s data. This event exemplifies the volatility characteristic of cryptocurrency trading.

Source: CryptoQuant

This liquidity cluster, marked on the Liquidation Delta chart, attracted stop-loss orders as ETH surged. However, the optimism was short-lived; over 144,000 ETH subsequently flowed into derivatives exchange reserves, signaling potential trend reversals.

In the aftermath of this short squeeze, the influx of ETH into these reserves raises concerns about the sustainability of the bullish momentum. While market participants celebrated the breakout, data suggests that renewed short positioning could be on the horizon.

Ethereum-Bitcoin correlation collapses

Historically, Ethereum and Bitcoin have exhibited a strong correlation, frequently hovering above 0.7. However, this relationship has deteriorated, with ETH’s correlation to BTC dropping to a mere 0.05 as of late May, down from 0.63 at the beginning of the year.

Source: CryptoQuant

This drastic decoupling disrupts one of the crypto market’s most consistent patterns, requiring a reevaluation of established investment strategies. Notably, Ethereum has underperformed relative to Bitcoin during recent rallies, adding another layer of complexity to market dynamics.

Decoupling dampens momentum

Ethereum’s deviation from Bitcoin is overshadowing market confidence. Without the buoyancy typically provided by synchronizing BTC rallies, Ethereum’s ecosystem is experiencing challenges in maintaining its growth trajectory.

Retail participation in Ethereum appears to be waning, with leading Layer 2 solutions—such as Optimism, Arbitrum, and Polygon—struggling to gain traction throughout 2025. Traditional forecast models, which relied on Bitcoin’s directional movements, seem increasingly ineffective.

While Ethereum may be transitioning into a more autonomous asset driven by its internal dynamics, this independence could isolate it in future bullish cycles. Currently, the prevailing conditions suggest that Ethereum’s decoupling might be more indicative of transient dynamics than a strategic evolution.

Conclusion

In summary, while Ethereum has made headlines with its recent price surge and short squeeze, critical indicators signal that market participants should proceed with caution. The rising exchange reserves and the shifting correlation with Bitcoin introduce new uncertainties. Observers of the market are encouraged to consider these factors when evaluating Ethereum’s future potential.