- Digital asset investment products saw $3.3B in inflows last week, marking the sixth consecutive week of net gains.

- CoinShares links this strong trend to U.S. economy concerns; Bitcoin ($2.9B) and Ethereum ($326M) led these inflows.

- In a notable shift, XRP experienced a record $37.2M outflow, which ended its long 80-week inflow streak, reports CoinShares.

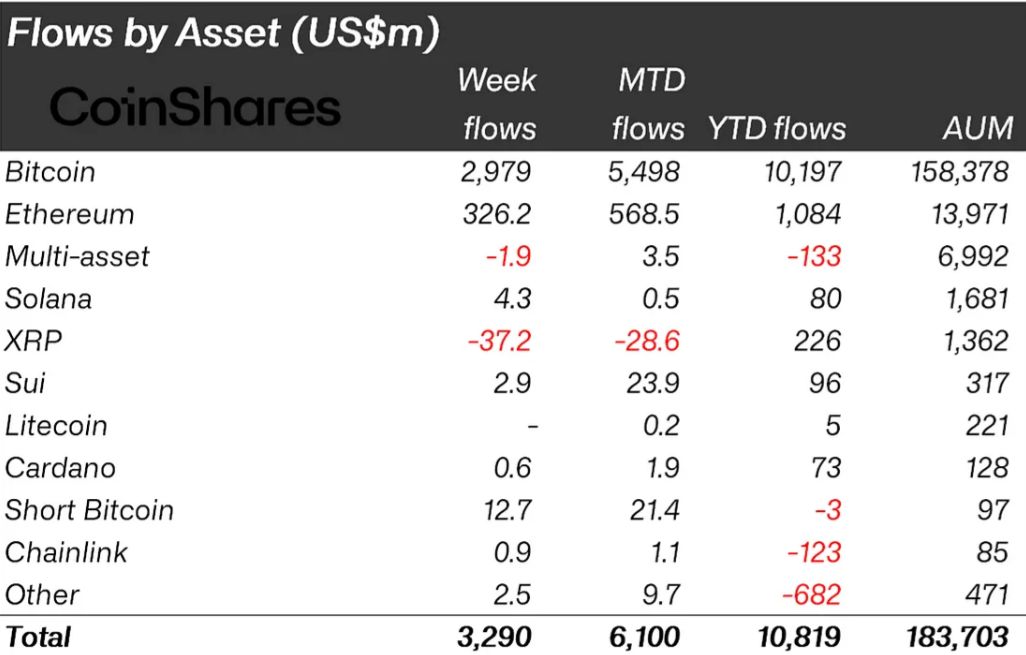

Digital asset investment products attracted a hefty $3.3 billion last week, notching their sixth consecutive week of steady capital flows. This strong run has pushed net inflows for the year-to-date to a new record high of $10.8 billion. Meanwhile, total assets under management (AuM) in these products also climbed to a new all-time high of $187.5 billion , signaling growing investor engagement with digital assets.

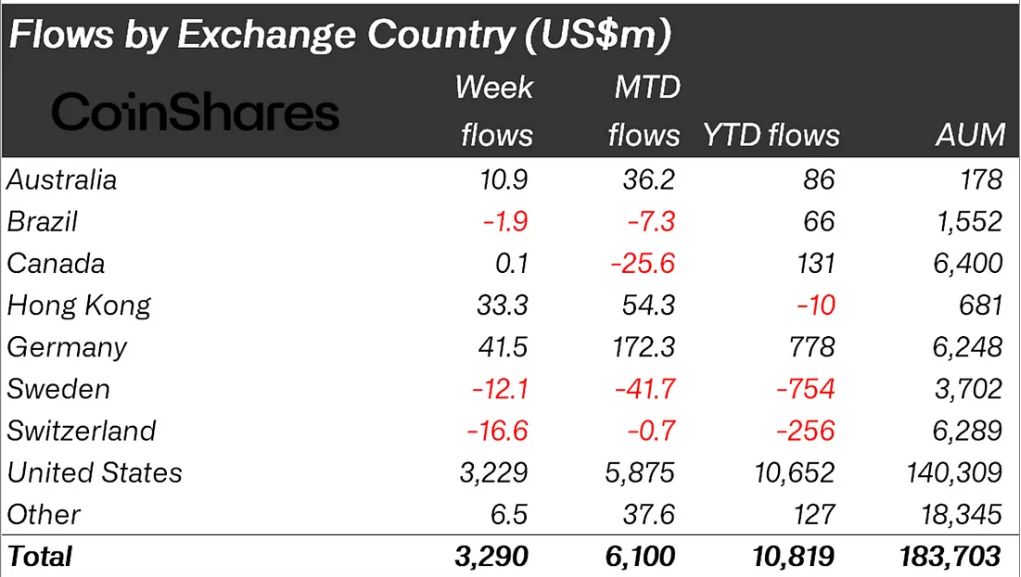

According to CoinShares’ latest report, growing concerns about the U.S. economy, especially following Moody’s credit rating downgrade and rising treasury yields, have driven investors to diversify into digital assets. The United States dominated inflows, contributing $3.2 billion in fresh capital during the week.

Bitcoin and Ethereum Lead Inflows as XRP’s Streak Ends

Bitcoin received the largest share of investment, with $2.9 billion entering the market the previous week. These funds make up roughly 25% of total inflows in 2024. With Bitcoin rising above $111,800, many investors have added more to their portfolios. At the same time, some investors took advantage of Bitcoin’s growth by investing in short Bitcoin products, which saw the highest weekly inflow since December 2024.

Related: John Deaton Sees Big Bitcoin Price Swing: $125K Then $112K Dip

Ethereum followed with $326 million in inflows. This represents the fifth week of capital gains and the largest week of inflows in 15 weeks—the sustained interest results from improving market sentiment towards the token and the ecosystem developments.

On the other hand, last week’s outflow of $37.2 million ended XRP’s 80-week inflow streak. This outflow is the largest in XRP’s history and breaks the streak of continuous inflows the token saw since early 2024.

Global Capital Flows Show Mixed Trends

Outside the U.S., Capital transfers in other markets showed mixed results. Inflows into Germany, Australia, and Hong Kong totaled $41.5 million, $10.9 million and $33.3 million, respectively. Although these numbers are less than those in the U.S., they still reflect international investors’ participation.

Investors in Switzerland took advantage of recent price rises resulting in withdrawals of $16.6 million in the last week. Similarly, Sweden saw outflows of $12.1 million while Brazil recorded $1.9 million outflows. The rising trends highlight investors’ profit-taking or portfolio rebalancing amid the rise in digital asset prices.

James Butterfill, CoinShares’ Head of Research noted that uncertainty in the U.S. economy has led investors to seek alternative assets. He said, “We believe that growing concerns over the U.S. economy, driven by the Moody’s downgrade and the resulting spike in treasury yields, have prompted investors to seek diversification through digital assets.”

Related: Crypto Prices Today: ETH, XRP, SOL Follow BTC Rally After President Trump’s EU Tariff Pause

The figures highlight investors’ ongoing preference for digital asset investment products amid shifting macroeconomic conditions. Despite some outflows of XRP, investors still have confidence in Bitcoin and Ethereum since these major cryptocurrencies are leading the inflows.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.