Ethereum Price Struggles Under $2,700; Uptrend Hits $4.4 Billion Supply Wall

Ethereum faces heavy resistance near $2,700, with large supply and investor selling slowing momentum. Holding $2,496 support is crucial for a potential rebound.

Failed breakouts have marked Ethereum’s price action this month, preventing the altcoin king from rallying decisively.

A noticeable shift in investor behavior over the past week has compounded this hesitation, making it harder for Ethereum to gain upward momentum.

Ethereum Faces Selling By Investors

Ethereum is currently facing a significant supply zone of 1.67 million ETH, valued at over $4.4 billion. This supply was acquired between $2,635 and $2,712, creating a formidable resistance level. Investors holding this volume are likely to sell and secure profits, exerting selling pressure and limiting Ethereum’s ability to rise.

This large supply zone acts as a barrier, discouraging new buyers and triggering profit-taking among existing holders. The presence of such a substantial supply near current prices dampens bullish hopes and increases uncertainty about Ethereum’s short-term recovery.

Ethereum IOMAP. Source:

IntoTheBlock

Ethereum IOMAP. Source:

IntoTheBlock

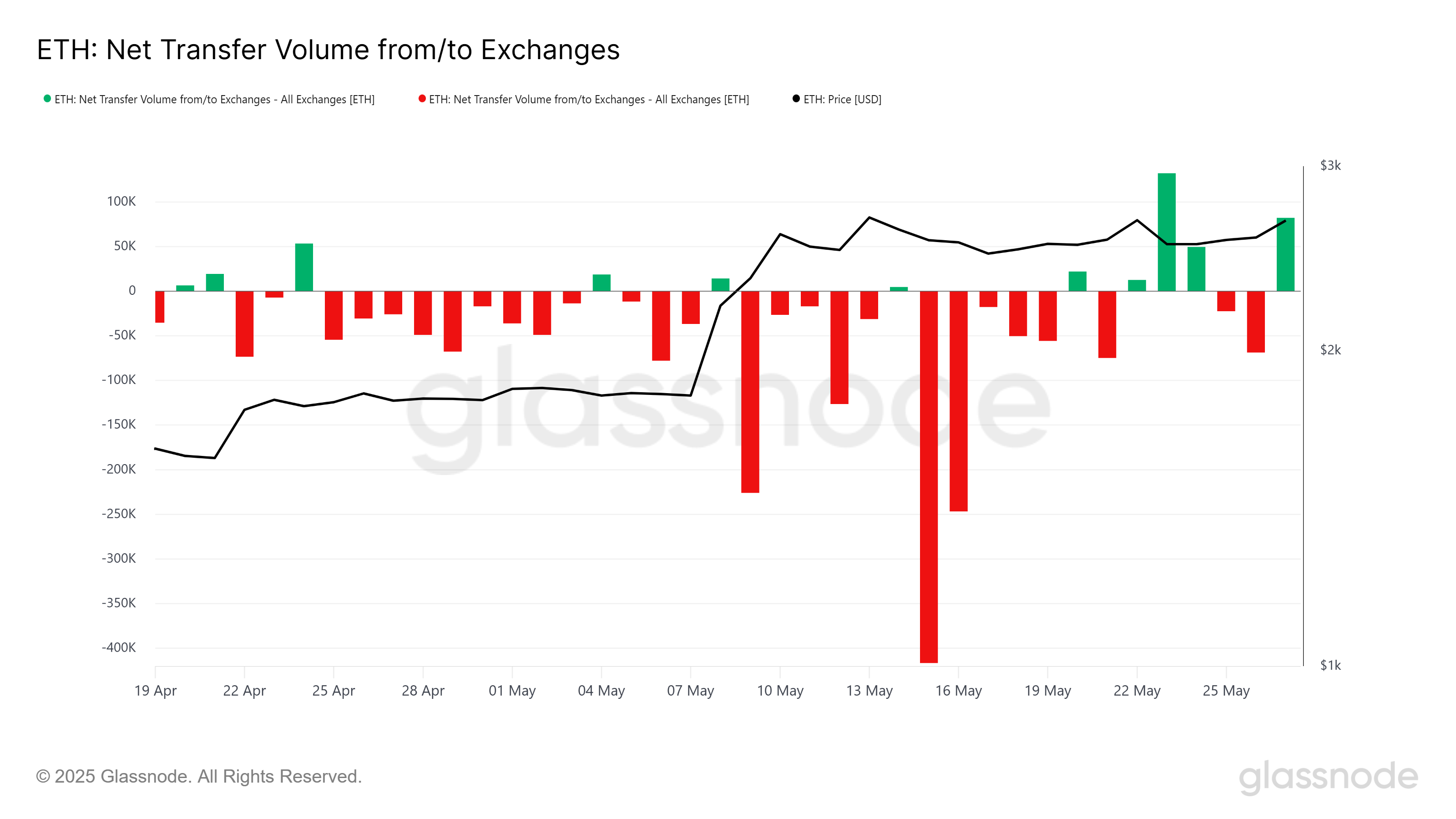

Transfer data shows a spike in supply moving to exchanges, indicating increased selling pressure. These spikes, the first significant ones recorded this month, indicate that sellers are beginning to act. Ethereum’s failure to break above $2,700, even as Bitcoin reached a new all-time high, is hurting the conviction among ETH holders.

This growing impatience among investors is causing hesitation and reducing buying interest. The combination of increased selling and stagnant price action points to a weakening momentum, challenging Ethereum’s ability to capitalize on Bitcoin’s bullish trend.

Ethereum Transfer Volume To/From Exchanges. Source:

Glassnode

Ethereum Transfer Volume To/From Exchanges. Source:

Glassnode

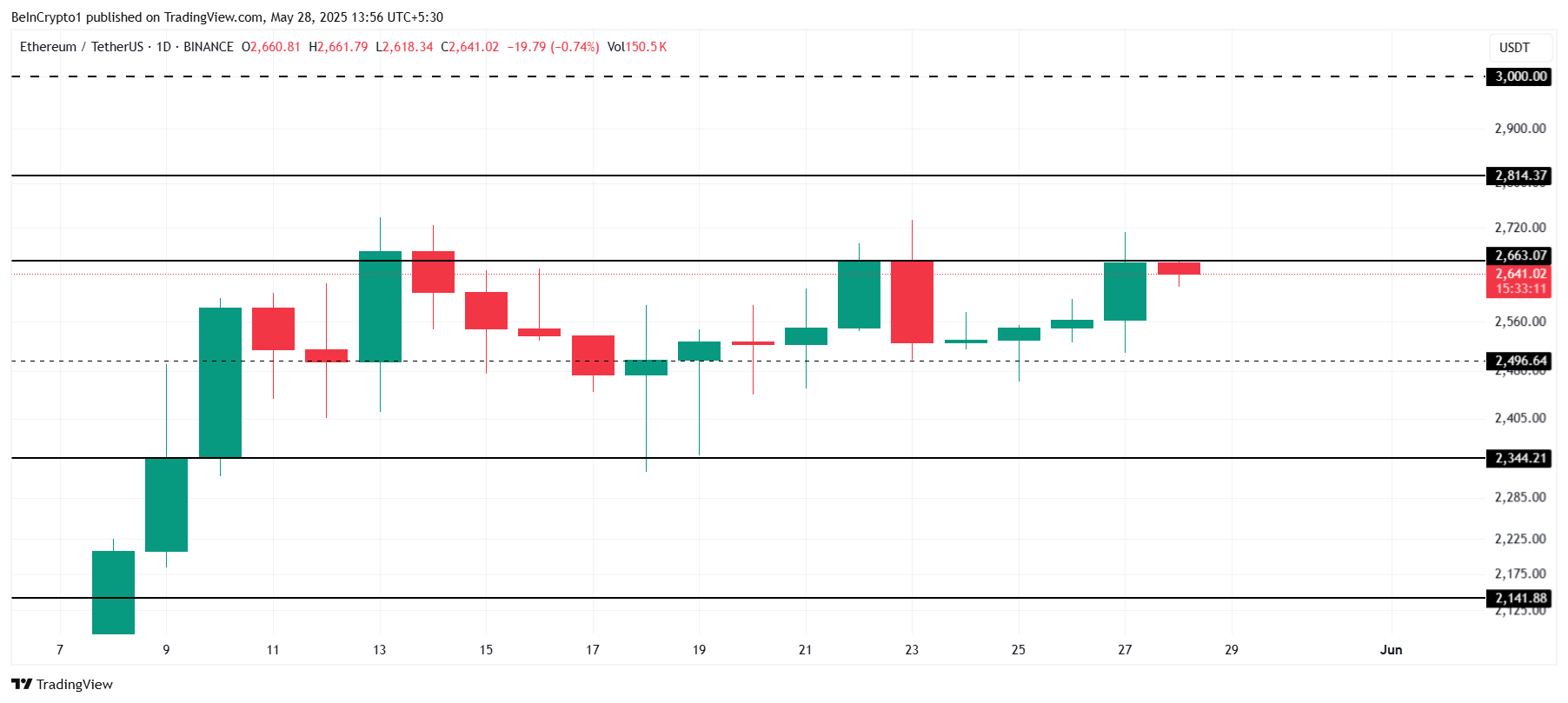

ETH Price Drop Fear Strengthens

Ethereum is currently trading at $2,641, struggling to breach the $2,663 resistance. This marks the third unsuccessful attempt since the start of the month, primarily due to the heavy supply and selling pressure described above.

On the support side, Ethereum is holding firm above $2,496. Therefore, the price is likely to consolidate around this support, gradually building strength for another attempt at overcoming the $2,663 resistance. Moreover, stability at this level is critical for future gains.

Ethereum Price Analysis. Source:

TradingView

Ethereum Price Analysis. Source:

TradingView

On the other hand, if market conditions improve and investors refrain from selling, Ethereum could push past the $2,663 resistance. Achieving this breakout would open the door to a rise toward $2,814, invalidating the current bearish thesis and signaling renewed optimism for the altcoin’s trajectory.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!