Federal Reserve Meeting Minutes: Inflation and Unemployment Risks Increased as of May Meeting

According to a report by Jinse Finance, the latest minutes from the Federal Reserve's May meeting reveal that Fed staff acknowledged they might face "difficult trade-offs" in the coming months, with rising inflation and unemployment rates. Fed officials' increased estimates of recession risks support this outlook. The simultaneous rise in inflation and unemployment will force committee members to decide whether to prioritize tightening monetary policy to combat inflation or to support economic growth and employment through interest rate cuts. As the economy adapts to the higher import tariffs proposed by the Trump administration, "almost all participants indicated that inflation might be more persistent than expected." The Fed anticipates that due to the impact of tariffs, this year's inflation rate will "significantly" rise, while the job market is "expected to weaken considerably," with the unemployment rate rising above the long-term expected level of full employment by the end of the year and remaining at that level for two years.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

VanEck to launch Degen Economy ETF, focusing on digital gaming, prediction markets, and related sectors

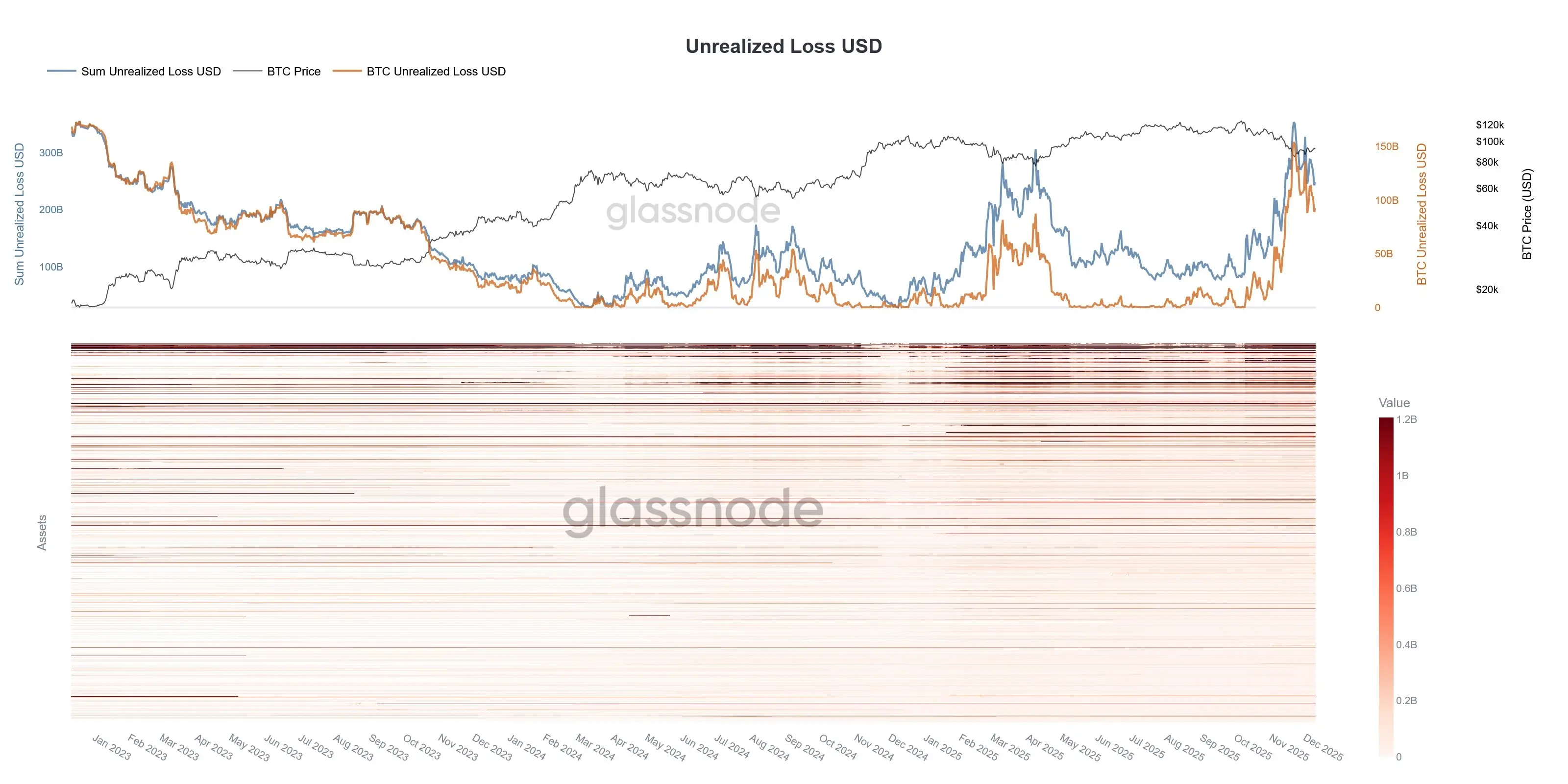

Glassnode: Unrealized losses in cryptocurrencies rise to $350 billions, high volatility expected in the coming weeks