Key Notes

- US-based institutional activity is surging, with the Coinbase Premium Gap hitting its highest level this year.

- Whale wallets have added over 122,000 BTC in six weeks, signaling major accumulation.

- Governments like Pakistan and companies like GameStop are now holding Bitcoin as a strategic asset.

Bitcoin BTC $96 611 24h volatility: 2.1% Market cap: $1.92 T Vol. 24h: $29.09 B climbed to a new all-time high of $111,900 last week before settling slightly lower at $107,800 at press time. While retail enthusiasm simmers under the surface, some analysts argue that real activity is happening with the institutions.

CryptoQuant analyst Darkfost, a regular voice on institutional inflows, notes that while spot Bitcoin ETFs have become popular, they aren’t the true measure of institutional interest.

In his view, “anyone can get exposure to ETFs,” and their current volumes are still relatively small compared to spot and futures markets. Instead, Darkfost points to a more compelling signal: the Coinbase Premium Gap.

Do you want to know when smart money is investing? The Coinbase Premium Gap holds the key.

These investor groups often use Coinbase for their trades. The Coinbase Premium Gap reflects their activity.

This metric has shown a strong correlation with price movements, especially… pic.twitter.com/U6BrtENbGP

— CryptoQuant.com (@cryptoquant_com) February 20, 2025

The metric, which compares the price of Bitcoin on Coinbase Pro versus Binance , reflects buying pressure from US-based, often institutional investors. Currently, the 30-day moving average of this premium sits at 55 — the highest level recorded this year.

Additionally, Bitcoin’s 30-day average daily inflow remains elevated at over $330 million, reflecting sustained institutional accumulation. This is not retail FOMO. It is a strategic positioning by heavyweight players.

BCMI: A Bullish Pulse Beneath the Calm

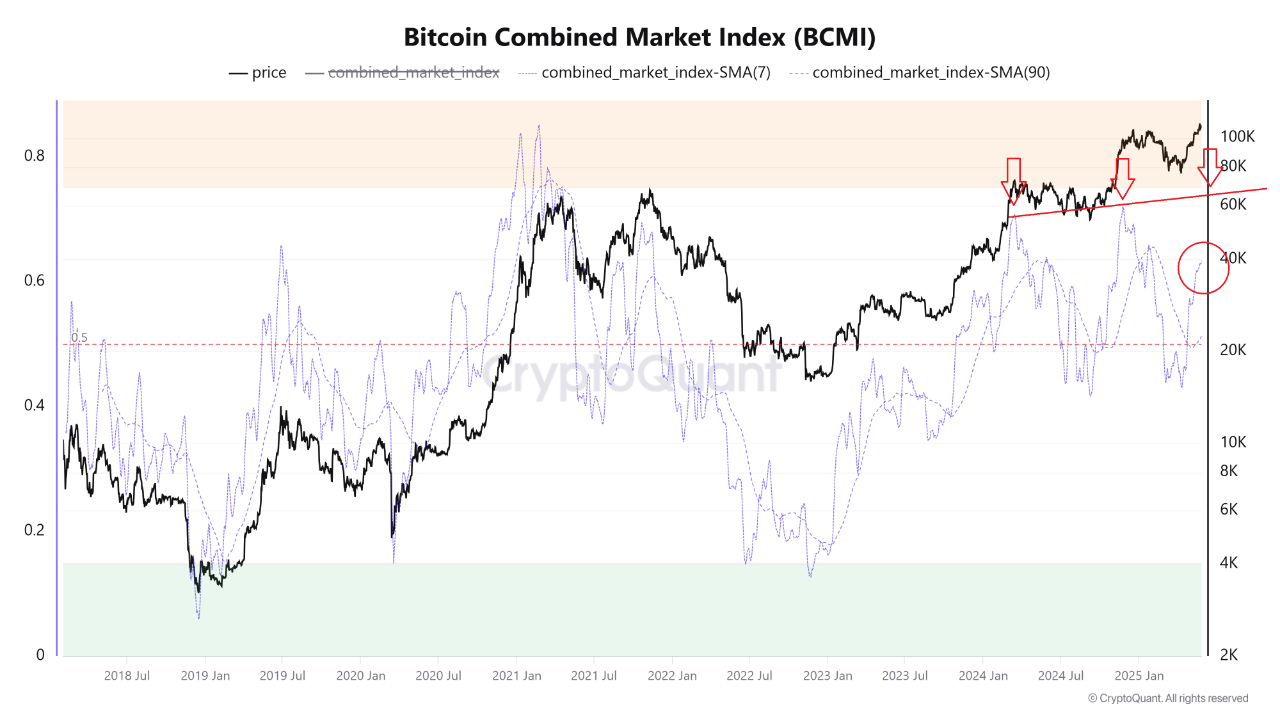

Analyst Woominkyu has further highlighted a sharp rebound in the Bitcoin Combined Market Index (BCMI) , a composite measure that blends metrics like MVRV, NUPL, SOPR, and the Fear Greed Index.

The 7-day SMA of BCMI now stands at 0.6, marking a clear shift towards early bullish sentiment. The 90-day SMA, however, remains neutral around 0.45, indicating the market is not in a euphoric or overheated state.

BCMI Chart | Source: CryptoQuant

This setup, short-term optimism within a longer-term stable trend, often precedes sustained bull runs.

“With on-chain sentiment rising and profit-taking easing,” Woominkyu noted, “the market may be entering an early accumulation phase.”

A Perfect Storm of Accumulation

Santiment data showcases the sharpest recent correlation between price and behavior of whale wallets, specifically those holding between 100 and 1,000 BTC.

Over the past six weeks, this cohort has added +337 wallets, accumulating a massive 122,330 BTC. Historically, this group’s moves often foreshadow larger market momentum shifts.

🐳 Over the past 5 years of Bitcoin's history, no tier of wallets has been more price-correlated to crypto markets than the behavior of whales holding between 100 to 1,000 $BTC . In the past 6 weeks, this group has +337 more wallets, collectively accumulating 122,330 more Bitcoin. pic.twitter.com/ALmWPO20n2

— Santiment (@santimentfeed) May 28, 2025

On the other hand, GameStop, a once-meme-stock-turned-digital-transition-player, revealed it had purchased 4,710 BTC . It’s a bold bet, reminiscent of MicroStrategy’s early moves.

Additionally, in a major geopolitical development, Pakistan has announced plans for a strategic Bitcoin reserve.

According to Bilal Bin Saqib, a crypto advisor to the Pakistani government, the move is inspired by the US, where US President Trump recently signed an executive order to initiate a similar Bitcoin reserve.

BREAKING 🔥

Woahhh Pakistan is launching Bitcoin Strategic Reserve @Bilalbinsaqib is bringing Pakistan to the forefront of the world map in blockchain adoption

Pakistan zindabaad 🇵🇰 pic.twitter.com/SyT06dE8ou

— Inspired Analyst (@inspirdanalyst) May 28, 2025

“We are getting inspired by the US government,” Saqib said at Bitcoin 2025 in Las Vegas.

nextDisclaimer: Coinspeaker is committed to providing unbiased and transparent reporting. This article aims to deliver accurate and timely information but should not be taken as financial or investment advice. Since market conditions can change rapidly, we encourage you to verify information on your own and consult with a professional before making any decisions based on this content.