May 29th Market Key Insights, How Much Did You Miss?

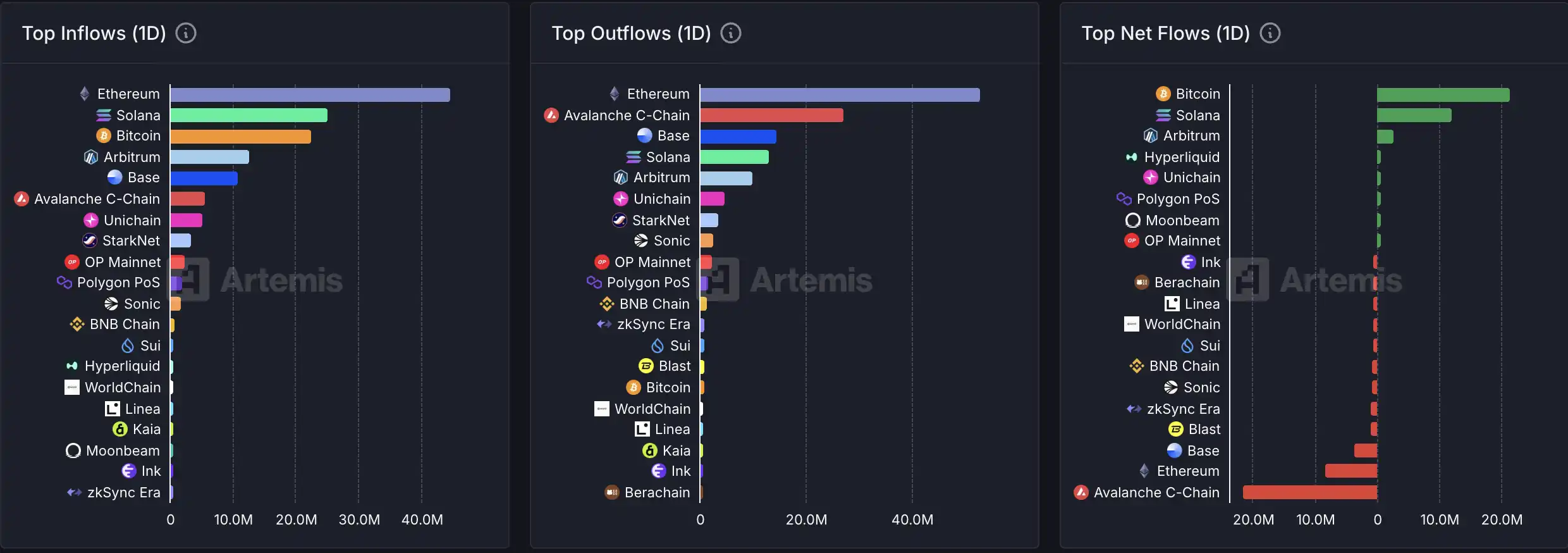

1. On-chain Funds: $22.4M Flowed into BTC; $27.2M Flowed out of Avalanche 2. Largest Price Swings: $BEER2, $SOPH 3. Top News: Bank of Russia Allows Financial Firms to Offer Crypto Derivatives Services to Qualified Investors

Editor's Picks

1.Trump Posts Image Featuring PEPE on Truth Platform

4.Reddio (RDO) Opens at $0.021, Market Cap Currently at $17.5 Million

5.Current Mainstream CEX, DEX Funding Rates Show Market's Bearish Sentiment Towards Bitcoin

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

LOUD

Today's discussion about LOUD is mainly focused on the @stayloudio project, which has gained widespread attention due to its unique "Initial Attention Offering (IAO)" mechanism and leaderboard system. The project fosters a competitive environment by rewarding outstanding speakers, creating a potentially lucrative reward system. Many tweets speculate on the project's sustainability and profitability, with some expressing doubts about its long-term viability. The community is actively engaged in discussions surrounding potential rewards, distribution mechanisms, and the project's impact on the crypto industry.

SOPHON

Sophon (SOPH) has attracted attention for its successful listings on major exchanges such as Binance, OKX, and Upbit, with trading volume reaching around $600 million in a short period. The listing was accompanied by a widely popular airdrop event, and its integrations with platforms like Mintify and SyncSwap have been well-received. Sophon focuses on creating a consumer-friendly crypto experience through its Layer 2 blockchain built on zkSync technology. Its innovative "Social Oracle" feature has been praised. The project aims to seamlessly integrate blockchain into everyday applications such as gaming, social media, and artificial intelligence, making it more easily accessible to the general public.

GME

GameStop (GME) became a hot topic after announcing the purchase of 4,710 bitcoins (approximately $512 million), transforming into a Bitcoin treasury company. This move sparked a strong market reaction, with some seeing it as a strategic hedge against currency devaluation, while others criticized the execution of the decision and questioned the company's management. Following the announcement, GME's stock price briefly surged, but some investors remain cautious about its long-term impact.

HUMANITY

Today's discussion about HUMANITY focused on the upcoming launch of the Humanity Protocol and its innovative approach to identity verification through biometric palm scanning. The protocol aims to address internet identity issues, ensure fair airdrop distribution, and secure online interactions by distinguishing between real users and bots. The project has allocated $2.2 million worth of $H tokens to Kaito stakers and Humanity Yappers, sparking significant attention and participation. The community is excited about the protocol's potential to redefine identity verification in Web3.

TON

TON garnered widespread attention today due to several significant developments. The TON Foundation has appointed former Visa executive Nikola Plecas as Vice President of Payments to expand payment capabilities for Telegram's large user base. Additionally, Telegram announced a $300 million partnership with Elon Musk's xAI to integrate Grok AI into its platform, leading to a 20% increase in TON's price. Furthermore, Telegram plans to raise $1.5 billion through bond issuance, with investors including BlackRock, Mubadala, and Citadel. These announcements collectively propelled TON to become the most discussed project in the crypto community.

Featured Articles

1.《Behind Trump's $25 Billion All In Bitcoin, Stock Market Inflow into 'BTC Fentanyl'》

On May 28, GameStop's stock price plummeted nearly 11% after announcing the purchase of 4,710 bitcoins, but prior to this, Trump's media tech group (TMTG) had also announced a whopping $25 billion All In Bitcoin. The Republican Vivek Ramaswamy-founded Strive announced a $750 million funding to create a "Bitcoin Treasury Company," and through the acquisition of Asset Entities, raised an additional $750 million, continually doubling down on BTC. On the other hand, SharpLink Gaming raised $425 million to establish an ETH treasury. Various signs indicate that 'BTC Fentanyl' is rapidly penetrating the stock market.

2.《Selling While Sprinting Towards IPO, What Is Circle Trying to Do?》

Approximately a month ago, Circle announced the initiation of its initial public offering (IPO) plan, but due to external policy changes, the process was forced to be postponed. During this time, Circle simultaneously engaged in deep negotiations with potential buyers, including Coinbase and Ripple, regarding acquisition matters. However, a consensus was not reached due to differences in valuation amounts. Circle is not in a rush to sell, and its strategic intent is evident: on the one hand, it hopes to validate and obtain a higher company valuation through pricing in the public IPO market; on the other hand, it is also pressuring potential acquirers, hoping they will further increase their offers. Essentially, Circle is engaging in a savvy "price comparison" game to advocate for the maximization of shareholder interests.

On-chain Data

On-chain Fund Flow on May 29

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!