XRP Futures Open Interest Crosses $220 Million Despite Price Slump

XRP futures show growing trader confidence as accumulation rises and exchange reserves fall, supporting hopes for a price rebound above $2.27.

XRP’s price has been declining over the past two weeks, extending a downtrend that has challenged bullish investors.

Despite the ongoing dip, some traders see this period as a potential opportunity to accumulate XRP before a possible price rebound.

XRP Has Strong Support

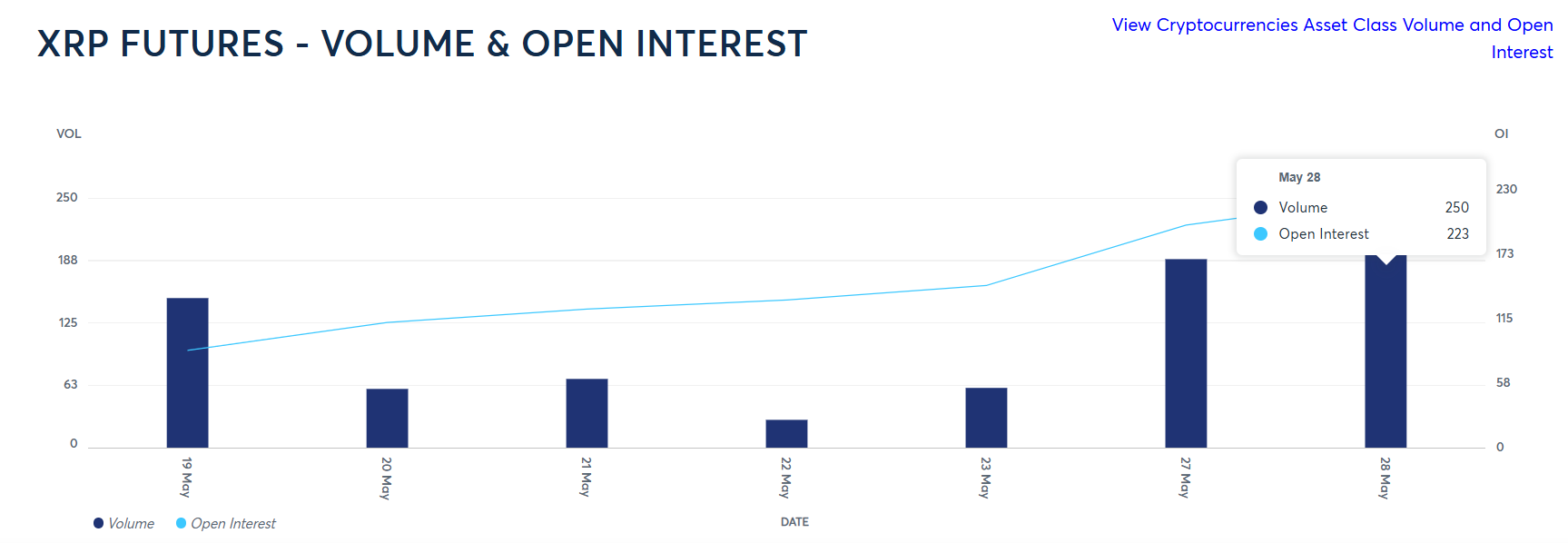

Demand for XRP has surged sharply in the futures market, with XRP CME Futures open interest reaching $223 million within just 10 days of its launch. This rapid increase in open interest generally is a bearish indication as traders are likely placing short contracts.

XRP Futures Open Interest. Source:

CME

XRP Futures Open Interest. Source:

CME

However, the situation is different this time. This is because the launch of XRP Futures on CME provides the token with better exposure. Thus, investors allocating capital in this area are likely doing so out of anticipation of gains.

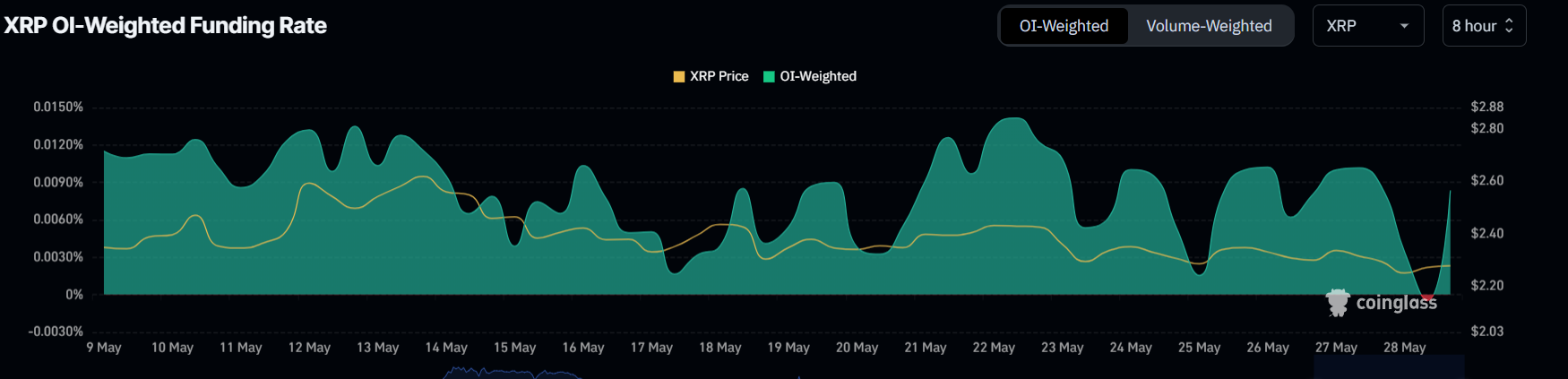

The funding rate, which has been nearly always positive for the past three weeks except for one instance of turning negative, further supports this bullish outlook. This shows that long contracts overpower short contracts.

XRP Funding Rate. Source:

Coinglass

XRP Funding Rate. Source:

Coinglass

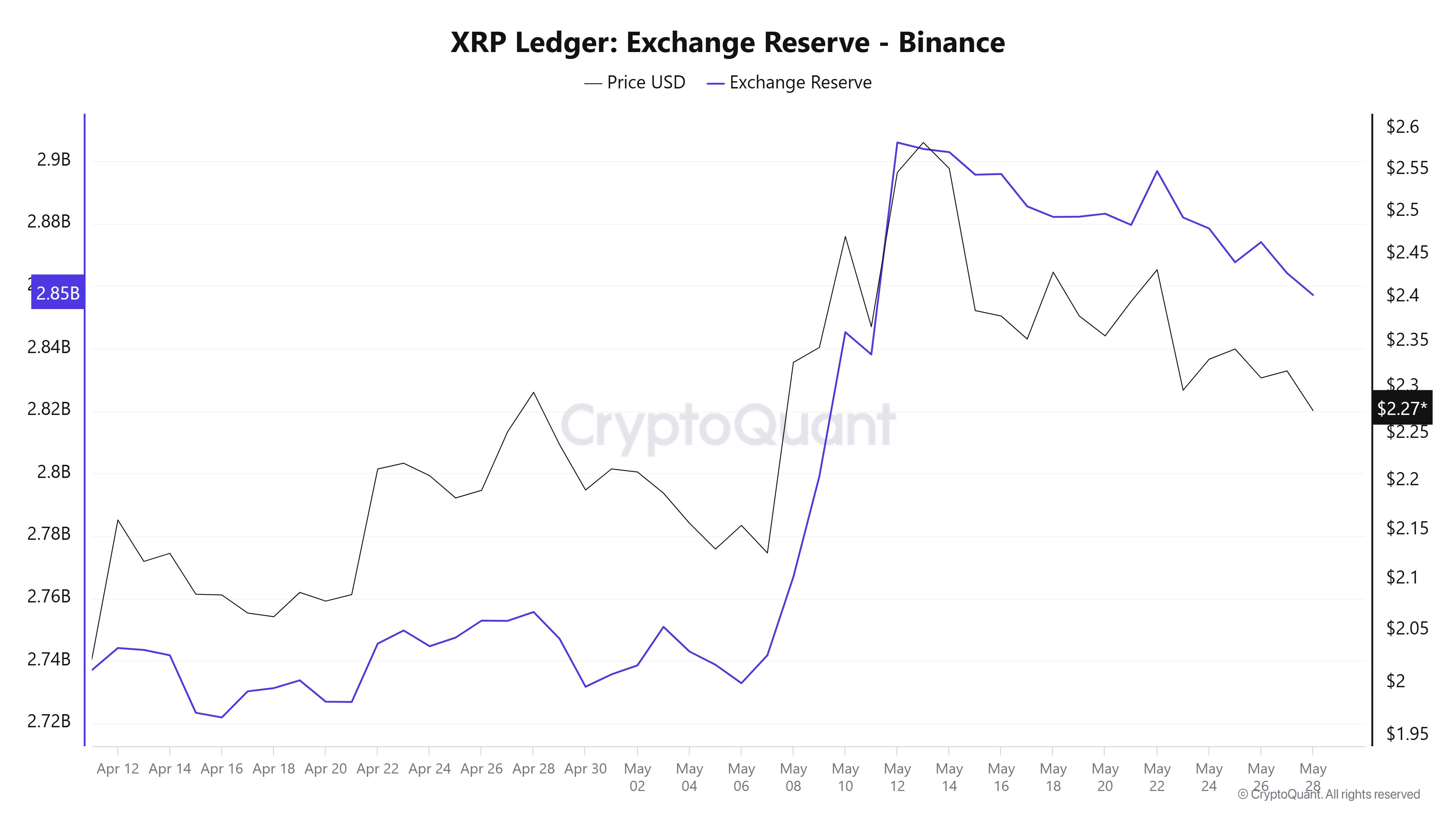

Exchange reserves of XRP spiked at the beginning of the month until a little over two weeks ago, signaling a wave of selling pressure. However, since then, these reserves have declined by nearly 50 million XRP, worth over $114 million, indicating significant withdrawals from exchanges.

This decrease in exchange reserves highlights increased accumulation by investors, likely driven by FOMO (fear of missing out). Buyers are capitalizing on the relatively low prices, expecting XRP to reverse its downtrend and generate profits as momentum shifts.

XRP Exchange Reserves. Source:

CryptoQuant

XRP Exchange Reserves. Source:

CryptoQuant

XRP Price Has A Shot

Currently trading at $2.28, XRP is still caught in a two-week downtrend that has prevented a breakout. The altcoin remains vulnerable despite holding slightly above the $2.27 support level, and further declines cannot be ruled out.

If XRP maintains the $2.27 support, it could recover and break the downtrend, pushing prices higher toward $2.38. This rebound would validate the growing demand for futures and accumulation seen in recent weeks, signaling renewed investor confidence.

XRP Price Analysis. Source:

TradingView

XRP Price Analysis. Source:

TradingView

Conversely, losing the $2.27 support would open the door to further losses. XRP could fall toward the next support level at $2.12, invalidating the bullish outlook and potentially extending the downtrend before any meaningful recovery.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!