Over $11 Billion Bitcoin, Ethereum Options Expire Today Amid Bullish Sentiment

Bitcoin and Ethereum face a massive $11.4 billion options expiration today, sparking volatility as traders weigh bullish call interest against growing protective put demand.

The crypto market will witness $11.4 billion in Bitcoin and Ethereum options expire today. This massive expiration could impact short-term price action, especially as both assets have recently declined.

This week’s expiring Bitcoin and Ethereum options are significantly higher than last week’s, as today’s expiring contracts are for the month.

May Options Expiry: Over $11 Billion Bitcoin and Ethereum Contracts Go Bust

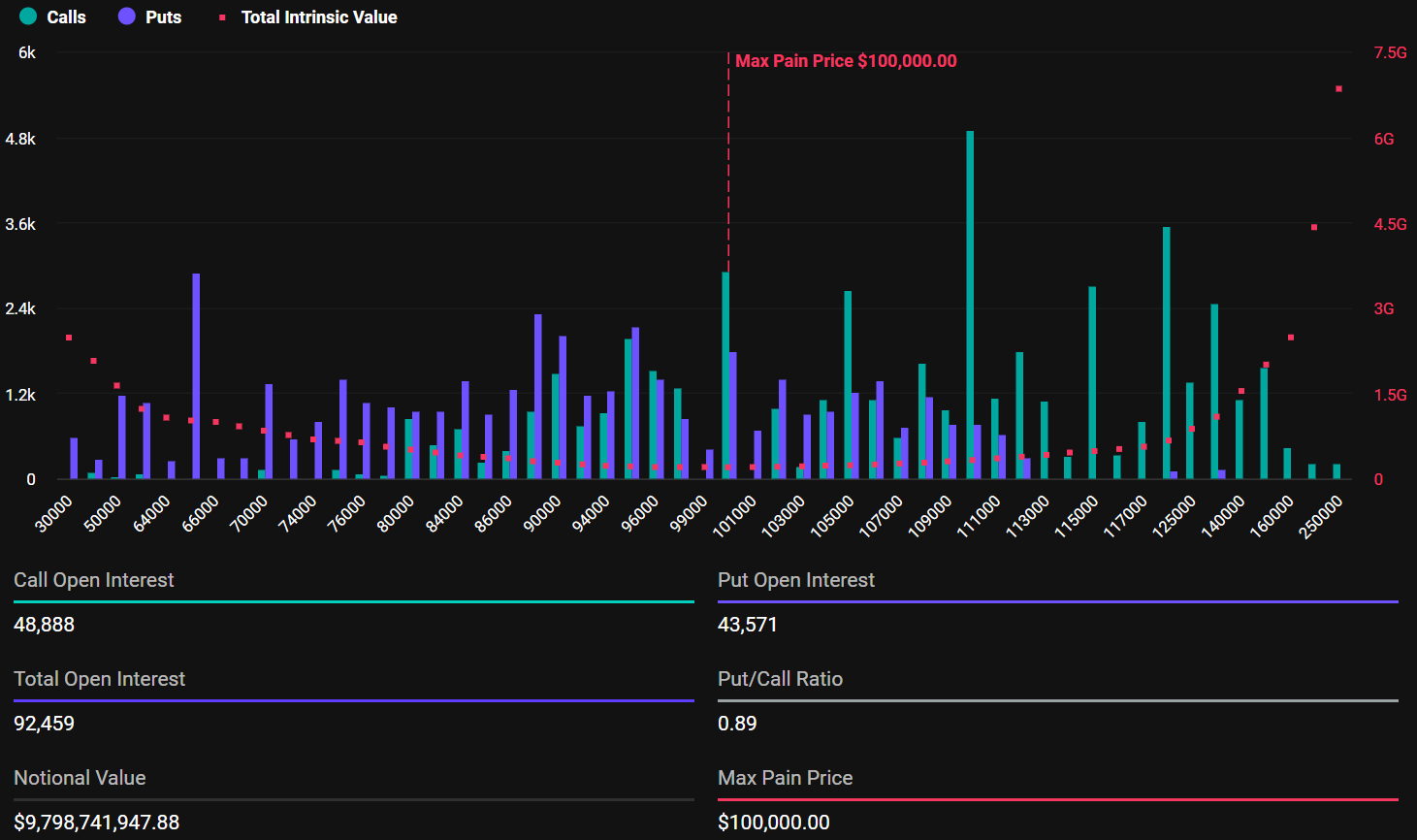

In today’s expiring options, Bitcoin contracts are valued at $9.79 billion and Ethereum at $1.63 billion. With this, traders are bracing for potential volatility.

Specifically, data on Deribit shows 92,459 contracts of expiring Bitcoin options, compared to 25,438 last week.

These expiring Bitcoin options have a maximum pain price of $100,000 and a put-to-call ratio of 0.89. This indicates a generally bullish sentiment despite the asset’s recent pullback.

Expiring

Bitcoin Options. Source:

Deribit

Expiring

Bitcoin Options. Source:

Deribit

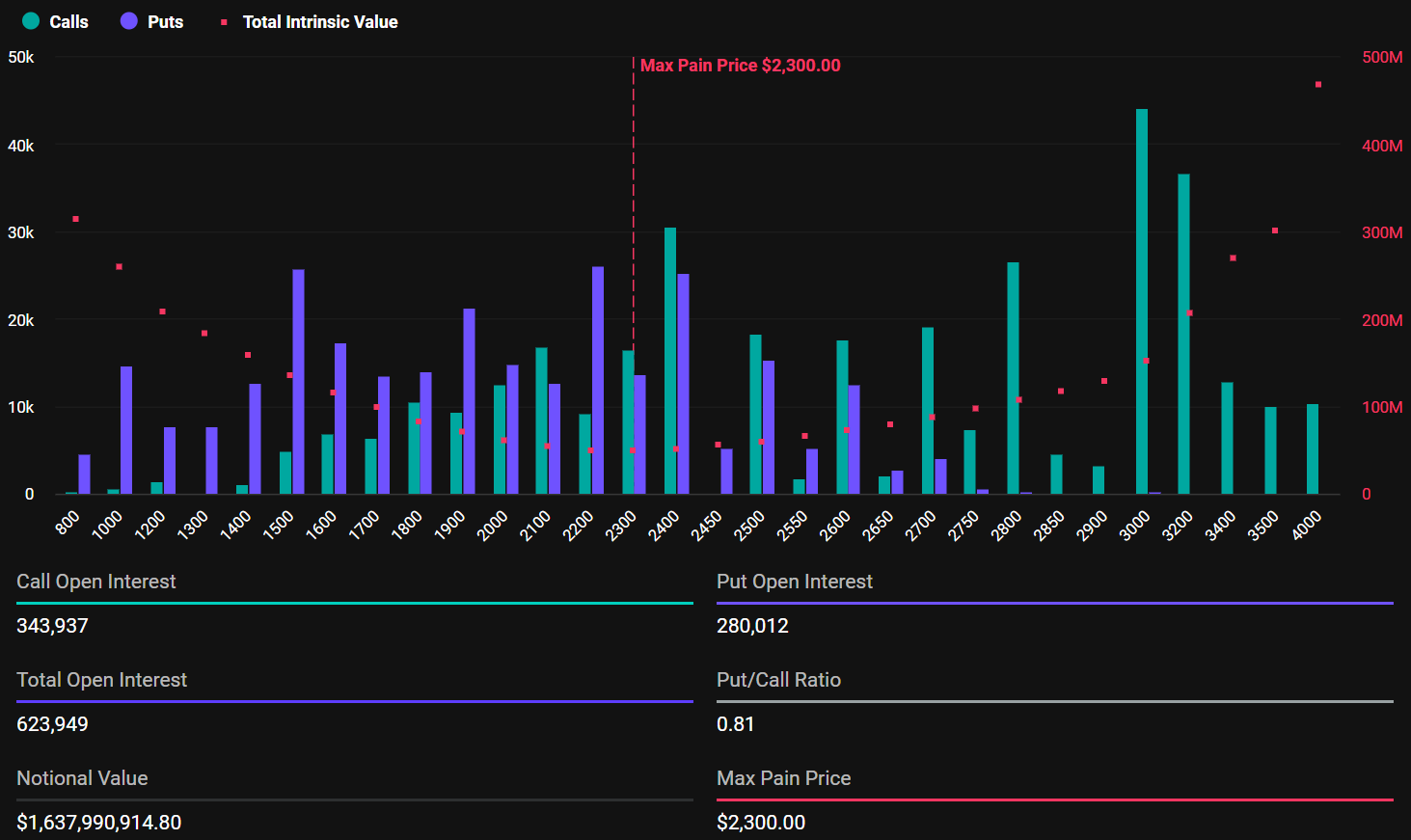

In comparison, their Ethereum counterparts have a maximum pain price of $2,300 and a put-to-call ratio of 0.81, reflecting a similar market outlook. Ethereum’s expiring options total 623,949 contracts, up from 25,438 contracts the previous week.

Expiring

Ethereum Options. Source:

Deribit

Expiring

Ethereum Options. Source:

Deribit

In crypto options trading, put-to-call ratios below 1 for Bitcoin and Ethereum suggest optimism in the market, with more traders betting on price increases.

It is also worth noting that calls dominate the total open interest for both Bitcoin and Ethereum expiring options. Specifically, calls account for 48,888 for Bitcoin options versus 43,571 for puts. Meanwhile, calls account for 343,937 for Ethereum options against 280,012.

“Calls dominate OI at higher strikes, reflecting lingering upside interest, but with volatility cooling. What do you expect to happen after the expiry?” analysts at Deribit posed.

Nevertheless, it is imperative to exercise caution due to the tendency of option expiration to cause market volatility.

Options expirations often cause short-term price fluctuations, creating market uncertainty. Meanwhile, BeInCrypto data shows Bitcoin’s trading value has dropped by 1.43% to $106,122. On the other hand, Ethereum’s price is down by 3.43%, now trading at $2,634.

Bitcoin and Ethereum Show Mixed Signals Ahead of Options Expiry

Notably, today’s expiring options come after the Bitcoin Conference 2025, the two-day event that ended on Thursday, May 29, in Las Vegas, Nevada.

Around this event, analysts at Greeks.live indicate that crypto markets entered a precarious holding pattern, bracing for heightened volatility.

While Bitcoin’s price remains above $100,000, sentiment in derivatives markets signals rising caution. The analysts note that despite BTC maintaining its range, traders actively hedge downside risk.

“Group consensus is that if buying pressure pauses “for one minute,” Bitcoin will domp like a rock,” wrote Greeks.live.

The Put/Call Ratio for delivery options has fallen, reflecting increased demand for protective puts (sales). According to the analysts, this suggests that many institutional players stay on the sidelines despite recent highs.

Ethereum, meanwhile, has shown relative strength. Though its upward momentum has slowed, implied volatility (IV) remains elevated at around 70% short term, with prices up 3% in the medium to long term. The market appears to be recalibrating ETH’s fair value as it consolidates recent gains.

Overall sentiment leans bearish, with most private-group traders expecting a sharp pullback in BTC. The dominant strategy centers on loading put spreads.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

How to achieve ultra-high win rates on Polymarket through insiders?

The more insiders there are, the more accurate the price is, and the more reliable the information provided by the market becomes.

Singapore Implicated in Cambodia Pig-Butchering Scam, "Tax Haven" Status Questioned Again

The charges have once again drawn attention to Singapore's role in criminal activities in the Southeast Asian region.

[Long Thread] Crypto "Three Kingdoms"

Research Report|In-Depth Analysis and Market Cap of Meteora(MET)