-

Test Token (TST) sees a dramatic downturn as a major whale sells millions, igniting controversy and speculation within the crypto community.

-

Market fluctuations have intensified as accusations against Binance’s leadership emerge, with many seeking answers amidst the chaos.

-

A statement from a prominent crypto user highlights the panic, emphasizing the need for clarity in the current trading environment.

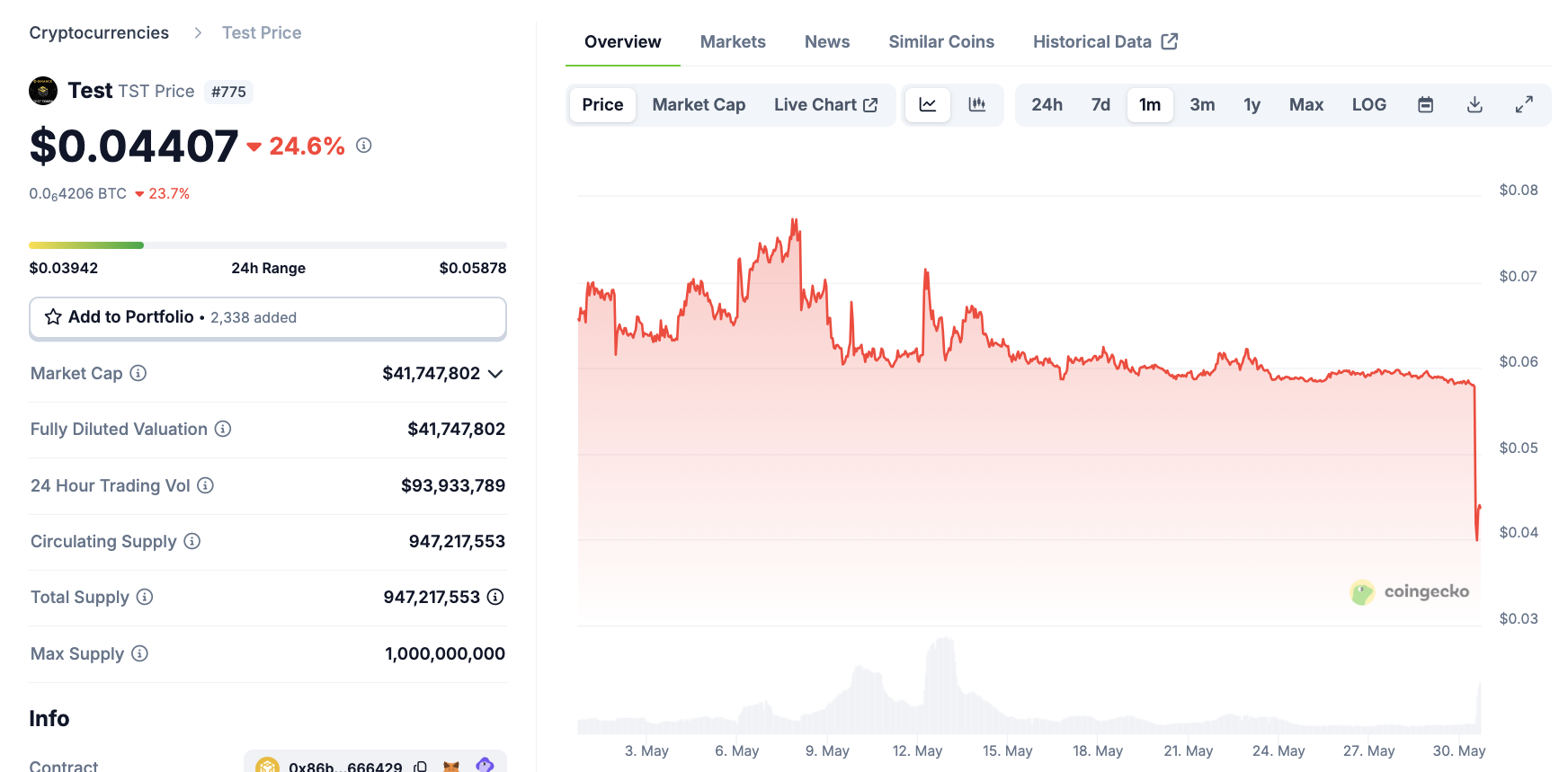

TST’s unexpected fall of over 40% occurred almost instantaneously after an anonymous whale liquidated a stake worth $6-7 million, significantly impacting the asset’s total market cap of $55 million.

The swift action of the whale led to a flurry of accusations on social media, as users speculated about the possible involvement of Changpeng “CZ” Zhao or Binance insiders in the sell-off. While the reactions stem from genuine concern, they lack substantiation.

Market Shockwave: The Impact of the TST Whale Sell-off

The narrative surrounding TST is as compelling as its volatility. Initially launched as a meme coin to illustrate the launch process, TST has captured traders’ interest as a high-risk speculative investment.

The chaos was triggered when a single whale unloaded a substantial amount of TST, leading to significant market repercussions:

One prominent figure noted the situation, stating: “This large sell-off is alarming. The team should address this promptly.” View Tweet

— Alpha Whale Crypto (@AlphaWhale_) May 30, 2025

According to data from Coinglass, TST’s trading volume soared by over 800% within 24 hours, underscoring how one whale’s actions can reverberate throughout the market.

The majority of this trading activity occurred on Binance’s spot and futures platforms, which were utilized by the whale to exit a significant position. As a result, TST’s market cap plummeted by nearly $20 million.

The sudden blame directed at the token’s founder, CZ, highlights the community’s distress. Speculations regarding the identity of the whale only add to the turmoil.

If TST’s total market cap was only $55 million, it raises questions about the concentration of holdings, indicating disproportionate influence by a single player. Past incidents involving Binance have fueled distrust among TST supporters, prompting reactions like:

“Binance has been dumping on their users repeatedly. The recent activity with TST mirrors earlier events with ACT, where markets collapsed seemingly overnight,” one commenter stated.

Despite the rampant speculation, there is currently no definitive proof linking CZ or any Binance associate to this significant withdrawal. The online discourse reflects a climate of panic, compounded by previous incidents involving sudden market shifts.

While the lack of clear evidence raises concerns, discerning the reactions and strategies that traders adopt is essential. One whale’s decisive move led to a market fluctuation exceeding prior activity over weeks.

TST Price Performance. Source: CoinGecko

The search for clarity over the whale’s identity remains ongoing. Future blockchain analyses may provide insights that could unravel some of the mystery surrounding the incident.

As the dust settles, investors should take heed of the crypto market’s inherent volatility, recognizing that while fears can spark knee-jerk reactions, unfounded accusations do little to establish trust or stability.

Conclusion

This incident serves as a stark reminder of the risks associated with meme coins and the rapid fluctuations that can occur. Investors must remain vigilant and avoid the trap of baseless speculations. Continuous monitoring and transparency are crucial for maintaining a trustworthy trading environment.