Bitcoin: A Trader Loses $100 Million On Hyperliquid In A Flash Liquidation

A trader lost everything. Within a few hours, a $100 million position on bitcoin collapsed. This silent crash highlights the excesses of a crypto market increasingly hungry for extreme speculation. And the Hyperliquid platform is on the front lines.

In Brief

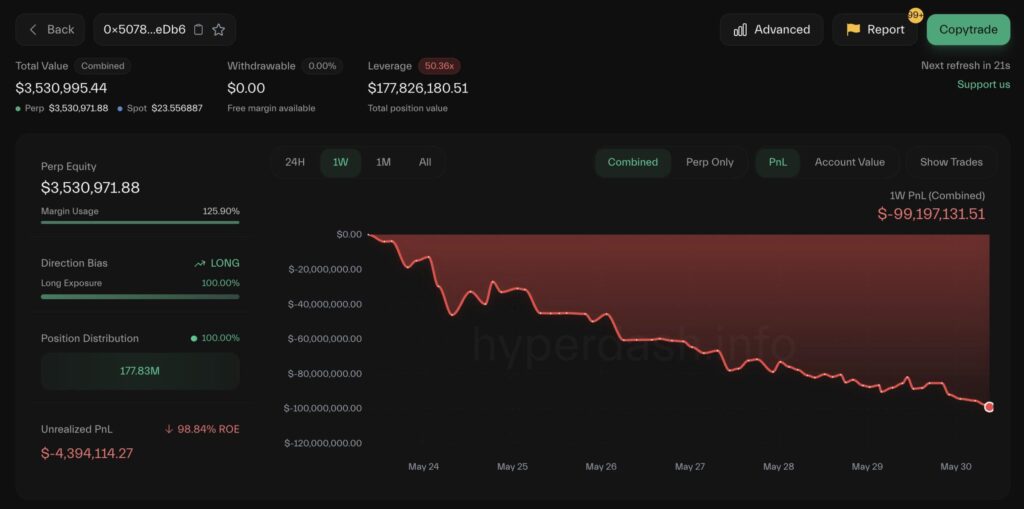

- A trader lost $99.3 million on Hyperliquid after a flash liquidation of 949 bitcoins.

- James Wynn, se qualifiant de « dégénéré », continue de parier malgré une nouvelle perte latente de 3,4 millions $.

- L’affaire révèle les failles du trading à levier sur les plateformes DeFi et relance le débat sur l’absence de garde-fous.

Bitcoin: a $100 million position liquidated in a few hours

The scene unfolded unnoticed by the market, yet it remains spectacular. As bitcoin briefly dipped below $105,000, a trader on Hyperliquid, identified under the pseudonym James Wynn, saw his long positions liquidated in two successive rounds. First 527.29 BTC, then 421.8 BTC , respectively at $104,950 and $104,150, for a total loss of $99.3 million.

$99.3 million in losses on the bitcoin bet.

$99.3 million in losses on the bitcoin bet.

This debacle was, however, preceded the day before by a first warning sign: the liquidation of 94 bitcoins at $106,330. But Wynn, far from backing down, persisted with a reckless exposure of $1.25 billion thanks to 40x leverage. Such a strategy is less investment and more Russian roulette. At the slightest market tremor, everything collapsed.

James Wynn, the “degenerate” trader who keeps betting

At this point, one might imagine a ruined trader, burned, ready to learn from his fall. That is to misunderstand James Wynn. This crypto market player claims his approach as a game. Describing himself as an “extreme degenerate“, he admits his lack of risk management, preferring the thrill of betting over any strategic discipline. His reaction after liquidation? A meme from “Matrix” posted on X, like a grimace directed at reality.

Worse, he didn’t give up. A new long position was opened at $107,993, still with 40x leverage. It already shows a latent loss of $3.4 million. Wynn appears ready to fall again, in a spiral where recklessness becomes a stance, and the fall becomes a signature.

Hyperliquid and the excesses of leveraged trading

After a trader liquidated $100 million in bitcoin on a lost bet , a disturbing question should be asked: How far can speculation on crypto derivatives go? The Wynn case highlights the excesses allowed by the lack of safeguards on platforms like Hyperliquid, where massive leverage becomes a double-edged sword.

This regulatory void reveals a structural flaw in decentralized finance: no mechanism curbs extreme risk-taking. In a market as unstable as bitcoin’s, emotion overrides strategy. This is no longer a simple individual failure, but a warning signal for an ecosystem seeking responsibility, threatened by its own excesses.

At the moment when GameStop commits $513 million into bitcoin , other investors suffer huge losses in leveraged bets. This contrast highlights the divide between institutionalization and speculative excess. Can crypto survive this strategic schizophrenia without rethinking its collective rules of the game?

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK