BlackRock's Bitcoin ETF sheds $430 million, its largest single-day outflow

Key Takeaways

- BlackRock's iShares Bitcoin Trust faced its largest single-day outflow of over $430 million.

- US-listed spot Bitcoin ETFs collectively experienced $616 million in outflows amid Bitcoin's price decline.

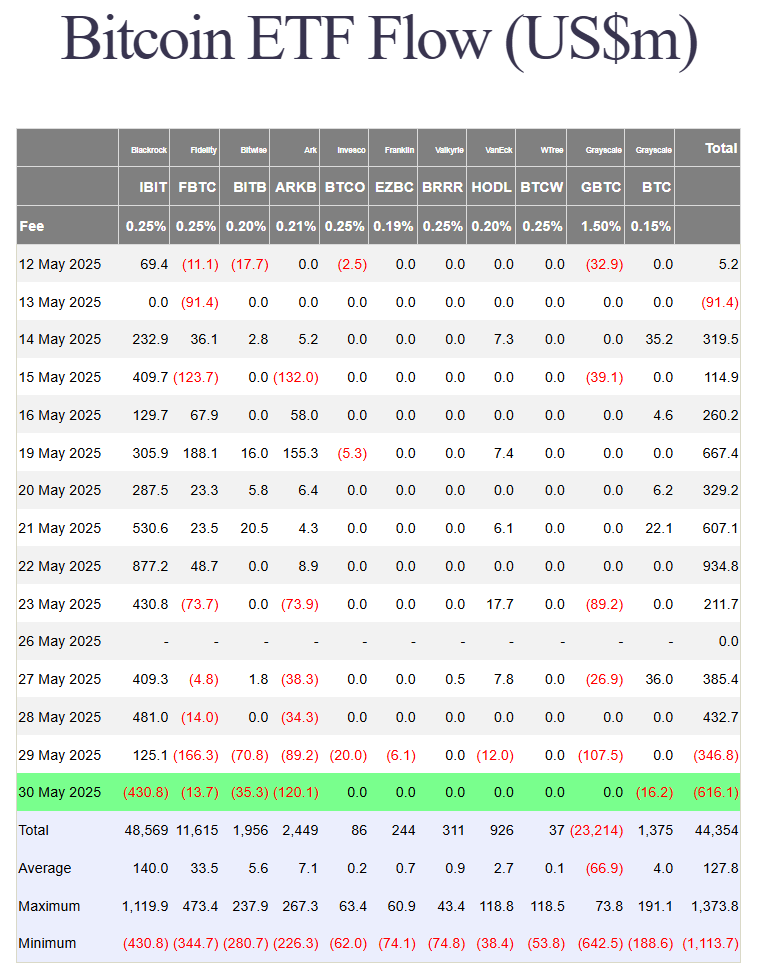

BlackRock’s iShares Bitcoin Trust (IBIT) saw over $430 million in outflows after markets closed Friday, snapping a week-long inflow streak that had lasted since April 10. It was the ETF’s largest single-day net outflow since launch, according to Farside Investors.

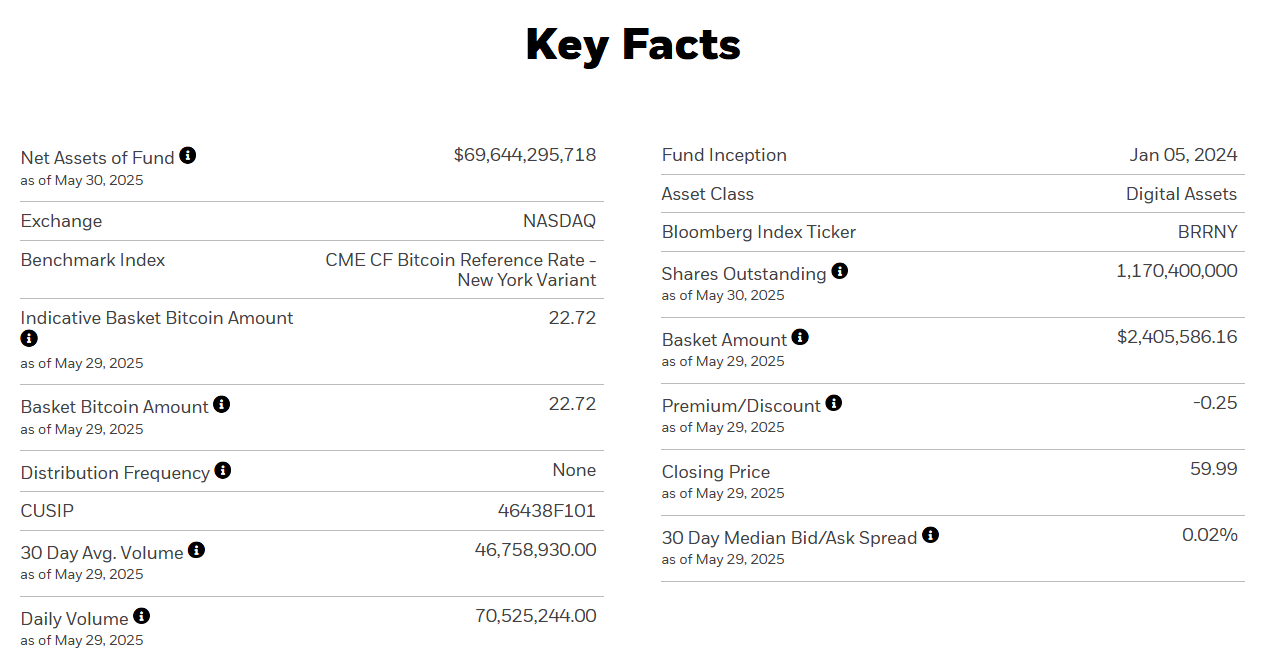

IBIT continues to dominate the global Bitcoin ETF market, despite its recent pullback. The fund has brought in around $48 billion in new capital since launch, with assets under management nearing $70 billion.

Other competing Bitcoin ETFs also posted losses on the final trading day of May.

Fidelity’s FBTC saw outflows of approximately $14 million, Grayscale’s GBTC lost around $16 million, Bitwise’s BITB shed $35 million, and Ark Invest’s ARKB recorded the major outflow at $120 million.

Overall, US-listed spot Bitcoin ETFs lost about $616 million on Friday, continuing their slide after $346 million in outflows on Thursday.

The return of negative ETF flows coincided with renewed selling pressure on Bitcoin. After reaching a weekly high of $110,000, the asset slipped below $105,000 on Thursday, then edged closer to $103,000 by Saturday.

At the time of writing, Bitcoin was hovering around $103,700, per TradingView data .

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK