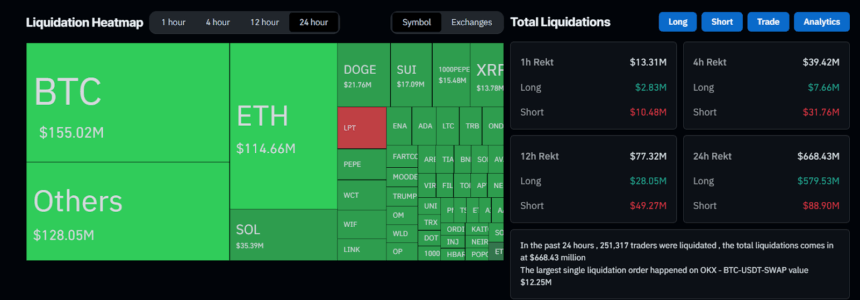

The crypto market saw long liquidations worth nearly $580 million in Bitcoin (BTC), Ethereum (ETH), and others. On-chain data shows that the recent liquidation event has made many traders doubt if the crypto market will suffer more losses.

Looking at the broader crypto market, it has dropped 1.46% and currently stands at $3.27 trillion. Ethereum witnessed a drop of 2.24% while XRP decreased by 0.70%.

In the last 24 hours, Bitcoin was responsible for $134 million in long liquidations. The world’s most popular cryptocurrency has been exposed to many leveraged position closures, as traders who expected it to go higher were surprised by price falls.

Meanwhile, 251,319 traders got liquidated today. Further, the total crypto market liquidations touched $668.45 million at press time. The largest single liquidation of $12.25 million took place on OKX crypto exchange on BTC/USD pair.

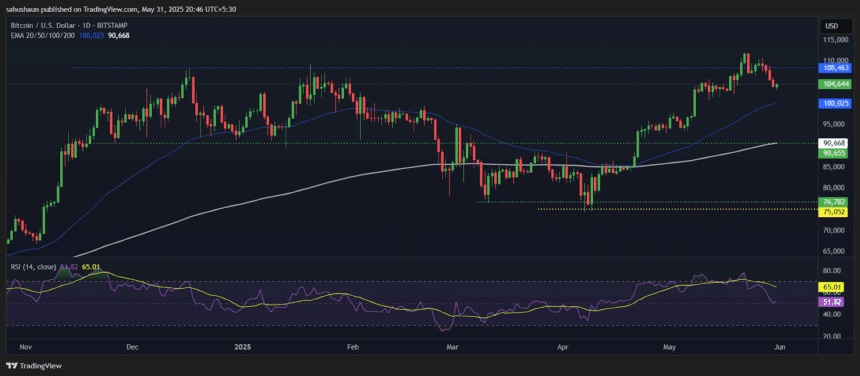

Bitcoin Price Chart, Source: Tradingview

Bitcoin Price Chart, Source: Tradingview

According to CoinMarketCap data, at the time of writing, Bitcoin (BTC) price is trading at $104,644 with an intraday drop of 1%. The daily trading volume has dropped by 18%, and the volume-to-market ratio stands at 2.31%.

Major altcoins also saw a lot of liquidations. Ethereum recorded $95.41 million long liquidations, Solana (SOL) saw $37.70 million longs liquidated while XRP witnessed 12.88 million liquidations. traders suffered similar losses. The massive liquidation numbers were also caused by Dogecoin (DOGE) and Sui (SUI), which had a ripple effect throughout the crypto market.

Crypto Market Liquidation Data, Source: Coinglass

Crypto Market Liquidation Data, Source: Coinglass

The Coinglass data shows that most losses come from long positions, which are much more common than short positions. This means that traders were very optimistic about the market before the recent drop, and most were heavily leveraged in anticipation of continued gains.

Due to the large amount of liquidation, the market could remain volatile. Analysis shows that big sell-offs are usually followed by more price adjustments as investors’ confidence slowly recovers. It is important for traders to be careful about using leverage at the current crypto market conditions.