-

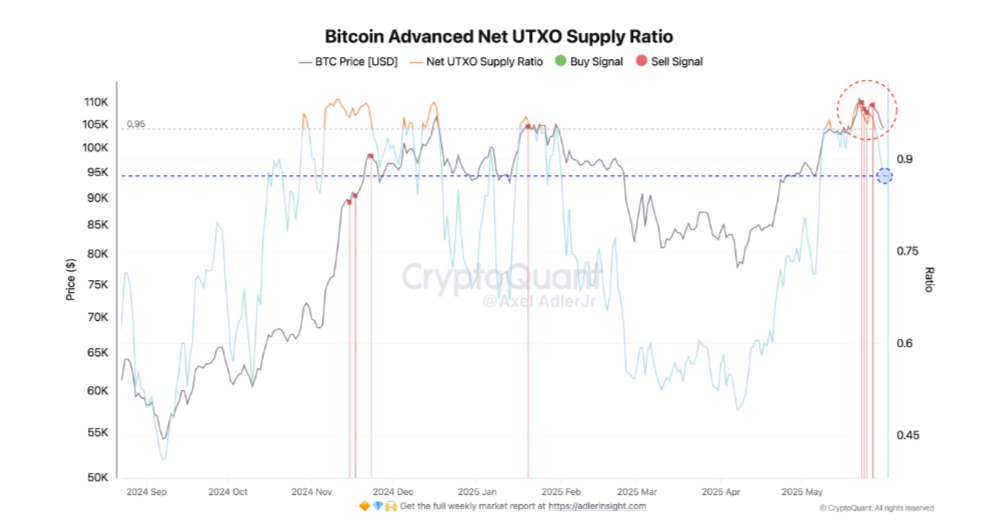

Bitcoin’s recent decline reflects an overheated market, as indicated by the Net UTXO Supply Ratio signaling potential sell-offs.

-

Investor sentiment is weakening, with notable dip predictions from analysts suggesting crucial support levels are at stake.

-

As CryptoQuant analyst Axel Adler explains, the market might need a serious reset to foster future recovery.

Bitcoin’s overheating signals sell-offs, with key support levels in jeopardy as investor sentiment wanes. Analysts predict possible dips to $92K.

Bitcoin’s Sell Signals and Market Heat

Bitcoin’s recent performance has raised alarms among traders. According to Axel Adler from CryptoQuant, the crypto has flashed four consecutive sell signals, highlighting its potential vulnerability to further declines. With the Net UTXO Supply Ratio dipping, a combination of increased selling pressure and dwindling buyer interest indicates an overheated market scenario.

Source: CryptoQuant

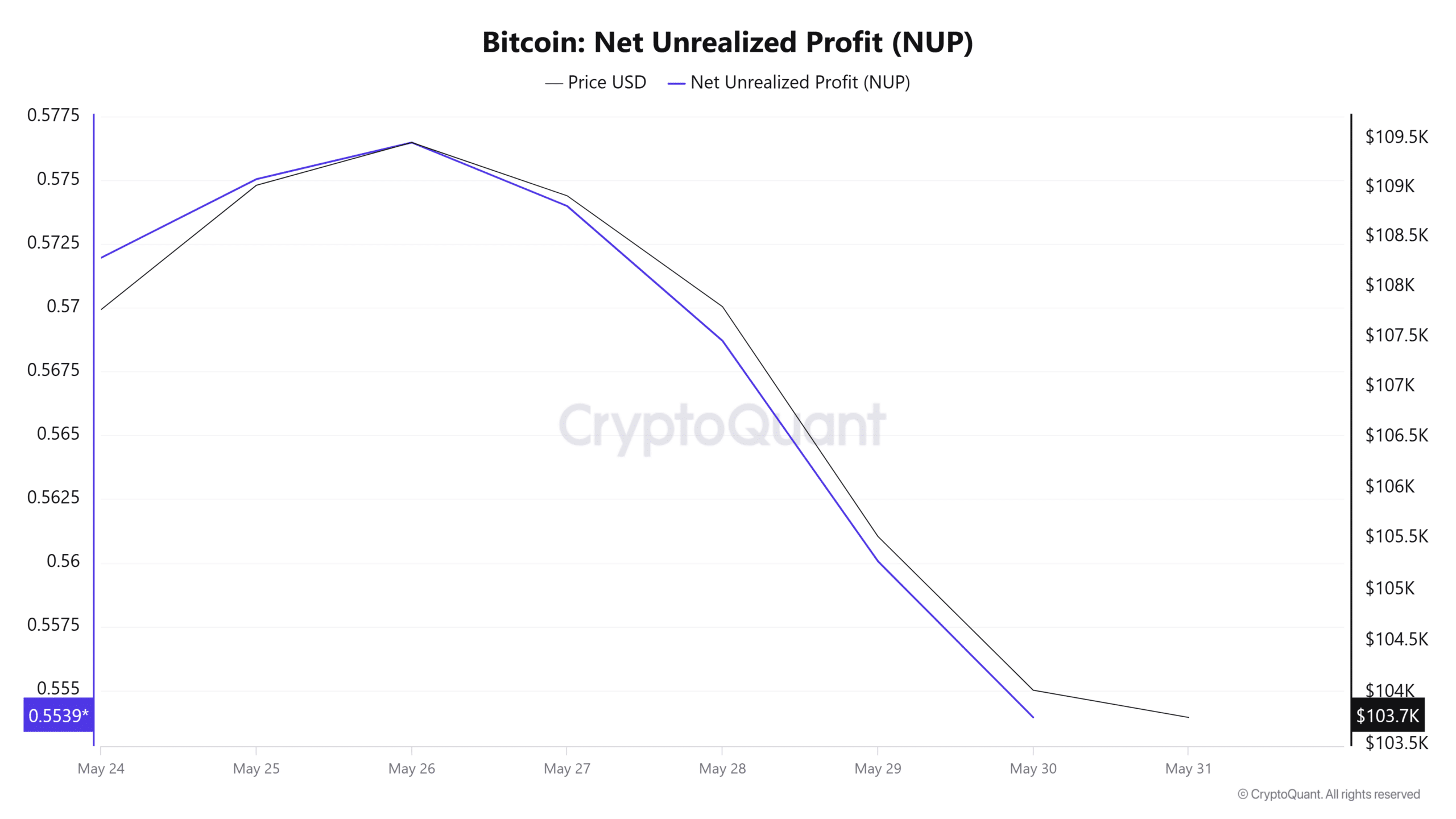

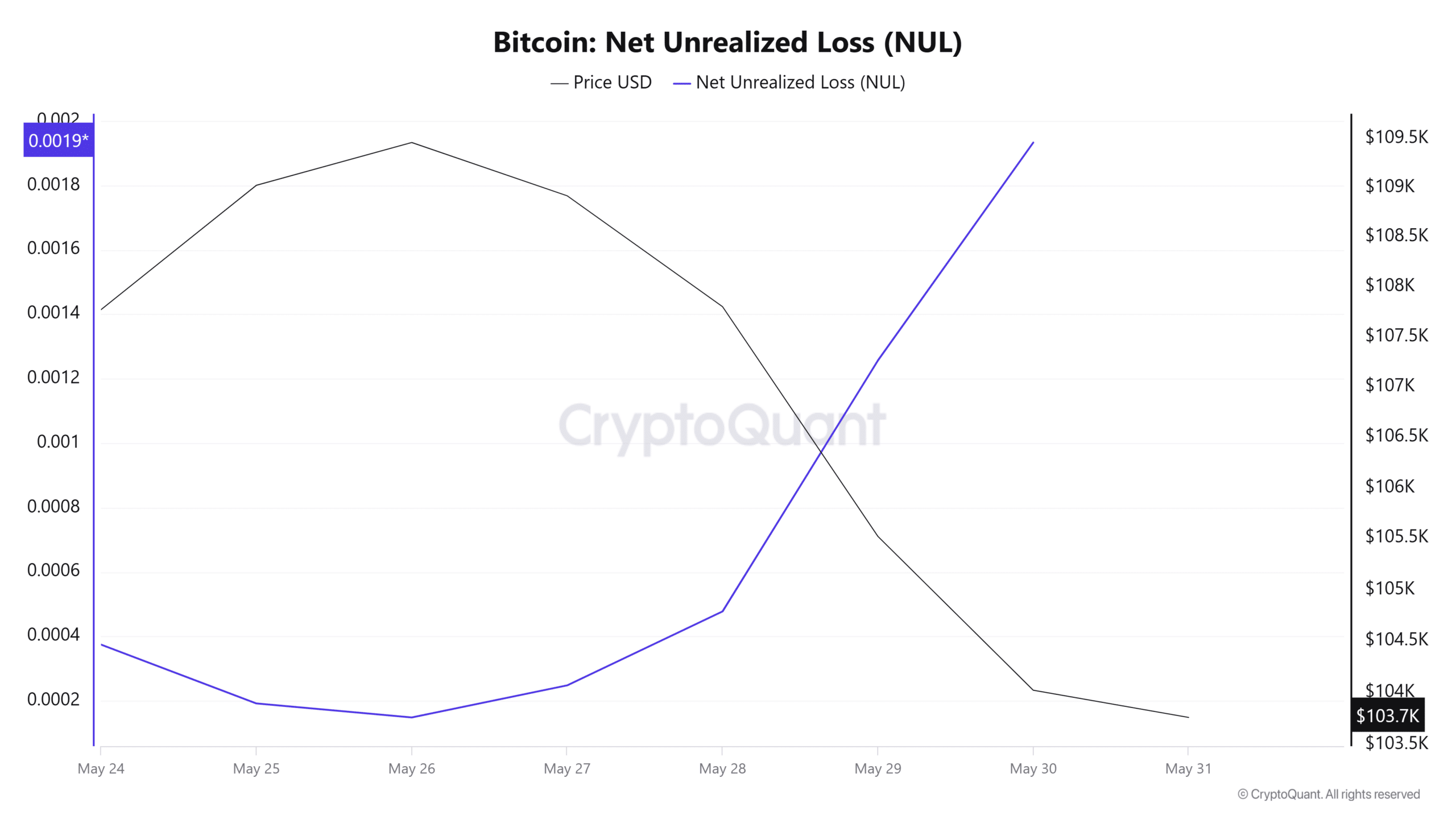

During this market phase, it’s critical to understand the dynamics at play. When profit-taking begins, it often signifies that a considerable portion of holders are now in unrealized profit. This scenario typically leads to less incentive to hold, resulting in increased profit-taking activities.

Source: CryptoQuant

Recent on-chain data shows that Bitcoin’s Net Unrealized Profit has dropped to a concerning 0.553, its lowest in several weeks. This decline suggests that many investors who purchased BTC within the $104K-$112K range are currently at a loss, raising concerns about impending market capitulation.

Source: CryptoQuant

This potential market reset implies a phase where BTC may oscillate between the $95K and $105K range until the Net UTXO Supply Ratio stabilizes around 0.85-0.9. Such conditions are essential for market stability to return post-sell signals, although a sharper pullback towards $92K may also occur, subsequently cooling off the current overheated condition.

Market Pressure and Key Support Levels

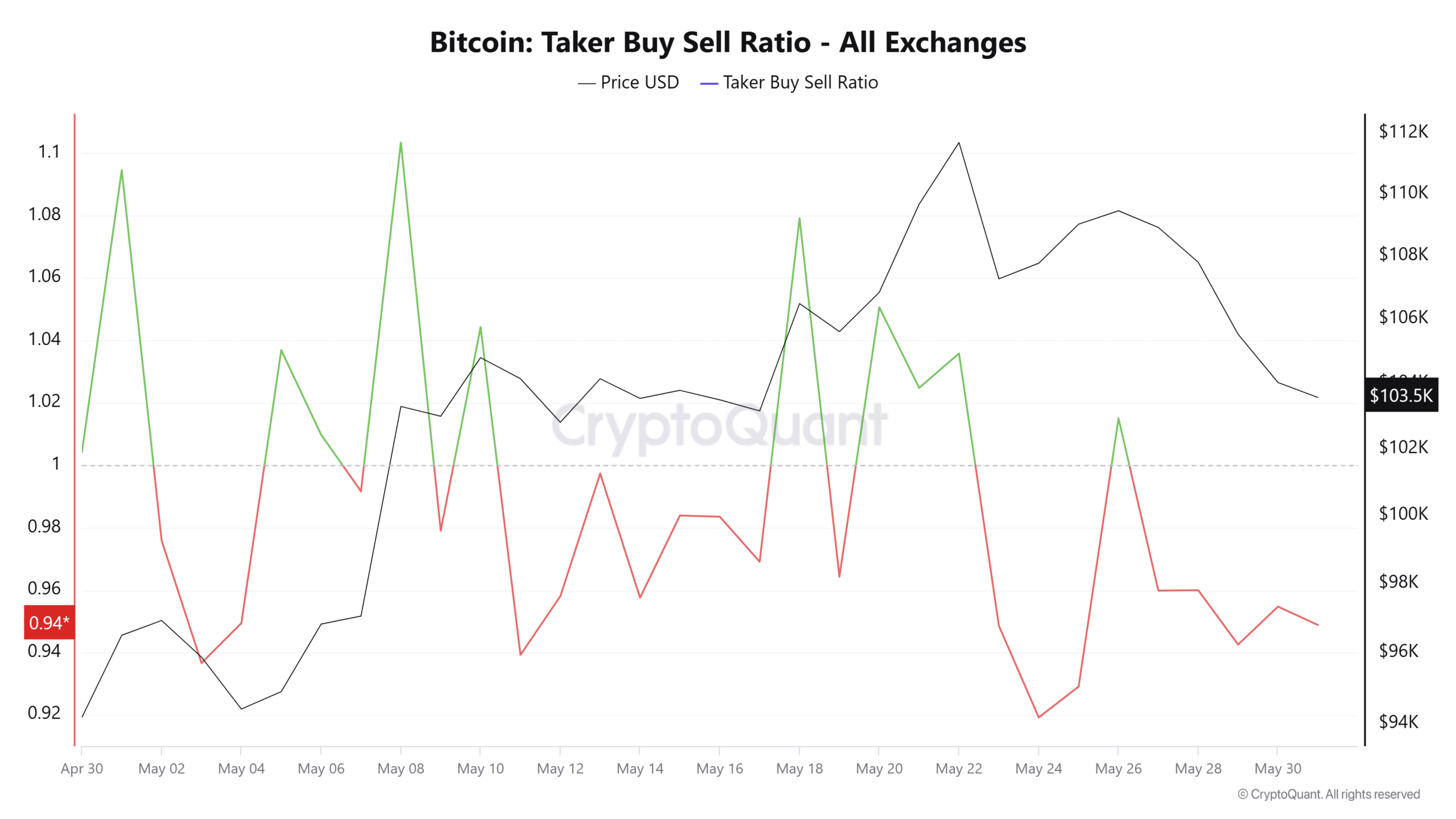

Additionally, the ongoing selling pressure is confirmed by the Taker Buy-Sell Ratio, which has shown a sustained negative trend for the past four days. This particular metric indicates heightened selling activity across exchanges.

Source: CryptoQuant

If this selling momentum persists, it’s likely that Bitcoin’s price will approach the critical support level at $101,488. Should this support falter, the next level to watch would be around $98,890, risking a dive below the psychologically significant $100k mark.

Conclusion

In summary, Bitcoin is currently navigating a tumultuous phase characterized by critical sell signals and declining investor sentiment. With support levels in jeopardy, especially around $101K, the market may experience significant fluctuations as traders assess profit-taking opportunities amidst weakening performance metrics. Understanding these dynamics will be vital for navigating potential future price movements.