Bitcoin Liquidation Data Shows Price Could Bounce Back to $109,000

Bitcoin may reclaim lost ground as technical indicators and funding rates support a push toward the $109K mark. Traders are eyeing key liquidity zones for the next move.

Leading coin Bitcoin has been in a corrective phase since hitting its all-time high of $111,968 on May 22. The king coin has slipped below the key $105,000 support level to trade at $104,536 at press time, reflecting the selling pressure.

However, on-chain data suggests a potential rebound above this critical support level, with a possible retest of BTC’s all-time high on the horizon. This analysis breaks down the key insights.

BTC Liquidity Clusters Signal Surge Toward $109,000

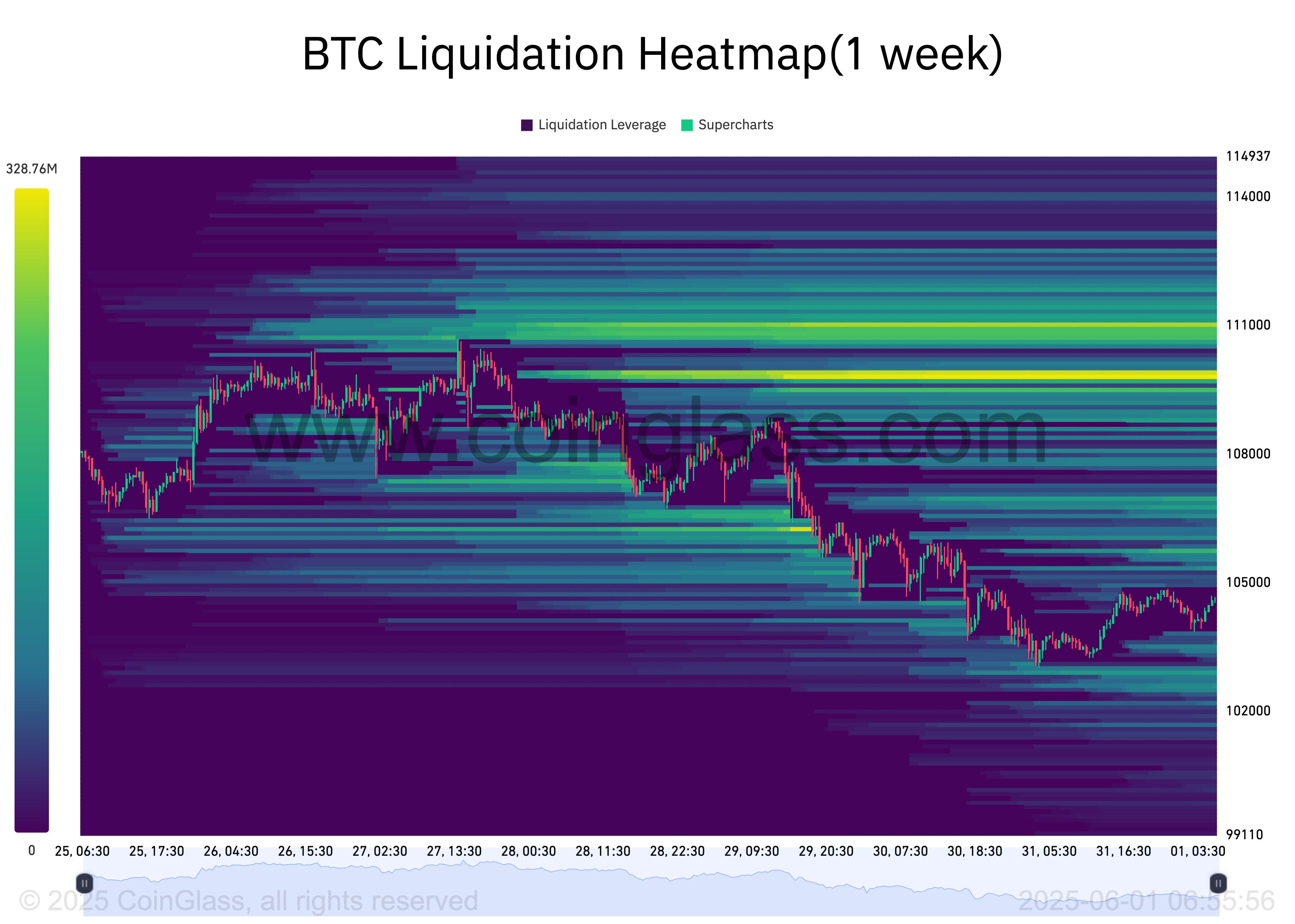

An assessment of BTC’s liquidation heatmap shows a notable concentration of liquidity around the $109,933 price zone.

BTC Liquidation Heatmap. Source:

Coinglass

BTC Liquidation Heatmap. Source:

Coinglass

Liquidation heatmaps identify price levels where large clusters of leveraged positions are likely to be liquidated. These maps highlight areas of high liquidity, often color-coded to show intensity, with brighter zones (yellow) representing larger liquidation potential.

Usually, these cluster zones act as magnets for price action, as the market tends to move toward these areas to trigger liquidations and open fresh positions.

Therefore, for BTC, the convergence of a high volume of liquidity at the $109,933 price level indicates a strong trader interest in buying or closing short positions at that price. It creates room for a surge toward the $109,000 mark.

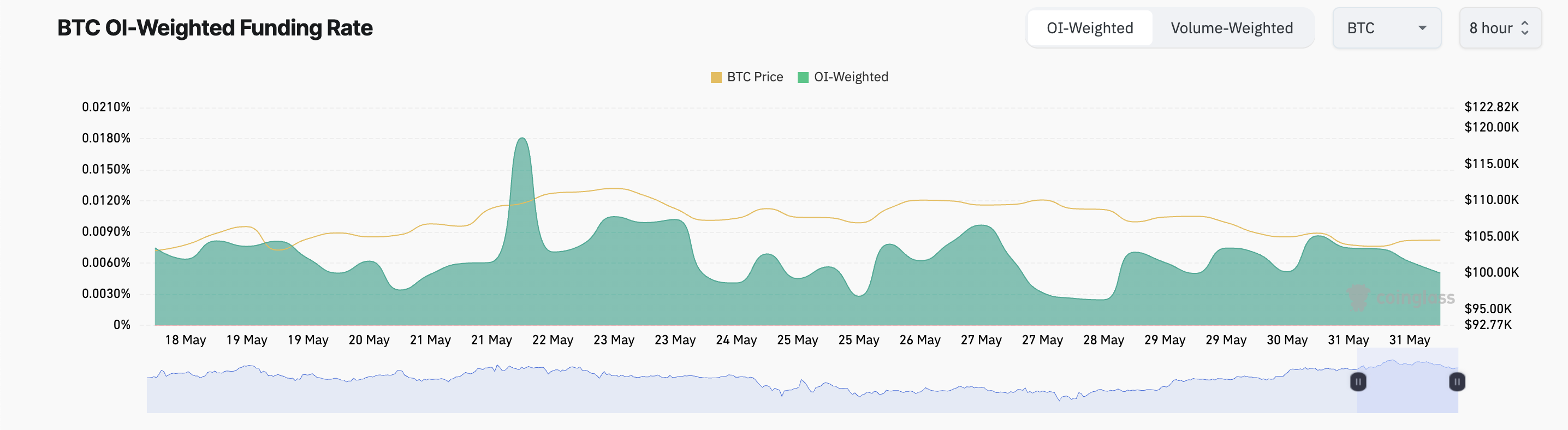

Further, the coin’s funding rate has remained positive despite its recent price pullback. At press time, this stands at 0.005%, per Coinglass.

BTC Funding Rate. Source:

Coinglass

BTC Funding Rate. Source:

Coinglass

The funding rate is a periodic payment between traders in perpetual futures contracts to keep the contract price aligned with the spot price. When the funding rate is positive, there is a higher demand for long positions.

This means more traders continue to bet on BTC’s price going up, even in the face of strengthening bearish momentum.

BTC Price Teeters Between $103,000 Support and $109,000 Liquidity Zone

BTC has posted a modest 1% gain in the past 24 hours, bouncing off the $103,952 support level. If demand soars, this support floor could hold firm and push prices above the psychological barrier at $105,000, potentially targeting $106,307.

A clean break above this zone may open the door to the $109,000 price area dense with leveraged positions.

BTC Price Analysis. Source: TradingView

BTC Price Analysis. Source: TradingView

However, increased profit-taking could drag BTC back below $103,952, with a further decline toward $102,590 likely.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!