The US SEC Questions the Compliance of Ethereum and Solana ETFs

According to a report by Jinse Finance, the U.S. Securities and Exchange Commission (SEC) raised concerns about two proposed ETFs related to Ethereum and Solana the day after stating that most cryptocurrency staking does not fall under securities laws. Last Friday, the SEC warned that the two proposed ETFs linked to Ethereum and Solana might not meet the legal definition of an investment company, raising concerns about their registration and potential listing eligibility. In a letter to the legal counsel of ETF Opportunities Trust, the SEC stated that staff still have unresolved questions about whether the REX-Osprey ETH and SOL ETFs (which include staking components) primarily invest in securities as required by the Investment Company Act of 1940. ETF Opportunities Trust is an open-ended investment company based in Delaware, serving as the legal vehicle for launching multiple exchange-traded funds, including those managed by REX. Under U.S. law, a fund is considered an investment company if it primarily engages in investing or trading securities, or if more than 40% of its total assets are investment securities.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The U.S. federal government "shutdown" may last until next week.

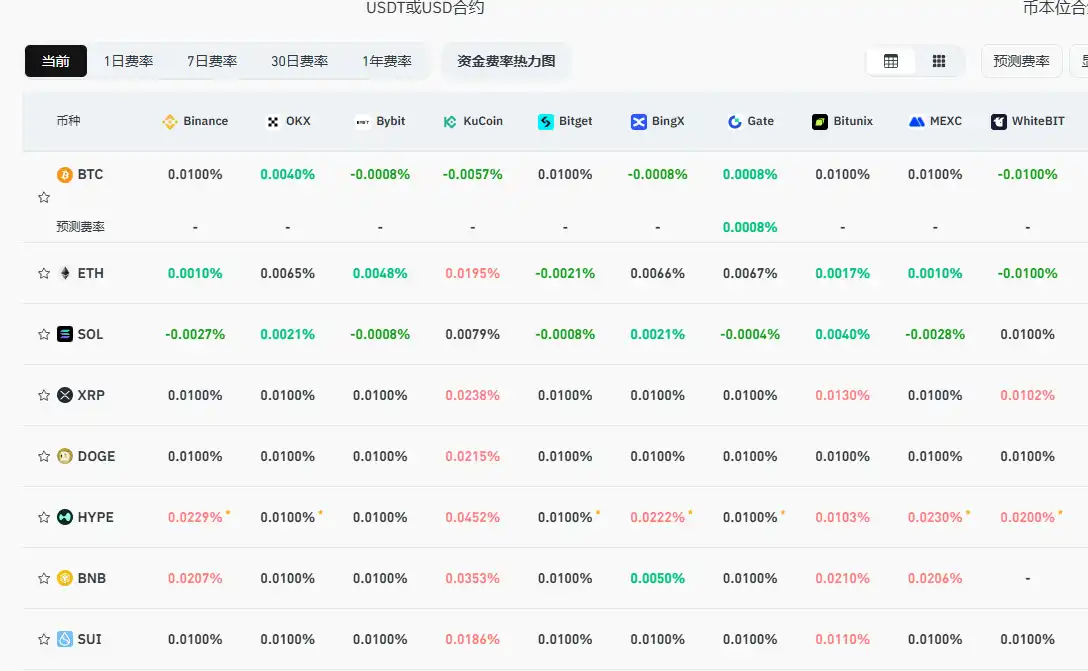

Current mainstream CEX and DEX funding rates indicate the market remains neutral