Market Moves Target James Wynn’s New $100 Million Bitcoin Position

James Wynn, known for his high-stakes crypto trades, has opened another $100 million long position on Bitcoin. Almost immediately after his order hit the market, BTC’s price started dropping toward his liquidation level of $103,637. BTC Price Dumps Amid James Wynn’s $100 Million Bet James Wynn, the high-risk trader on Hyperliquid, opened a long position … <a href="https://beincrypto.com/james-wynn-opens-100-million-bitcoin-long/">Continued</a>

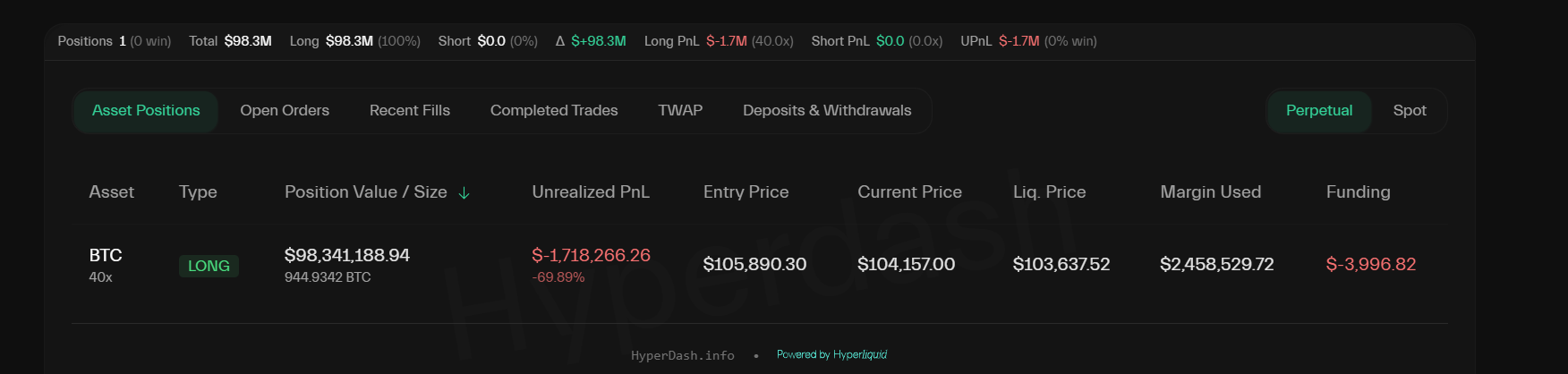

James Wynn, known for his high-stakes crypto trades, has opened another $100 million long position on Bitcoin.

Almost immediately after his order hit the market, BTC’s price started dropping toward his liquidation level of $103,637.

BTC Price Dumps Amid James Wynn’s $100 Million Bet

James Wynn, the high-risk trader on Hyperliquid, opened a long position of 945 BTC, valued at approximately $99 million, using a staggering 40x leverage.

James Wynn’s Latest BTC Position. Source:

Hyperdash

James Wynn’s Latest BTC Position. Source:

Hyperdash

Soon after Wynn placed his trade, the Bitcoin price started dropping. This has sparked renewed speculation about the influence of so-called “shady market makers,” who are believed to monitor and manipulate large on-chain positions.

“James Wynn opened another $100M BTC long. Within seconds the shady market makers dumped the price towards his liquidation price of $104,580 Why are they so desperate to see him lose?” crypto analyst Gordon asked on X.

Wynn, once up $87 million in late May, is now down $1.4 million, highlighting the brutal volatility of leveraged crypto trading.

“The moment I entered my long the insta hunted me. There is an agenda here and I don’t know what it is. It can’t be just my long, maybe it’s because I’m a fish playing a whales game or maybe it’s because I’m bringing attention to Hyper Liquid,” James Wynn posted on X.

James Wynn has recently emerged as one of the most talked-about figures in the crypto industry. His bold trading moves and volatile portfolio have captured the attention of market watchers.

Wynn’s latest trade comes despite his recent statement that he was planning to take a break from trading.

“I’ve decided to give perp trading a break. Thank you HyperliquidX for your hospitality. Your service, impeccable. Your platform exquisite. Its been a fun ride. Approx $4m into $100m and then back down to a total account loss of $17,500,000,” Wynn posted on X just hours before his latest trade.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!