Circle’s Cross-Chain USDC Trading Hits All-Time High at $7.7 Billion

Circle's CCTP set a new record with $7.7 billion bridged in May, fueling IPO ambitions and highlighting growing demand for stablecoin utility.

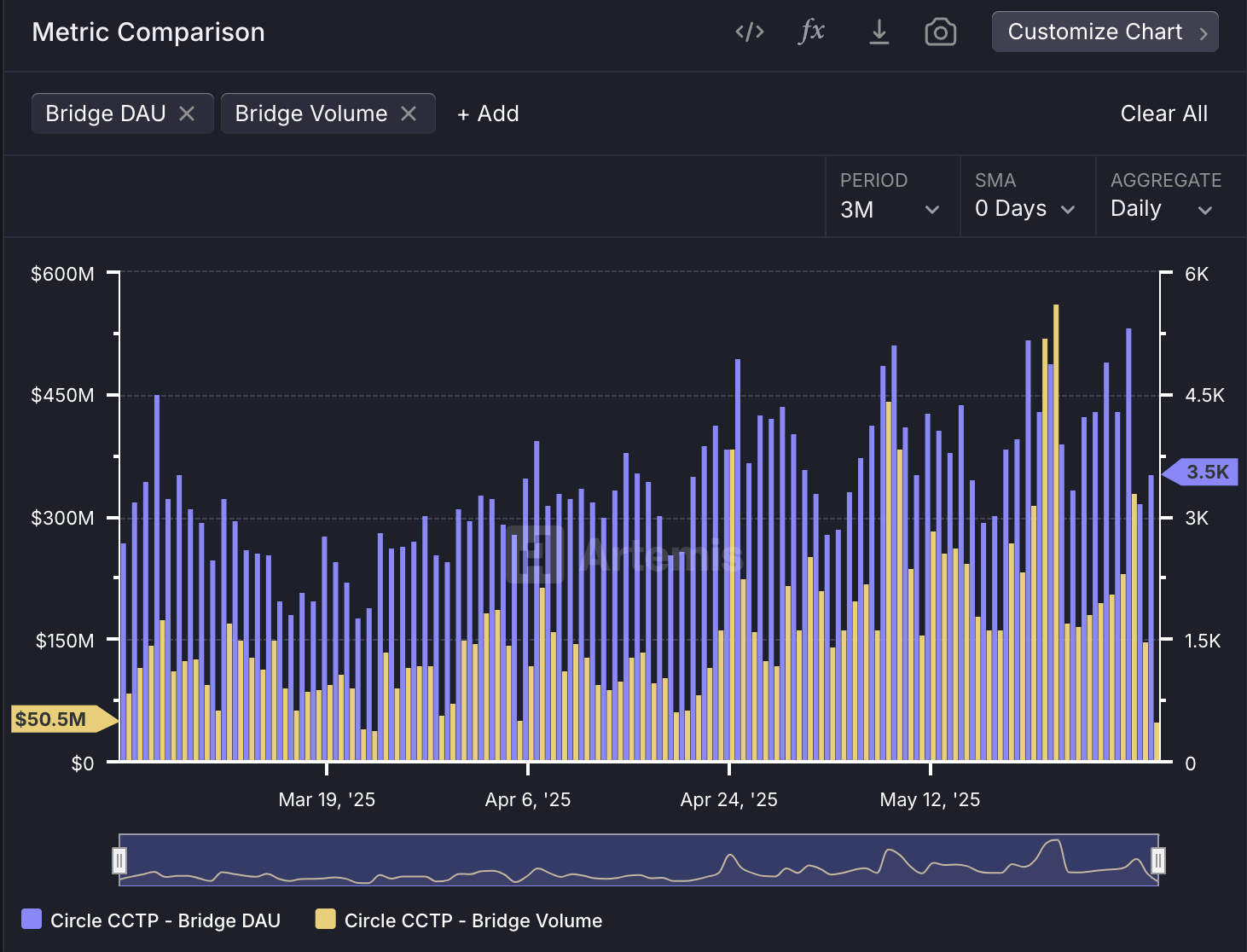

Circle’s Cross-Chain Transfer Protocol (CCTP) facilitated $7.7 billion in stablecoin bridging volume in May, an all-time high and an 83.3% increase from April.

The firm launched its IPO last week, rejecting outright buyout efforts to remain an active player in the stablecoin market. This impressive growth can help demonstrate Circle’s progress and solid foundations.

Circle’s CCTP Breaks Volume Records

Circle, one of the largest stablecoin issuers, first launched CCTP in 2023 to seamlessly bridge USDC across blockchains. Since then, it’s integrated the protocol with a number of prominent chains, increasing USDC’s interoperability. Today, blockchain data analysis shows that CCTP hit a new all-time high for bridging volume last month:

Circle CCTP Bridging Volume. Source:

Artemis

Circle CCTP Bridging Volume. Source:

Artemis

This CCTP volume is especially relevant for Circle for another reason. Specifically, the total number of active stablecoin addresses also reached a new record last month: 33.1 million.

In a time when the total demand for stablecoins and utility solutions is only growing, Circle is working to present its payments ecosystem as an attractive option.

The company has been planning an IPO for the last few months, but it rejected a $5 billion offer from Ripple to acquire it outright. Instead, the firm opened its stock sale last week, aiming to raise $624 million while maintaining its independence.

CCTP’s record growth could signal Circle’s long-term market potential, better enticing new capital investment. The stablecoin issuer already increased its IPO size today, setting a more ambitious target of $896 million.

While the number of active stablecoin addresses is rising, major investment banks are planning to substantially increase their presence in the industry.

Citigroup predicts a $3.7 trillion stablecoin market by 2030, and it isn’t alone in these bullish predictions. All that is to say, Circle isn’t the only issuer developing new cross-chain transaction solutions.

In other words, Circle’s record CCTP growth comes at a useful time. USDC’s trading volume also broke records in April, and now the stablecoin’s utility protocols are surging, too.

Circle is intent on remaining an independent company and positioning itself as a strong contender in this sector. To do this, it will need positive metrics like CCTP’s volume to move the market.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!