Why Solana 15% Crash Might Set Up a Potential Rally

Solana’s sharp 15% decline might be setting the stage for a bullish rebound. On-chain metrics reveal growing confidence among long-term holders.

Solana has declined sharply over the past week, shedding 15% amid a broader market pullback that hit most major altcoins. The Layer-1 coin now trades at $153.53, down from last week’s high near $180.

While the correction mirrors weakness across the crypto market, on-chain metrics suggest this downturn may be nearing its end.

Solana’s Long-Term Holders Show Confidence as Market Cools

Solana’s Liveliness has dropped notably in recent days, indicating that Long-term holders (LTHs) view the recent price decline as a strategic buying opportunity. According to Glassnode, it currently stands at 0.76, its lowest in the past 14 days.

Solana Liveliness. Source:

Glassnode

Solana Liveliness. Source:

Glassnode

Liveliness measures the ratio of an asset’s coin days destroyed to the total coin days accumulated to track the activity of LTHs. When it climbs, it suggests that more dormant coins are being moved or sold, signaling increased profit-taking by long-term holders.

On the other hand, liveliness decreases when dormant wallets begin accumulating. This trend indicates that SOL’s LTHs are moving assets off exchanges, a bullish sign of accumulation.

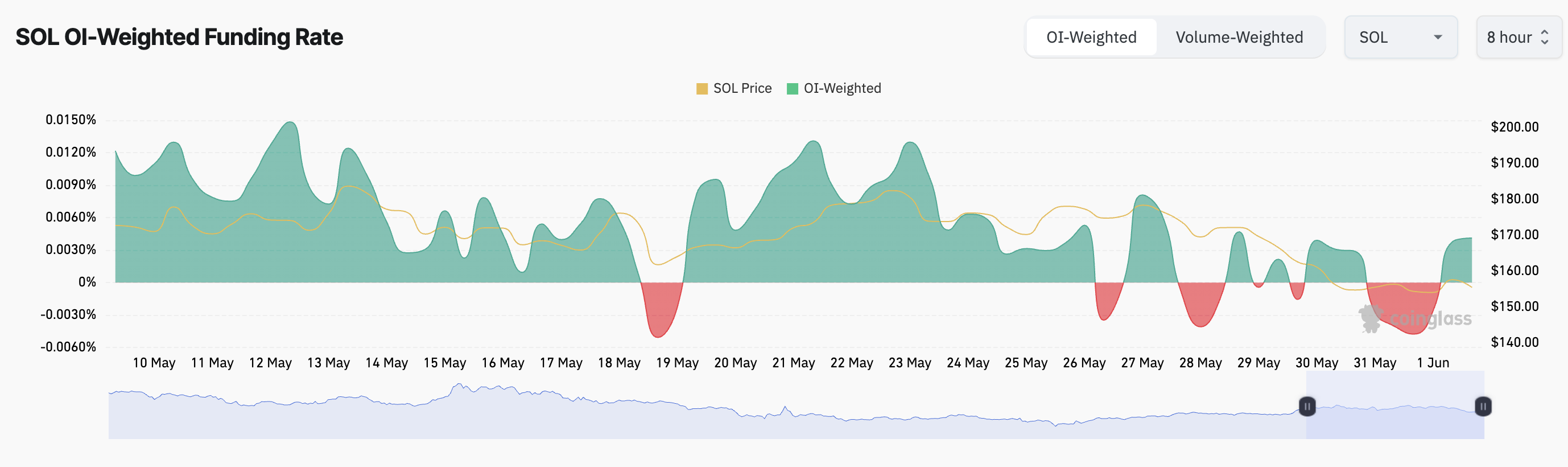

Further, the coin’s funding rate has flipped positive and is currently at 0.0041%. This indicates a preference for long positions among SOL futures traders.

Solana Funding Rate. Source:

Coinglass

Solana Funding Rate. Source:

Coinglass

The funding rate is a recurring fee paid between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot price. When positive, long traders pay shorts, indicating that bullish sentiment dominates and more traders expect prices to rise.

SOL Could Surge to $195 if Support Holds

Solana’s price could rebound toward the $171.88 mark if its LTHs continue to double down on coin accumulation and broader market conditions stabilize. Should that price zone solidify as a support floor, it could further propel SOL toward the $195.55 level.

Solana Price Analysis. Source:

TradingView

Solana Price Analysis. Source:

TradingView

However, sellers could drive SOL down to $142.59 if bearish momentum intensifies.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Unveiling Solana's "Invisible Whale": How Proprietary AMMs Are Reshaping On-Chain Trading

The rapid rise of proprietary AMMs on Solana is no coincidence; rather, it is a logical and even inevitable evolution as the DeFi market pursues ultimate capital efficiency.

XRP Reenters Global Top 100 With Market Cap Near HDFC

Quick Take Summary is AI generated, newsroom reviewed. XRP has entered the Top 100 Global Assets at $181.8B XRP trades at $3.05 showing strong annual growth and volume activity XRP has surpassed companies like Adobe, Pfizer, and Shopify in valuation ETF filings and Ripple’s U.S. banking license could boost XRP adoption Japan’s banks and RippleNet partners highlight growing global use of XRPReferences $XRP reenters the top 100 global assets by market cap.

Solana Treasury Fund, operated by Sharps Technology, and Pudgy Penguins have announced a strategic partnership

Through this partnership, Pudgy Penguins' top-tier IP will be combined with STSS's institutional-grade Solana vault, creating a brand-new interactive opportunity for retail and institutional users.

Magma Finance Officially Launches ALMM: Sui's First Adaptive & Dynamic DEX, Pioneering a New Liquidity Management Paradigm

Magma Finance today officially announced the launch of its innovative product ALMM (Adaptive Liquidity Market Maker), becoming the first Adaptive & Dynamic DEX product on the Sui blockchain. As an improved version of DLMM, ALMM significantly enhances liquidity efficiency and trading experience through discrete price bins and a dynamic fee mechanism, marking a major upgrade to the Sui ecosystem's DeFi infrastructure.