Institutional investments in Ethereum total US$321 million in the week

- Ethereum attracts $321 million in new funding

- Positive outlook for institutional cryptocurrency products

- Six straight weeks of Ethereum fund inflows

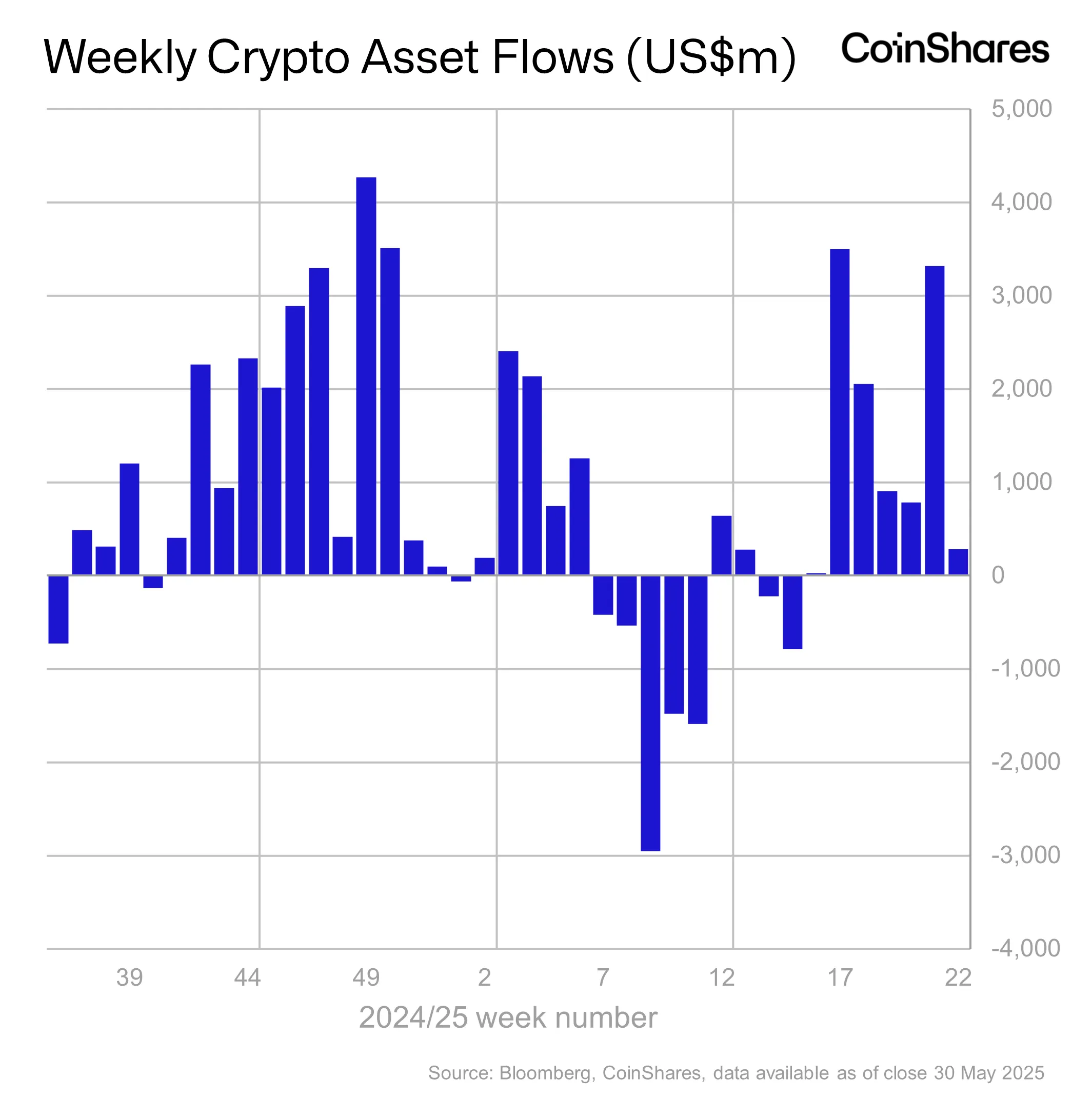

Institutional cryptocurrency products moved $286 million last week, making it seven consecutive weeks of inflows, according to the latest data from CoinShares. This cumulative flow brought the total inflows to $10,9 billion in just under two months.

Despite the positive performance, total assets under management (AuM) fell to $177 billion, below the all-time high of $187 billion. The decline occurred amid volatility caused by regulatory uncertainty surrounding U.S. tariffs.

The US led weekly inflows with US$199 million, while other relevant markets also contributed: Hong Kong with US$54,8 million, Germany with US$42,9 million and Australia with US$21,5 million. Switzerland recorded significant outflows of US$32,8 million, being one of the only regions with a negative balance in the year to date.

Ethereum (ETH) stood out, recording its sixth consecutive week of inflows. $321 million was added last week alone, bringing the recent total volume to $1,19 billion. This movement reinforces the growing institutional demand for exposure to ETH, solidifying positive expectations among investors seeking alternatives to Bitcoin.

Meanwhile, XRP saw a second straight week of outflows, with a total of $28,2 million withdrawn from products associated with the coin.

In the case of Bitcoin, the behavior of flows was mixed. The week started with strong inflows, but the reversal came after a decision by the US Trade Court that invalidated American tariffs. The impact reduced institutional appetite and led to modest outflows of US$8 million — the first after six consecutive weeks of inflows that totaled US$9,6 billion.

Institutional market behavior indicates a growing focus on Ethereum, even in the face of price instability and regulatory decisions. The continued positive flow points to renewed confidence among large investors in products linked to the second-largest cryptocurrency by market value.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x US: Trade to share 5,400,000 US

[Initial Listing] Bitget to list Almanak (ALMANAK). Grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

[Initial listing] Bitget to list Talus (US) in the Innovation and AI zone