HYPE jumps 15% on Binance US listing news, eyes breakout to new ATH

HYPE price surged 15% following the announcement of its upcoming listing on Binance US, fueling bullish momentum as the token’s price tracks towards retesting the all-time-high at $40.

Hyperliquid ( HYPE ) is up 15%, currently trading at $37.50, with 24-hour trading volume jumping 80% to $370 million. The surge follows news that HYPE will soon be listed on Binance US .

This surge extends HYPE’s rally from a recent pullback after setting an all-time high of $40 on May 26. The uptrend market structure remains intact, with HYPE price forming a consistent pattern of higher highs and higher lows, while staying well above the EMA 20 since the April trend reversal.

Momentum is building, with the RSI is at 68, approaching the overbought zone and on the verge of a golden cross, with the RSI line nearing a breakout above its moving average. MACD also shows weakening bearish momentum, with the histogram bars shrinking. The MACD line is about to cross above the signal line.

Source: TradingView

Source: TradingView

HYPE’s price action on the 12-hour chart reinforces the bullish outlook. After bottoming at $9.30 on April 7, the price surged to $40 in May, which formed a cup-and-handle pattern with the cup’s upper resistance around $28.40. The recent pullback can be seen as a healthy break-and-retest of this key resistance level, which often acts as strong support before the uptrend resumes.

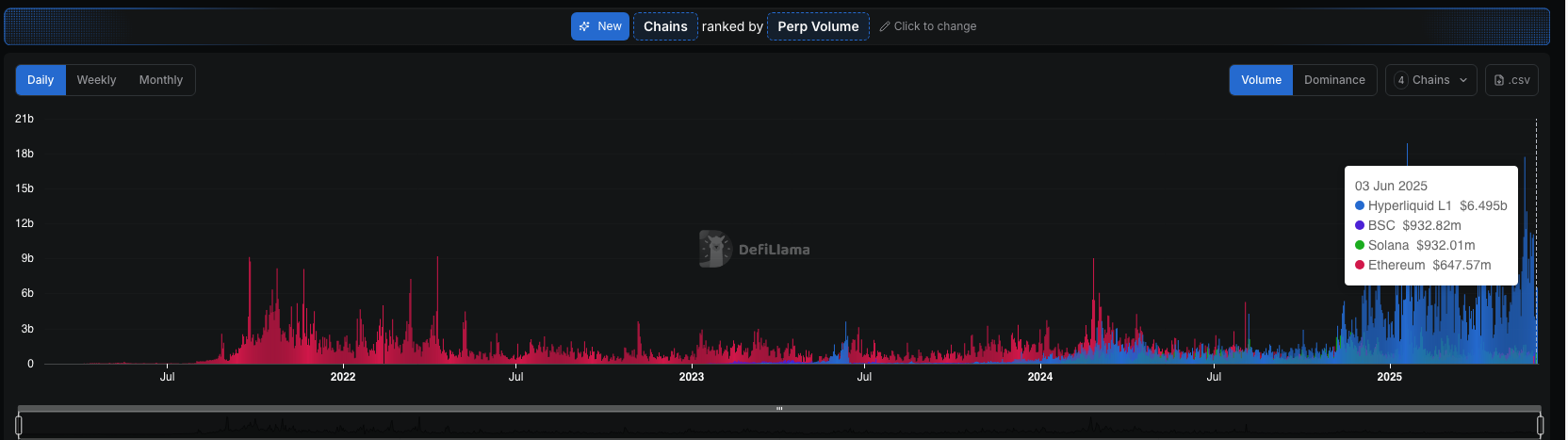

Fundamentals also support the bullish case. Hyperliquid continues to dominate the derivatives DEX market, holding over 81% market share, according to CoinMarketCap rankings . It also leads in perpetuals trading volume, with $6.495 billion traded in the past 24 hours on Hyperliquid Layer 1 .

Source: Chains ranked by perp volume | DeFiLlama

Source: Chains ranked by perp volume | DeFiLlama

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

[Initial Listing] Bitget Will List Almanak (ALMANAK). Come and grab a share of 4,200,000 ALMANAK

[Initial listing] Bitget to list Cysic (CYS) in the Innovation zone

CandyBomb x US: Trade to share 5,400,000 US

Earn up to 50 USDT: Make your first USD deposit!