A recent study examining nearly two years of data reveals a troubling trend within venture capital investments in altcoin projects between 2023 and 2024. Almost half of the 1,181 altcoin projects backed by venture capital have ceased operations. Despite support from major funds, 77% of these projects failed to generate even a thousand dollars in monthly revenue, demonstrating a significant challenge in achieving sustainable success. Large investment funds, such as those led by Polychain Capital, have also struggled, with more than three-quarters of their projects not yielding returns. Moreover, the size of the investment has had a direct impact on the chances of a project’s success. Specifically, one-third of ventures with investments below $50 million faced failure.

The Reality of Venture-Backed Altcoin Project Closures

The study highlights the challenges faced by projects supported by Polychain Capital, where 44% of projects were lost, and 76% failed to produce income. Similarly, former Binance Labs, now known as Yzi Labs, experienced a staggering 72% lack of revenue generation. Prestigious funds such as Circle, Delphi Ventures, Consensys, and Andreessen Horowitz also faced similar outcomes, with two out of every three investments disappearing from the market.

Despite the large portfolios that offered institutional prestige, they were inadequate in ensuring sustainable revenue. Projects earning less than a thousand dollars per month constituted 77% of all altcoin ventures during this period. Increasingly harsh market conditions, regulatory pressures, and a shrinking user base have made these ventures increasingly vulnerable. Consequently, investors have shifted their focus from growth to cash flow, hastening the closure of funding opportunities for early-stage projects.

Angel Investors Confront the Zombie Project Truth

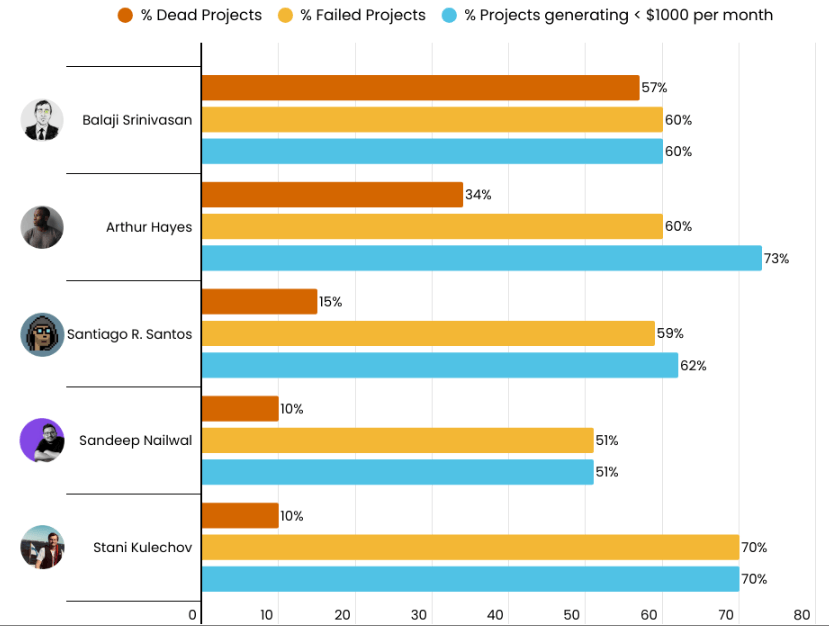

For angel investors, the scenario was even more stark. Among projects supported by former Coinbase CTO Balaji Srinivasan, 57% became “zombie” projects. Arthur Hayes experienced a 34% rate of projects turning stagnant, while Santiago Santos presented a relatively more robust portfolio with only 15% at risk. Meanwhile, investments by Sandeep Nailwal and Stani Kulechov saw a closure rate of just 10%.

Zombie Altcoin Projects

Zombie Altcoin Projects

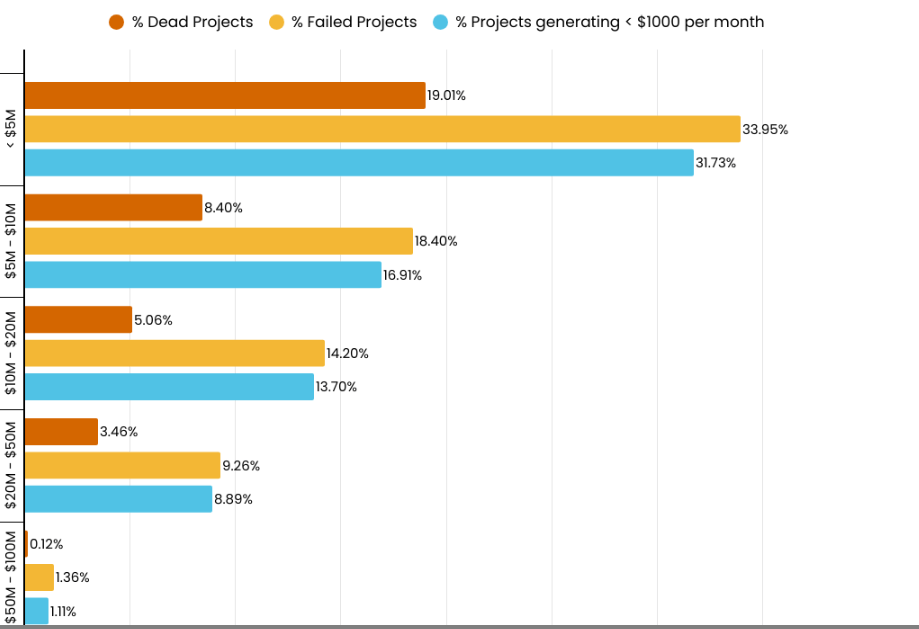

The data confirms a strong correlation between the size of the funding round and the likelihood of survival. Altcoin projects securing over $50 million in funding exhibited significantly lower failure rates. In contrast, ventures that raised less than $5 million faced severe challenges, with one-third facing bankruptcy and one-fifth quietly ceasing operations. For projects whose share in the venture capital market shrank, disappearing from the spotlight occurred even faster.

Altcoin Investments

Altcoin Investments

This research underscores the importance of not just financial investment but also the critical role of sustainable business models and timing in the cryptocurrency market . Investors and stakeholders must reassess these factors to navigate the challenging landscape successfully.