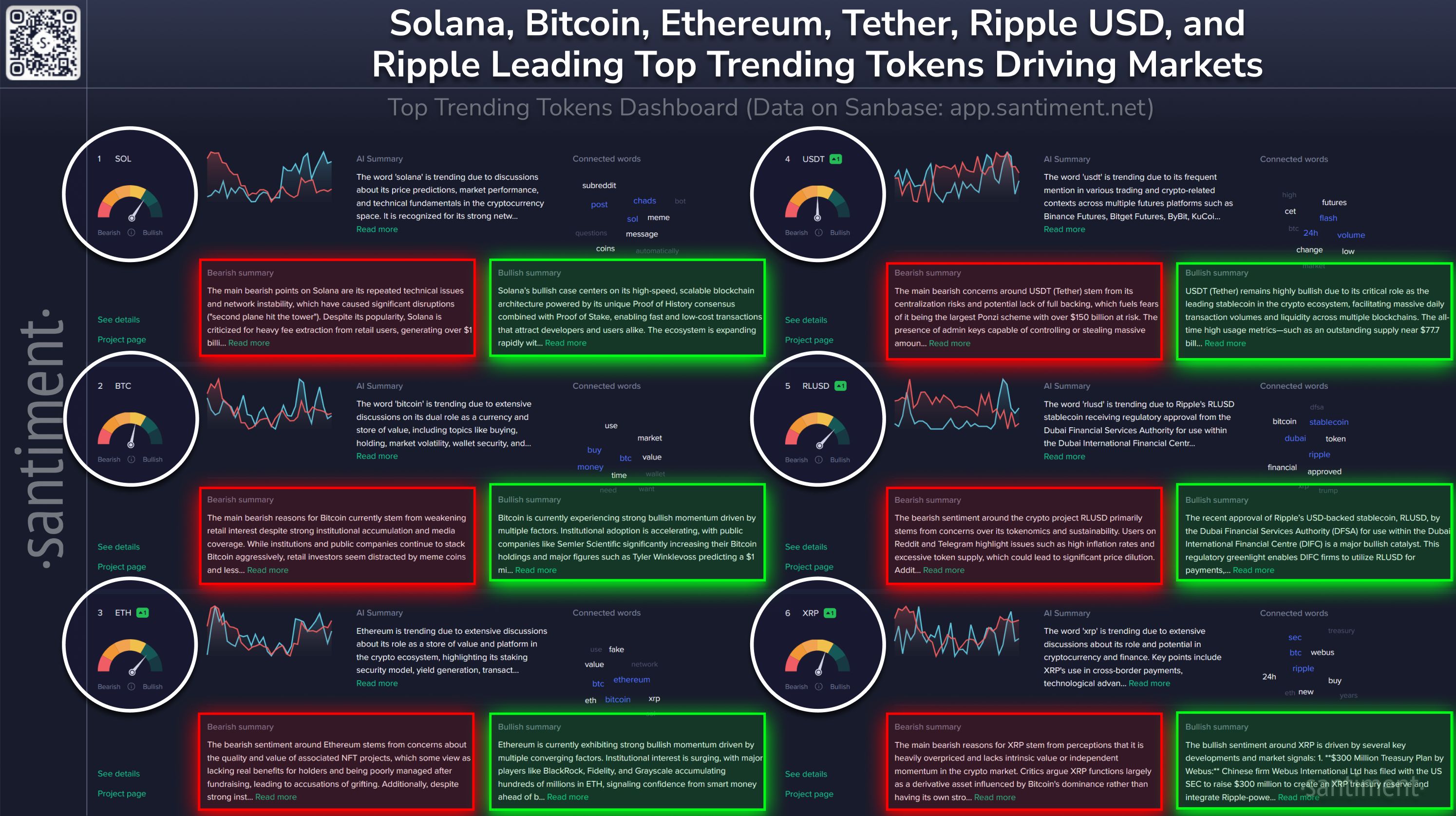

Trending Coins Dominated By Top Caps as Traders Await Crypto Breakouts

🗣️ The crypto assets generating the most hype across social media Wednesday include:

🪙 Solana $SOL: Trending due to discussions about its price predictions, market performance, and technical fundamentals in the cryptocurrency space. It is recognized for its strong network fundamentals, high transaction speeds, and a robust DeFi ecosystem with significant Total Value Locked (TVL). Solana is a Layer-1 blockchain supporting smart contracts and decentralized applications, backed by an active developer community and institutional interest. Market data such as current prices, market cap, trading volume, and whale activity highlight its investor relevance. On social media, Solana frequently appears in posts related to blockchain activities, liquidity metrics, market cap, holder counts, NFTs, and trading.

🪙 Bitcoin $BTC: Increased discussions on its dual role as a currency and store of value, including topics like buying, holding, market volatility, wallet security, and ETF impacts. Significant developments such as regulatory delays on Bitcoin ETFs, large transactions, treasury acquisitions by companies, new ETF filings, and involvement of prominent figures are also driving interest.

🪙 Ethereum $ETH: Trending due to extensive discussions about its role as a store of value and platform in the crypto ecosystem, highlighting its staking security model, yield generation, transaction volume, active addresses, and Layer 2 solutions. Institutional interest is rising, with major financial players like BlackRock, Fidelity, and Grayscale investing heavily in ETH, signaling bullish sentiment and growing prominence in the crypto market.

🪙 Tether $USDT: Mentioned with multiple futures platforms such as Binance Futures, Bitget Futures, ByBit, KuCoin, and OKX. It is associated with trading pairs, take-profit targets, entry prices, and transferability features. The texts also highlight 'flash usdt' as a transferable, tradeable, and convertible asset used in wallets, betting apps, and gaming sites, with multiple network supports like TRC20, BNB, ETH, and Solana.

🪙 Ripple USD $RLUSD: Trending due to Ripple's RLUSD stablecoin receiving regulatory approval from the Dubai Financial Services Authority for use within the Dubai International Financial Centre. This approval enables RLUSD to be integrated into Ripple's global payment services in Dubai and the UAE, facilitating payments, treasury management, real estate tokenization, and cross-border transfers.

🪙 XRP $XRP: Extensive discussions about its role and potential in cryptocurrency and finance. Key points include XRP's use in cross-border payments, technological advantages via the XRP Ledger, institutional adoption by Ripple's partners, and regulatory challenges. Recent news highlights a Chinese firm, Webus, filing with the US SEC to raise $300 million for an XRP treasury plan involving debt financing and integration with Ripple's payment system. There are also updates on Ripple's corporate activities, price predictions, and legal developments involving Ripple and the SEC.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

METUSDT now launched for pre-market futures trading

New spot margin trading pair — ZEN/USDT!

YBUSDT now launched for pre-market futures trading

(Sep25-Oct8) Winner List of Audience in Bitget Live Incentive Program