M2 Money Supply Hits Record High of $21.86 Trillion: Will Bitcoin Follow the Surge?

With the M2 money supply reaching an all-time high, investors are hopeful that Bitcoin may follow suit, driven by economic challenges and growing liquidity.

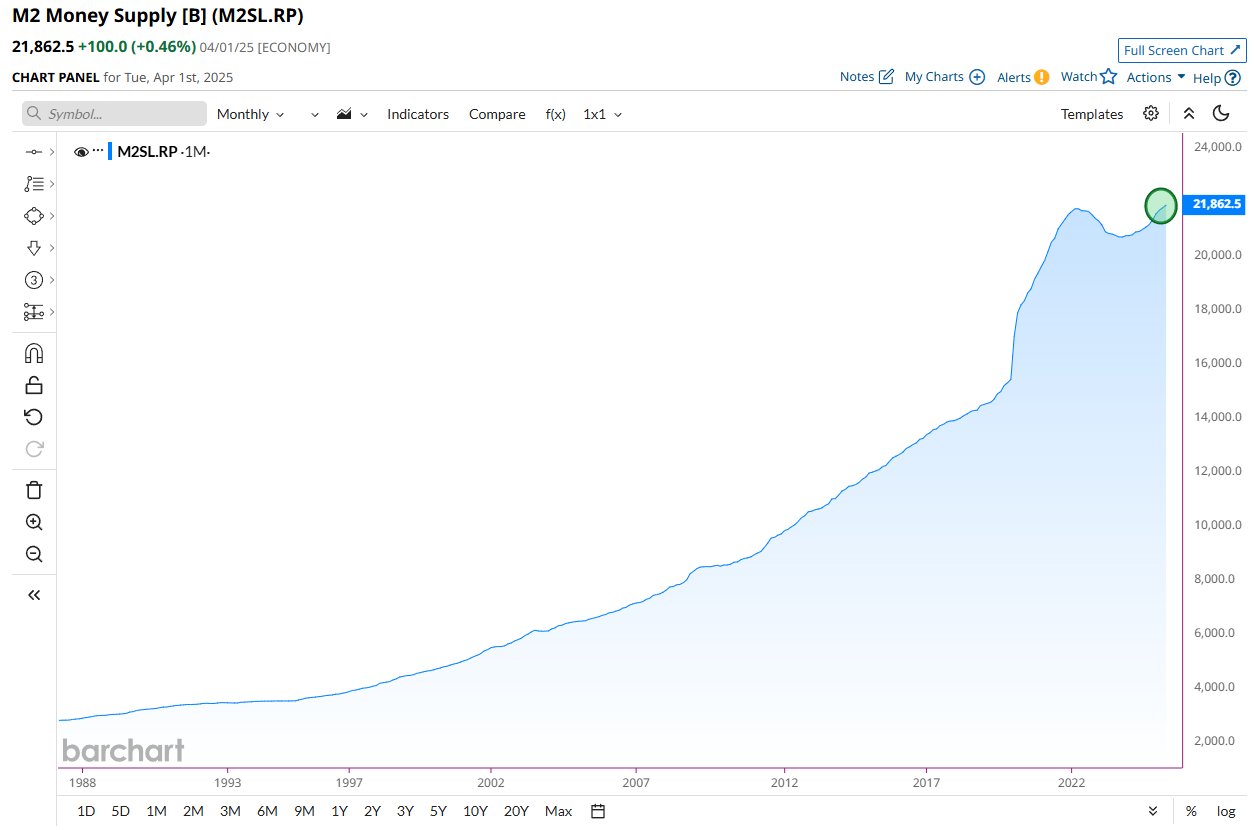

The M2 money supply has reached a record $21.86 trillion, sparking optimism among investors that Bitcoin (BTC) could soon mirror this upward trend.

This surge comes as the economy faces mounting pressures, with escalating national debt, soaring government spending, and rising inflationary concerns threatening financial stability.

How the Record $21.86 Trillion M2 Money Supply Could Impact Bitcoin

For context, the M2 money supply measures the total amount of money circulating within the economy. It includes M1 (cash and checking deposits), savings accounts, time deposits, and mutual funds.

According to the latest data from Barchart, the metric has peaked at an all-time high of $21.86 trillion.

M2 Money Supply Performance. Source:

Barchart

M2 Money Supply Performance. Source:

Barchart

The recent surge aligns with broader economic challenges in the US. A pseudonymous analyst named Tech Lead recently shared his insights on X (formerly Twitter). He highlighted that the US debt-to-GDP ratio has reached historically high levels.

Net interest payments now account for 20% of federal revenue, placing significant strain on the budget. Additionally, the analyst pointed out that government spending continues to outpace revenue.

“M2 money supply surging to all-time highs. Money printer is on,” he added.

Nonetheless, experts are increasingly optimistic about Bitcoin’s prospects in light of this data. Their view is supported by historical trends showing a strong correlation between M2 growth and Bitcoin’s price.

“On average, M2 Global Money Supply tends to lead BTC price by around 12 weeks. Recently, M2 hit a new all-time high of $21.86 trillion. That strongly suggests BTC may follow suit in the coming months,” Weiss Crypto stated.

Analyst Tech Lead corroborated the sentiment.

“There’s a lot of mixed signals, but the only one that really matters is liquidity. Follow the money,” he said.

But why does Bitcoin rise with M2? Well, as M2 expands, it can erode the value of fiat currencies, driving investors toward Bitcoin as a store of value. More liquidity in the market also encourages speculation.

Furthermore, lower interest rates make traditional investments less attractive, increasing demand for Bitcoin and pushing its price higher.

“When you follow Global M2 money supply, you realize everything else is just noise,” investor James Wynn posted.

Besides these factors, mathematician and analyst Fred Krueger highlighted BTC’s potential amid these market conditions. He noted that since 2000, the global money supply and US debt have been growing at a consistent rate of 8%.

However, the analyst stressed that Bitcoin stands out as an asset that not only retains its value but also grows at a much higher rate, making it an attractive alternative.

“Basically, we have a ‘leaky bucket’ that loses 8% of its value a year. Stocks almost make up for it. Not after taxes. Housing does not make up for it. At all. Bitcoin doesn’t leak and is growing 40% per year,” Krueger posted.

These factors paint a bullish picture for the largest cryptocurrency, which has faced a correction after peaking at an all-time high of $111,917 on May 22.

Bitcoin Price Performance. Source:

BeInCrypto

Bitcoin Price Performance. Source:

BeInCrypto

BeInCrypto data showed that BTC has declined by 2.9% over the past week. At press time, it traded at $104,529, marking a 0.8% decline over the past day.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Stunning $204 Million USDT Transfer Ignites Market Speculation