Bitcoin Flashing Bearish Signal After Failing To Break Above Major Resistance, Says Crypto Trader – Here Are His Targets

A closely followed crypto strategist believes that Bitcoin ( BTC ) is on the verge of a pullback after facing resistance at a key level.

Analyst Justin Bennett tells his 115,600 followers on the social media platform X that Bitcoin may be forming a bear flag pattern and decline more than 7% of its current value.

Bearish flag patterns are used in technical analysis to forecast abrupt moves to the downside. They are formed when price consolidates upwards after a strong downtrend, but fails to break a key support level.

“Here’s a different perspective of BTC with the same conclusion: April trend line break plus failure to hold $106,600 plus a potential bear flag below resistance. $97,000-$98,000 is the objective. $106,600-$106,800 is my invalidation. Simple.”

Source: Justin Bennett/X

Source: Justin Bennett/X

However, the analyst says Bitcoin may not dip below six figures if the stock market continues to rally, based on BTC’s historic correlation with stocks.

“The big wildcard with any bearish crypto stance is the US stock market. Without a pullback there, you have to wonder if we’ll get a further pullback here. Time will tell.”

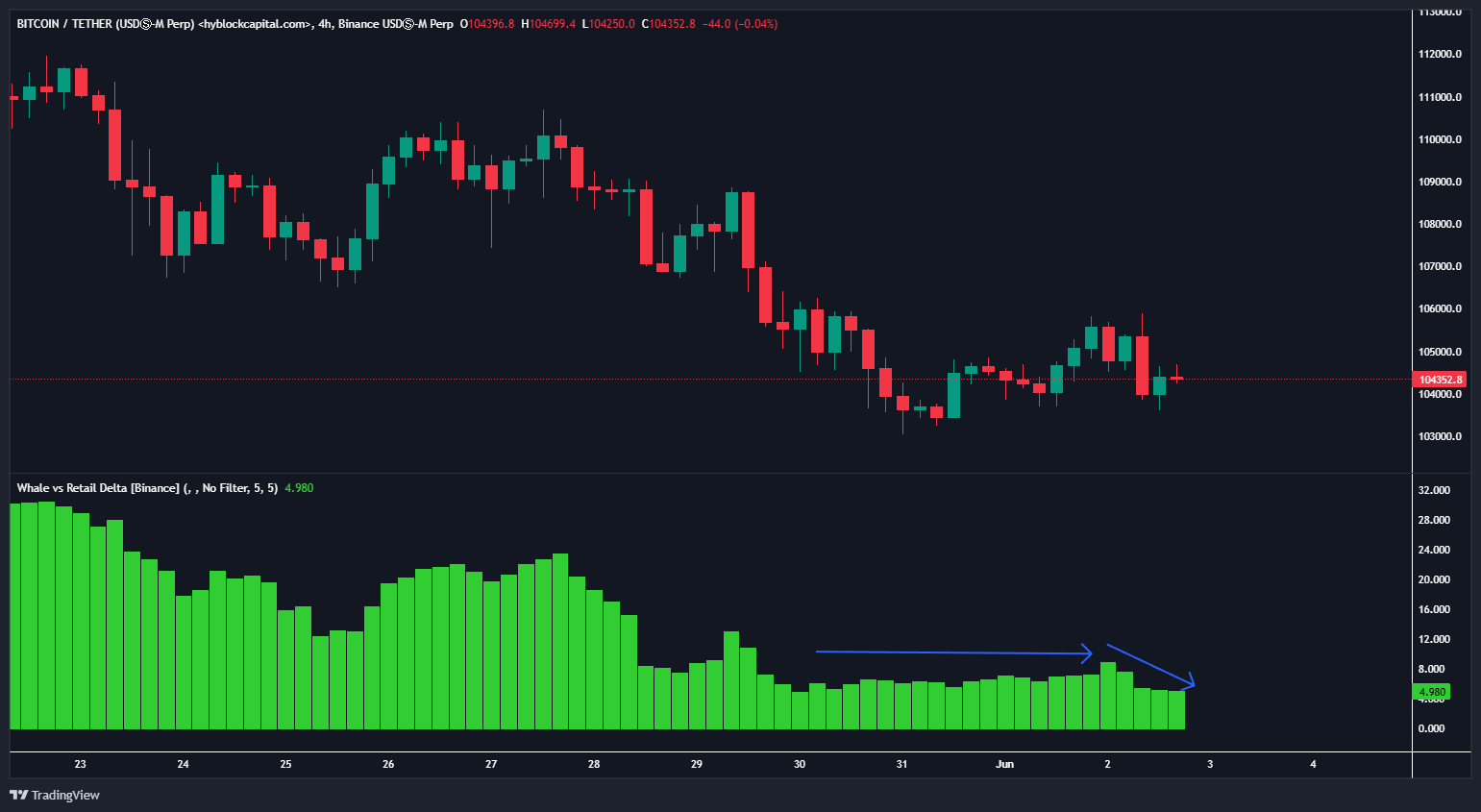

Lastly, the analyst says Bitcoin is flashing bearish based on the whale versus retail delta indicator (WRD), which gauges whether whales or retail traders are more bullish. A higher value means more whales are longer Bitcoin than retail traders.

The declining WRD value is bearish for Bitcoin since whales tend to be a better predictor of the market direction.

“Not a great sign for Bitcoin. The Hyblock Capital whale versus retail delta was trending sideways to slightly higher, but is back to trending lower again. Translation: whales are once again increasing their BTC short exposure versus retail.”

Source: Justin Bennett/X

Source: Justin Bennett/X

Bitcoin is trading for $105,069 at time of writing, down 1.2% in the last 24 hours.

Follow us on X , Facebook and TelegramDon't Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Surf The Daily Hodl Mix

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Subscribe to ETH Earn products for dual rewards exclusive for VIPs— Enjoy up to 10% APR and trade to unlock an additional pool of 50,000 USDT

Bitget Spot Margin Announcement on Suspension of SANTOS/USDT, MYRO/USDT, DUSK/USDT, PHB/USDT, ALPINE/USDT Margin Trading Services

CandyBomb x RAVE: Trade futures to share 200,000 RAVE!

Bitget TradFi: Trade gold, forex, and more assets in one account