How Sei Network Hit 600,000 Active Wallets Despite a 30% Token Slide

Sei Network’s active wallets soared past 600,000 as its ecosystem, led by gaming apps, continues to grow—even amid a sharp SEI price decline. Technical signals hint at a possible bullish reversal.

Sei Network, a high-speed Layer 1 blockchain, has just reached a remarkable milestone. The number of active wallets on its network has surpassed 600,000, the highest number in its history.

This growth comes as Sei’s ecosystem gains increasing attention from gaming and DeFi projects. However, the price of its native token, SEI, dropped more than 30% in May.

Why Is Sei Network’s Ecosystem Booming in Q2?

According to data from Flipside, Sei Network has attracted 17 million new addresses since January 2025, bringing the total number of active addresses to 26.8 million. Q2 has become Sei’s acceleration phase, with daily new address creation surpassing 330,000.

The surge in new addresses shows a strong influx of users joining the Sei ecosystem. As a result, Sei’s daily active wallet count reached a new peak, crossing 600,000.

Daily active wallet count on Sei Network. Source:

Flipside

Daily active wallet count on Sei Network. Source:

Flipside

New users also brought in fresh capital, driving Sei’s total value locked (TVL) to a new all-time high of over $550 million in May before adjusting to $471 million at the time of writing.

Sei Network is known as a high-speed blockchain designed to optimize performance and scalability. It’s particularly suitable for applications that require fast transactions, such as high-frequency trading and on-chain gaming.

On-chain gaming is now a major driver of Sei Network’s growth. Data from DappRadar shows that the most active DApps on Sei are gaming projects. Titles like World of Dypians, Hot Spring, and Archer Hunter have attracted large user bases.

“A lot of Sei Games = A lot of Unique Address Transactions. It is as simple as that, ” X handle Gaming On Sei said.

Despite the ecosystem’s strong development, the price of SEI has failed to reflect this growth. According to BeInCrypto, SEI’s price dropped more than 30% in May 2025. This decline has raised concerns among investors.

SEI token price performance over the past month. Source:

BeInCrypto

SEI token price performance over the past month. Source:

BeInCrypto

The drop came amid broader pressure on altcoins. Bitcoin dominance increased, and most investor attention remained focused on Bitcoin.

Still, some analysts remain optimistic about SEI’s prospects. Soroush Osivand, CEO of SSE Exchange, pointed out that SEI has formed an inverse head-and-shoulders pattern on the weekly chart. This is a technical signal that could suggest a trend reversal from bearish to bullish.

Technical analysis and SEI price forecast. Source:

Soroush Osivand

Technical analysis and SEI price forecast. Source:

Soroush Osivand

Despite the positive on-chain data, SEI’s price decline may affect investor sentiment, especially among those still on the sidelines. In a fiercely competitive Layer 1 market — with rivals like Solana, Aptos, and Sui — Sei must continue to innovate and attract major projects to maintain its position.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

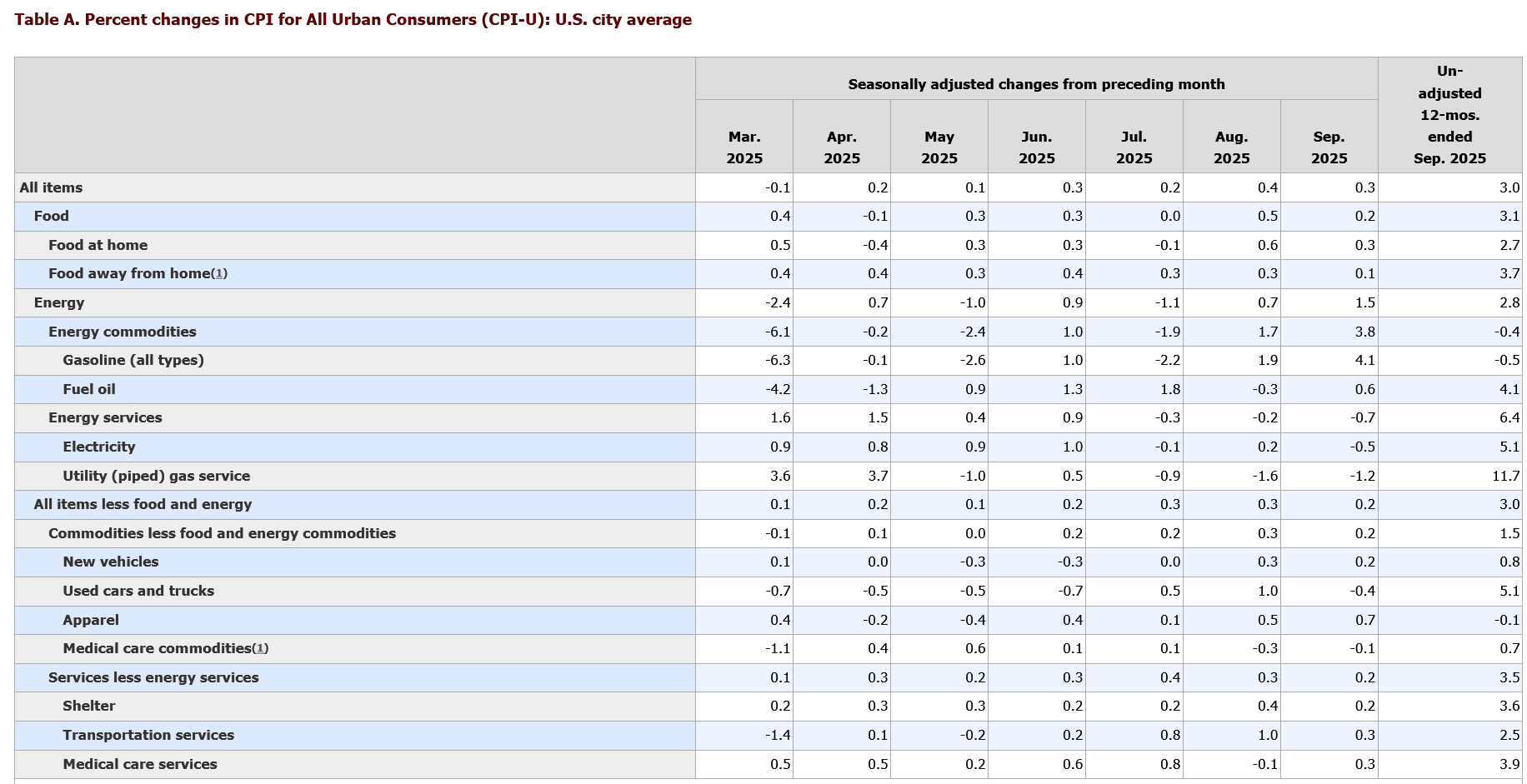

As inflation eases slightly, will XRP break its downward trend?

After several weeks of decline, XRP is finally showing signs of recovery as US inflation slightly cools.

XRP price eyes rally to $3.45 after Ripple CEO tells investors to ‘lock in’

Why is Prop AMM flourishing on Solana but still absent on EVM?

In-depth analysis of the technical barriers and EVM challenges faced by Prop AMM (Professional Automated Market Makers).

Zero Knowledge Proof Whitelist Coming Soon: Where Builders Find Purpose in the Next Blockchain Era