-

Ethereum’s MVRV metric continues to decline, signaling potential bearish momentum unless it surpasses the critical 1.90 threshold.

-

The altcoin recently experienced a sharp drop to $1,300 amid macroeconomic volatility, underscoring the fragility of its current consolidation phase.

-

Crypto analyst Burak Kesmeci highlights that without reclaiming key MVRV levels, Ethereum’s bullish prospects remain limited.

Ethereum’s MVRV decline and recent price volatility suggest bearish pressure; a rebound above 1.90 is crucial for renewed bullish momentum.

MVRV Momentum Dips Below Bullish Threshold, Indicating Weakening Ethereum Sentiment

Ethereum’s Market Value to Realized Value (MVRV) ratio has become a pivotal indicator in assessing the asset’s price trajectory. Currently, the MVRV Z-Score stands at approximately 1.21, reflecting a loss of upward momentum. This decline is significant because historical data shows that MVRV values above 1.90 are essential to confirm a bullish trend. When MVRV surpasses 3.00, Ethereum typically enters an overbought state, signaling potential profit-taking opportunities. However, the current failure to breach the 1.90 mark suggests investor caution and a lack of conviction in sustained price gains.

Source: X

Ethereum’s Relative Strength Index (RSI) has also declined sharply from 61 to 46, indicating a reduction in buyer enthusiasm and an increase in selling pressure. This aligns with the MVRV Z-Score’s downward trend, suggesting that holders are increasingly realizing profits as unrealized gains diminish. Such metrics collectively point to a cautious market environment where bullish momentum is fading.

Source: TradingView

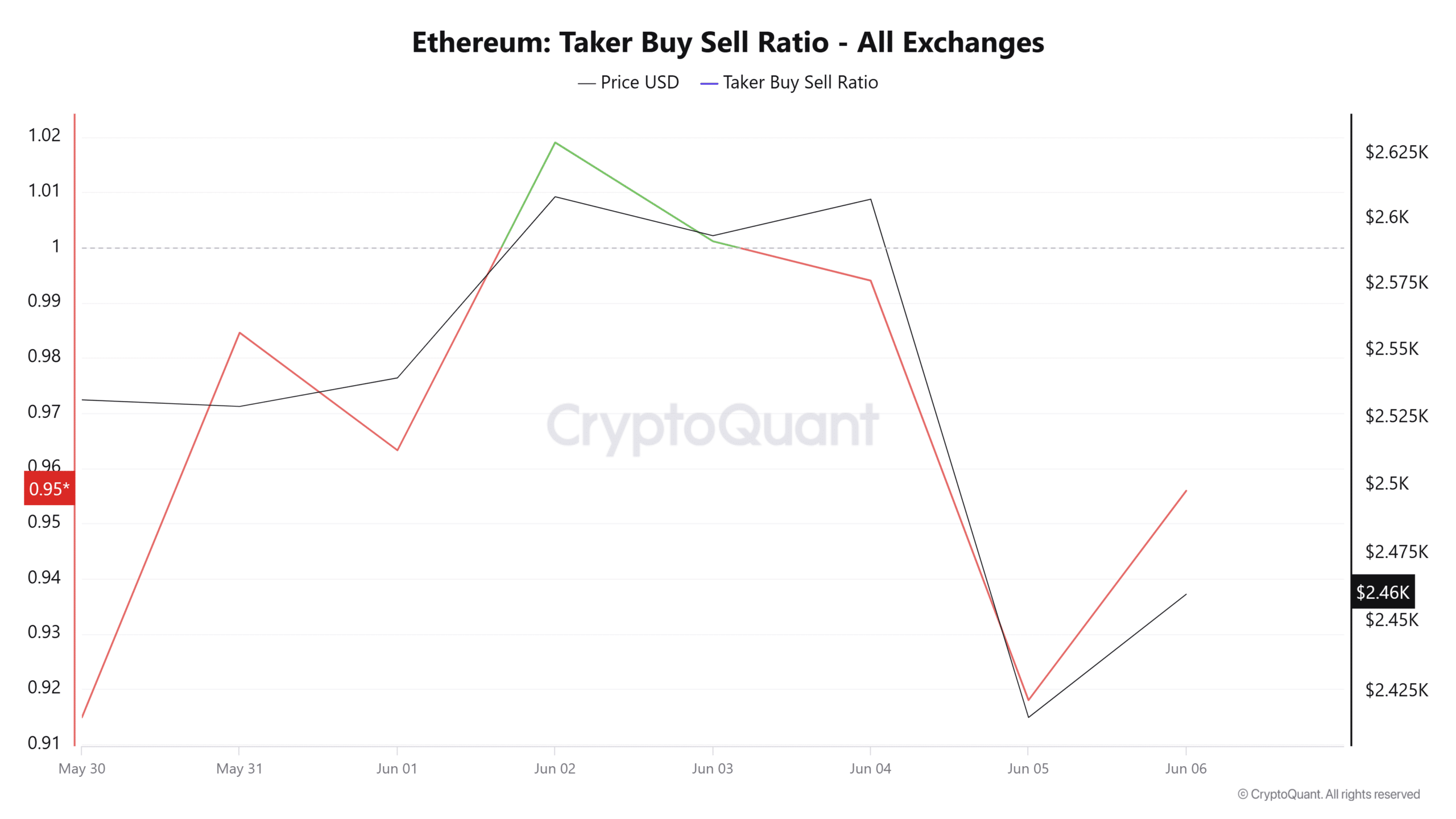

Taker Activity Confirms Bearish Market Structure for Ethereum

Supporting the bearish outlook, Ethereum’s Taker Buy-Sell Ratio has declined for two consecutive days, as reported by CryptoQuant. This metric, which measures the balance between aggressive buyers and sellers on exchanges, currently resides in negative territory. Such a trend indicates that sellers are exerting greater influence over the market, further undermining bullish recovery attempts. The persistent weakness in both spot and derivative markets continues to suppress the MVRV’s ability to rebound, reinforcing the likelihood of continued downside pressure unless a significant shift occurs.

Source: CryptoQuant

Future Outlook: Ethereum Faces Critical Support Levels Amidst Profit-Taking

Ethereum currently stands at a critical juncture, with its MVRV ratio hovering around 1.21 and showing signs of further decline. If the MVRV falls below 1.03, technical analysis suggests a potential price drop to approximately $2,323. Conversely, maintaining MVRV above this level could enable Ethereum to retest resistance near $2,700. However, for a sustained bullish breakout, the MVRV must climb back above 1.90, which would signal renewed investor confidence and stronger upward momentum.

Historically, Ethereum’s bull market peaks have corresponded with MVRV values between 2.9 and 3.4, indicating that the asset remains undervalued relative to previous cycles. Investors should monitor these key MVRV thresholds closely, as they provide critical insights into market sentiment and potential price action.

Conclusion

Ethereum’s current market dynamics, characterized by declining MVRV and RSI metrics alongside bearish taker activity, point to a cautious near-term outlook. Without reclaiming the crucial 1.90 MVRV level, sustained bullish momentum appears unlikely. Traders and investors should watch for MVRV movements around 1.03 and 1.90 to gauge potential price reversals or further downside risks. Maintaining vigilance on these indicators will be essential for navigating Ethereum’s evolving market landscape.