Macro Outlook for Next Week: CPI Data to Test Fed's Patience Again, Gold to Receive Directional Signal

According to Jinshi reports, this week, major U.S. stock indices closed higher, with the S&P 500 index hitting a more than three-month high on Friday. The Dow Jones index also rose to a three-month high. A better-than-expected non-farm payroll report eased market concerns about the economy, while Tesla (TSLA.O) rebounded from Thursday's sharp decline, and tech stocks continued to rise. However, as of June 4, U.S. stock funds experienced outflows for the third consecutive week due to ongoing concerns about U.S. trade policy. In commodities, gold prices saw significant declines on Thursday and Friday but still recorded an overall increase for the week, closing at $3,311.68 per ounce. Notably, despite the slightly better-than-expected increase in U.S. non-farm payrolls in May, Trump once again pressured the Federal Reserve on social media, urging a 100 basis point rate cut. Here are the key points the market will focus on in the new week: Monday 09:30, China's May CPI year-on-year; Monday 22:00, U.S. April wholesale sales month-on-month; Monday 23:00, U.S. May New York Fed 1-year inflation expectations; Tuesday, to be determined, China's May M2 money supply year-on-year; Tuesday 14:00, UK April three-month ILO unemployment rate, May unemployment rate, May jobless claims; Tuesday 15:10, ECB Governing Council member Villeroy speaks; Tuesday 18:00, U.S. May NFIB small business optimism index; Wednesday 20:30, U.S. May CPI data; Wednesday 22:30, U.S. EIA crude oil inventories, Cushing crude oil inventories, strategic petroleum reserve inventories for the week ending June 6; Thursday 14:00, UK April three-month GDP month-on-month, manufacturing output month-on-month; Thursday 14:00, UK April seasonally adjusted goods trade balance, industrial output month-on-month; Thursday 20:30, U.S. initial jobless claims for the week ending June 7, U.S. May PPI; Friday 14:00, Germany May CPI month-on-month final value; Friday 14:00, France May CPI month-on-month final value; Friday 22:00, U.S. June one-year inflation rate preliminary value, U.S. June University of Michigan consumer sentiment index preliminary value. The U.S. May CPI report to be released next Wednesday will test the market's optimism about rate cuts, as it may show a stall in the recent trend of declining inflation. In other economic data, the UK will release its three-month employment report ending in April next Tuesday, with the market watching for signs of more layoffs.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

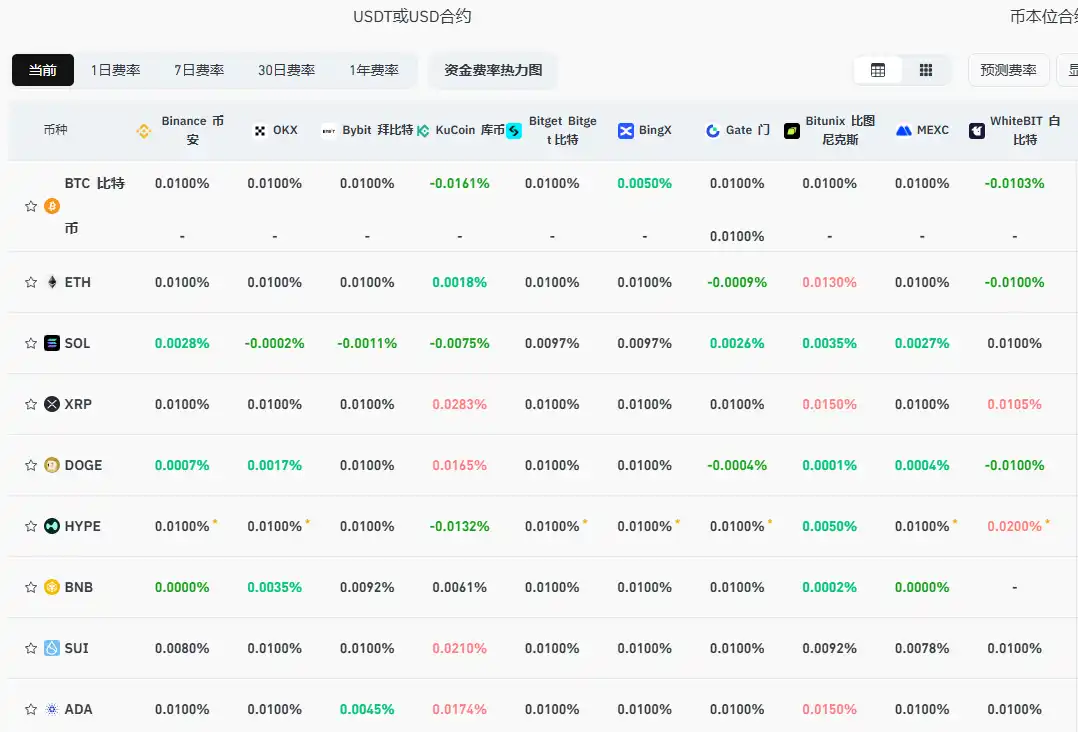

Current mainstream CEX and DEX funding rates indicate the market remains neutral

10x Research: Bitcoin exchange balances drop to six-year low