- Ethereum ETF-themed tokens are seeing price spikes despite low liquidity and incomplete project data, signaling high market speculation.

- Bitcoin-related funds experienced a $12M net outflow in early June, marking the first weekly decline since April amid regulatory uncertainty.

- Lava protocol now supports over 1 million users daily across 40+ chains, accelerating blockchain integration for developers and AI agents.

Ethereum-based ETF tokens are gaining fresh momentum in the crypto market just as Bitcoin products register their first weekly capital outflow in two months. As speculative interest surges across lesser-known ETF-themed tokens, volatility and high-volume trades are raising red flags about market stability.

Growing Interest in Ethereum-Based Investment Products

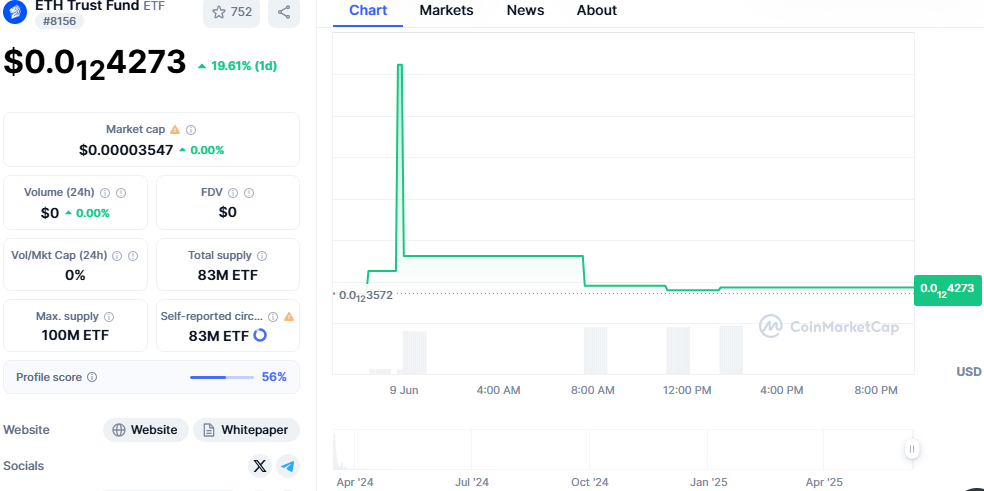

Ethereum-related exchange-traded fund (ETF) products are experiencing renewed momentum as multiple tokens mimicking Ethereum trust fund structures have shown notable price movements. One such token, ranked 8173 on CoinMarketCap, rose over 19% in the past 24 hours to trade at $0.0124273. Despite the sharp gain, the token recorded no visible trading volume or market capitalization movement.

Source : CoinMarketcap

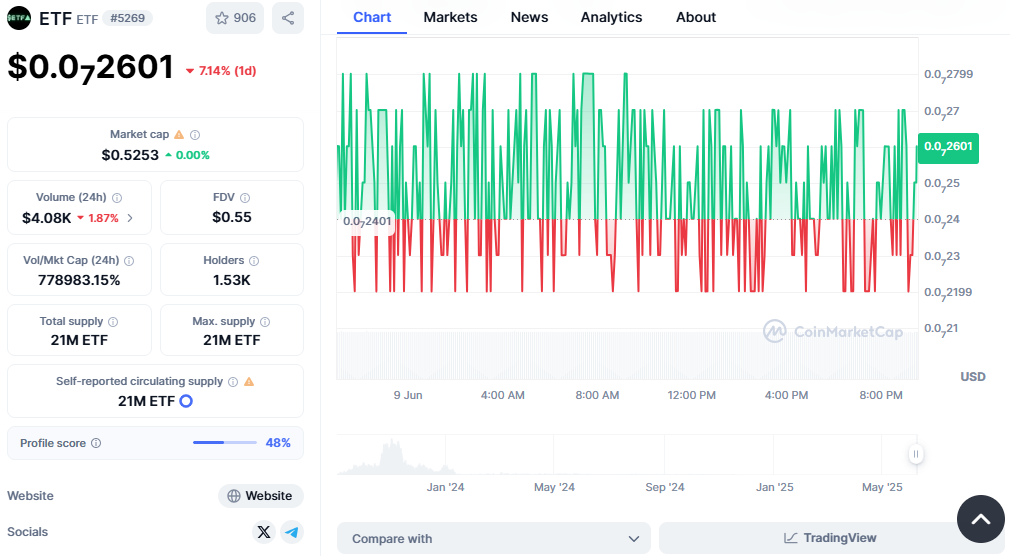

In the same time, another asset called token 5280 with a price of $0.072601 had a very small 0.02% drop on CoinMarketCap . Still, the game experienced a huge increase in trading, amounting to over $4,000 within 24 hours. The token’s high-volume-to-market cap ratio could mean there is a lot of speculative behavior, perhaps because of computer software that uses fast trading algorithms.

Volatility Dominates ETF-Themed Token Trading

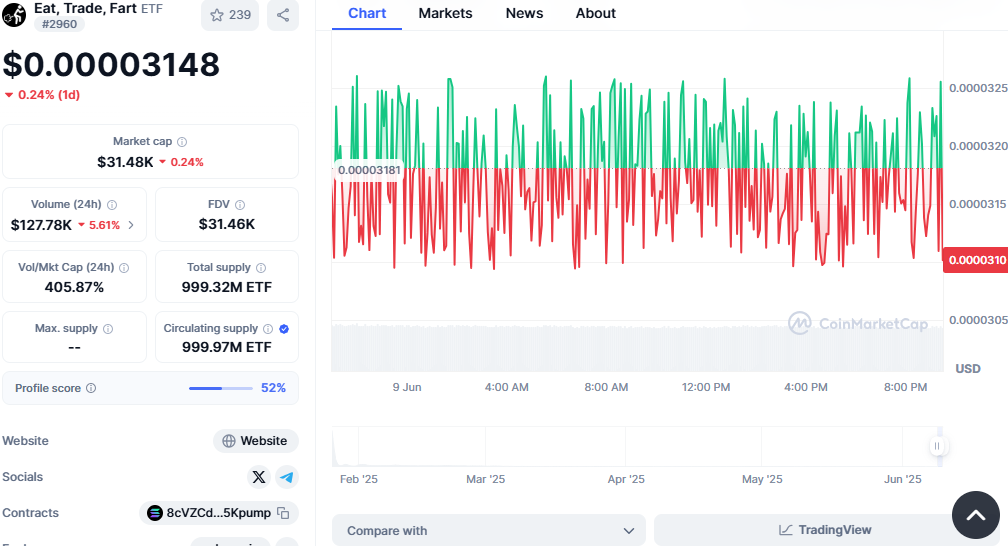

The price behavior across several ETF-named tokens reflects a pattern of sharp intraday fluctuations, often followed by periods of consolidation or decline. For instance, the 2960-ranked Eat, Trade, Fart (ETF) token on Solana has shown volatile chart behavior despite a modest daily gain of 1.12%.

Source: CoinMarketcap

Yet, the most striking thing is the amount of trading, which achieved $129.28K in the previous 24-hour period. This means that the volume of trading is more than 400% above the market cap, suggesting that a lot of traders are using short-term plans.

Bitcoin Records Net Outflow for the First Time Since April

Unlike Ethereum ETFs, there was a decline in Bitcoin investment products last week after two straight months of gains. A review of digital asset management firm data shows that institutions removed some $12 million from Bitcoin-related funds at the start of June.

Source : CoinMarketcap

The decline follows several consecutive weeks of positive inflows into Bitcoin products, coinciding with the approval and launch of spot Bitcoin ETFs earlier this year. With Ethereum-based tokens and ETF products gaining attention, capital appears to be rotating within the digital asset market.

Infrastructure Boost: Lava Enhances Blockchain Accessibility

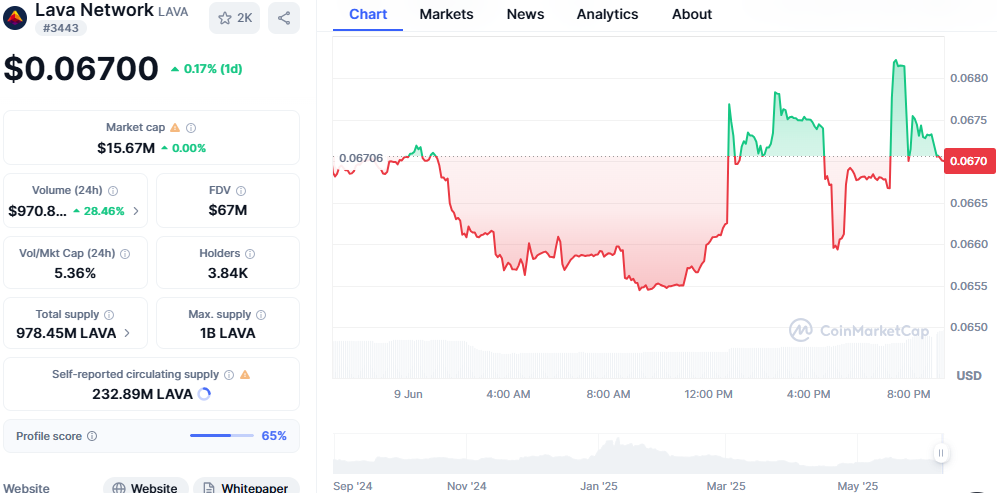

Parallel to the ETF market developments, infrastructure growth continues in the blockchain space. Lava, a protocol coordinating a global network of Remote Procedure Call (RPC) providers such as Alchemy, Blockdaemon, and Chainstack, has reported major usage milestones.

Source: CoinMarketCap

Lava’s permissionless and open-source model allows contributors to add support for new chains by defining JSON-based specifications. This flexibility significantly shortens the onboarding time for newer or less-resourced blockchains. Moreover, Lava integrates easily with development frameworks like web3.js, ethers.js, and cosm.js, making it easier for developers and AI agents to interact with blockchains in real time without intermediaries.

Speculative Activity Raises Concerns Over Token Stability

Ethereum ETF interest aligns with broader market shifts, the trading behavior observed in these tokens may pose risks to uninformed participants. Many of the tokens examined show low profile completion scores on CoinMarketCap, ranging from 48% to 56%, indicating incomplete project data or insufficient verification.

The extremely high volume-to-market cap ratios, erratic price charts, and low holder counts further suggest that these assets are subject to sudden price manipulation or instability.