Hyperliquid Hits New ATH Today: What's the Hype about HYPE?

HYPE Price Explodes to New Highs

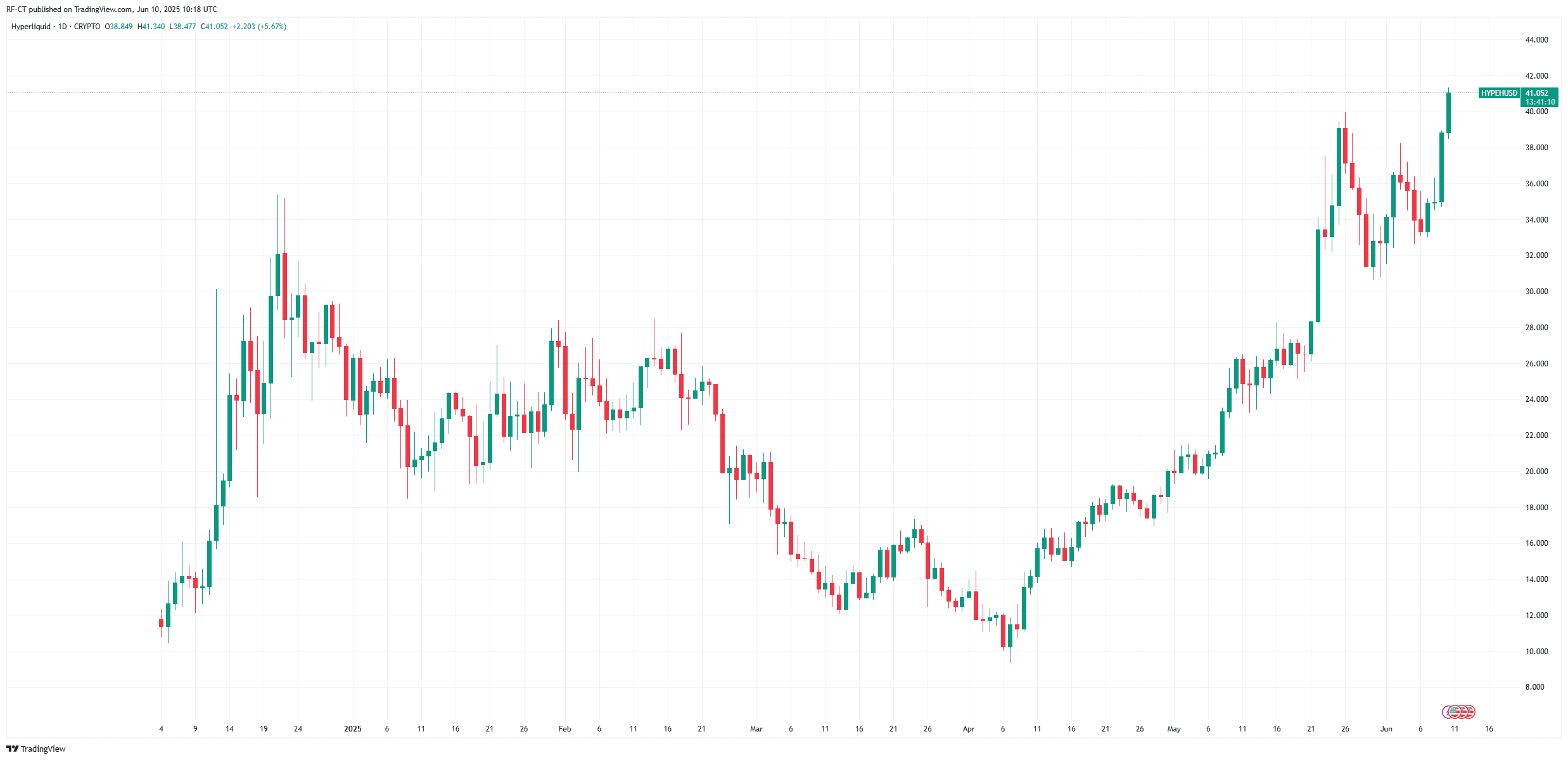

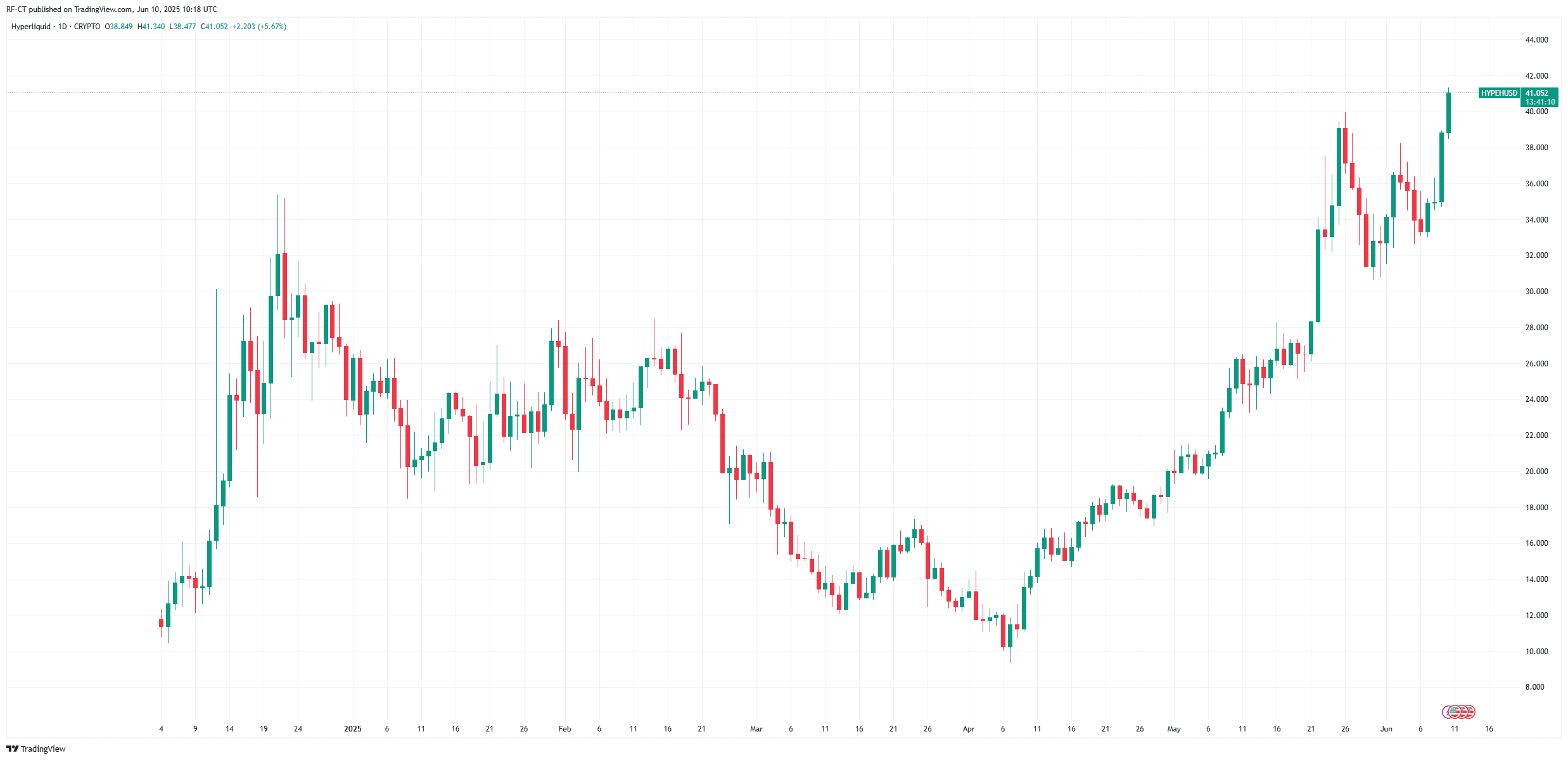

Hyperliquid (HYPE) is grabbing headlines today as it trades around $40.86, reaching an intraday high of $40.99. The surge marks a new all-time high (ATH) and comes amid intense market speculation and rising institutional interest. HYPE has gained over 12% in the last 24 hours, with over $430 million in trading volume, putting it firmly on the radar of crypto investors.

On-Chain Metrics Signal Explosive Growth

Hyperliquid’s fundamentals look as bullish as its chart :

- Total Value Locked (TVL) is estimated between $560 million and $1.46 billion, reflecting growing platform adoption.

- Futures Open Interest has hit over $1.7 billion, showing serious trader commitment to the platform.

- Stablecoin reserves exceed $3.6 billion, ensuring high liquidity and platform scalability.

These numbers paint a picture of a rapidly expanding Layer-1 ecosystem designed for high-throughput on-chain perpetual trading.

Whales Fueling the Fire

Institutional and whale activity is playing a major role in the recent price action:

- A single whale recently bought around 259,000 HYPE (worth nearly $10 million) at an average price of $38.46.

- The top 20 wallets hold approximately 24% of the platform’s open interest, currently totaling over $2.1 billion across more than 300,000 traders.

While this boosts momentum, it also introduces the risk of price swings if large holders begin offloading.

Buybacks and Tokenomics: A Unique Strategy

Hyperliquid stands out with its aggressive buyback strategy:

- The protocol uses ~97% of daily trading revenue to buy back HYPE tokens from the market—roughly $1 million daily.

- More than $850 million worth of tokens have already been repurchased and effectively removed from circulation.

- This tightens supply while demand increases, reinforcing HYPE’s bullish structure.

The token has a max supply of 1 billion, with ~333 million currently circulating. There’s also an active burn mechanism, and emissions are scheduled to taper through 2027–28.

By TradingView - HYPEHUSD_2025-06-10 (All)

By TradingView - HYPEHUSD_2025-06-10 (All)

Real Utility: Beyond the Speculation

HYPE isn’t just a speculative asset —it powers the Hyperliquid Layer-1 blockchain, a high-performance decentralized exchange (DEX) offering on-chain order books for perpetual futures trading.

Token use cases include:

- Staking and governance

- Fee reduction and rewards

- Liquidity incentives for ecosystem dApps

Its infrastructure is designed to process over 100,000 orders per second, with finality times under 1 second—making it one of the fastest DEX systems currently available.

HYPE Price Outlook: Bullish but Cautious

After breaking its ATH, HYPE appears to be entering price discovery mode , with traders eyeing $46 as the next key psychological level. Support levels sit around $32–$35, and any retracement into this zone could offer new entry points.

However, reliance on whale behavior and sustained trading volume makes it sensitive to external shifts.

By TradingView - HYPEHUSD_2025-06-10 (5D)

By TradingView - HYPEHUSD_2025-06-10 (5D)

Key Risks to Watch

- High concentration of holdings could lead to volatility if whales exit positions.

- Revenue-driven buybacks mean token strength is closely tied to platform usage—any volume drop could dampen price support.

HYPE has lived up to its name —rising on strong fundamentals, smart tokenomics, and major trader interest. Whether you’re a momentum trader or a long-term believer in on-chain futures infrastructure, Hyperliquid is a project worth watching.

$HYPE, $Hyperliquid

HYPE Price Explodes to New Highs

Hyperliquid (HYPE) is grabbing headlines today as it trades around $40.86, reaching an intraday high of $40.99. The surge marks a new all-time high (ATH) and comes amid intense market speculation and rising institutional interest. HYPE has gained over 12% in the last 24 hours, with over $430 million in trading volume, putting it firmly on the radar of crypto investors.

On-Chain Metrics Signal Explosive Growth

Hyperliquid’s fundamentals look as bullish as its chart :

- Total Value Locked (TVL) is estimated between $560 million and $1.46 billion, reflecting growing platform adoption.

- Futures Open Interest has hit over $1.7 billion, showing serious trader commitment to the platform.

- Stablecoin reserves exceed $3.6 billion, ensuring high liquidity and platform scalability.

These numbers paint a picture of a rapidly expanding Layer-1 ecosystem designed for high-throughput on-chain perpetual trading.

Whales Fueling the Fire

Institutional and whale activity is playing a major role in the recent price action:

- A single whale recently bought around 259,000 HYPE (worth nearly $10 million) at an average price of $38.46.

- The top 20 wallets hold approximately 24% of the platform’s open interest, currently totaling over $2.1 billion across more than 300,000 traders.

While this boosts momentum, it also introduces the risk of price swings if large holders begin offloading.

Buybacks and Tokenomics: A Unique Strategy

Hyperliquid stands out with its aggressive buyback strategy:

- The protocol uses ~97% of daily trading revenue to buy back HYPE tokens from the market—roughly $1 million daily.

- More than $850 million worth of tokens have already been repurchased and effectively removed from circulation.

- This tightens supply while demand increases, reinforcing HYPE’s bullish structure.

The token has a max supply of 1 billion, with ~333 million currently circulating. There’s also an active burn mechanism, and emissions are scheduled to taper through 2027–28.

By TradingView - HYPEHUSD_2025-06-10 (All)

By TradingView - HYPEHUSD_2025-06-10 (All)

Real Utility: Beyond the Speculation

HYPE isn’t just a speculative asset —it powers the Hyperliquid Layer-1 blockchain, a high-performance decentralized exchange (DEX) offering on-chain order books for perpetual futures trading.

Token use cases include:

- Staking and governance

- Fee reduction and rewards

- Liquidity incentives for ecosystem dApps

Its infrastructure is designed to process over 100,000 orders per second, with finality times under 1 second—making it one of the fastest DEX systems currently available.

HYPE Price Outlook: Bullish but Cautious

After breaking its ATH, HYPE appears to be entering price discovery mode , with traders eyeing $46 as the next key psychological level. Support levels sit around $32–$35, and any retracement into this zone could offer new entry points.

However, reliance on whale behavior and sustained trading volume makes it sensitive to external shifts.

By TradingView - HYPEHUSD_2025-06-10 (5D)

By TradingView - HYPEHUSD_2025-06-10 (5D)

Key Risks to Watch

- High concentration of holdings could lead to volatility if whales exit positions.

- Revenue-driven buybacks mean token strength is closely tied to platform usage—any volume drop could dampen price support.

HYPE has lived up to its name —rising on strong fundamentals, smart tokenomics, and major trader interest. Whether you’re a momentum trader or a long-term believer in on-chain futures infrastructure, Hyperliquid is a project worth watching.

$HYPE, $Hyperliquid

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

China Renaissance to Raise $600 Million for U.S.-Listed Fund Focused on BNB Accumulation Strategy

Bitcoin and Crypto Serve the Same Purpose as Gold, BlackRock CEO Larry Fink Says

Rising Crypto Adoption in Emerging Markets: Nigeria, China, and India Lead the Way

Altcoins Surge as Bitcoin Dominance Drops Post-Tariffs

Bitcoin dominance falls sharply after tariffs crash, with altcoins now leading the market in performance.Altcoins Take the Lead in Post-Crash RecoveryWhy Bitcoin Dominance Is FallingWhat This Means for Traders and Investors