Société Générale-Forge Debuts USD-Pegged Stablecoin on Ethereum and Solana

Société Générale-Forge (SG-Forge), the crypto division of French banking giant Société Générale, has unveiled a new stablecoin pegged to the U.S. dollar, marking its latest foray into the digital asset space.

Société Générale-Forge (SG-Forge), the crypto division of French banking giant Société Générale, has unveiled a new stablecoin pegged to the U.S. dollar, marking its latest foray into the digital asset space.

The stablecoin, named USD CoinVertible (USDCV), will be issued on both Ethereum and Solana blockchains.

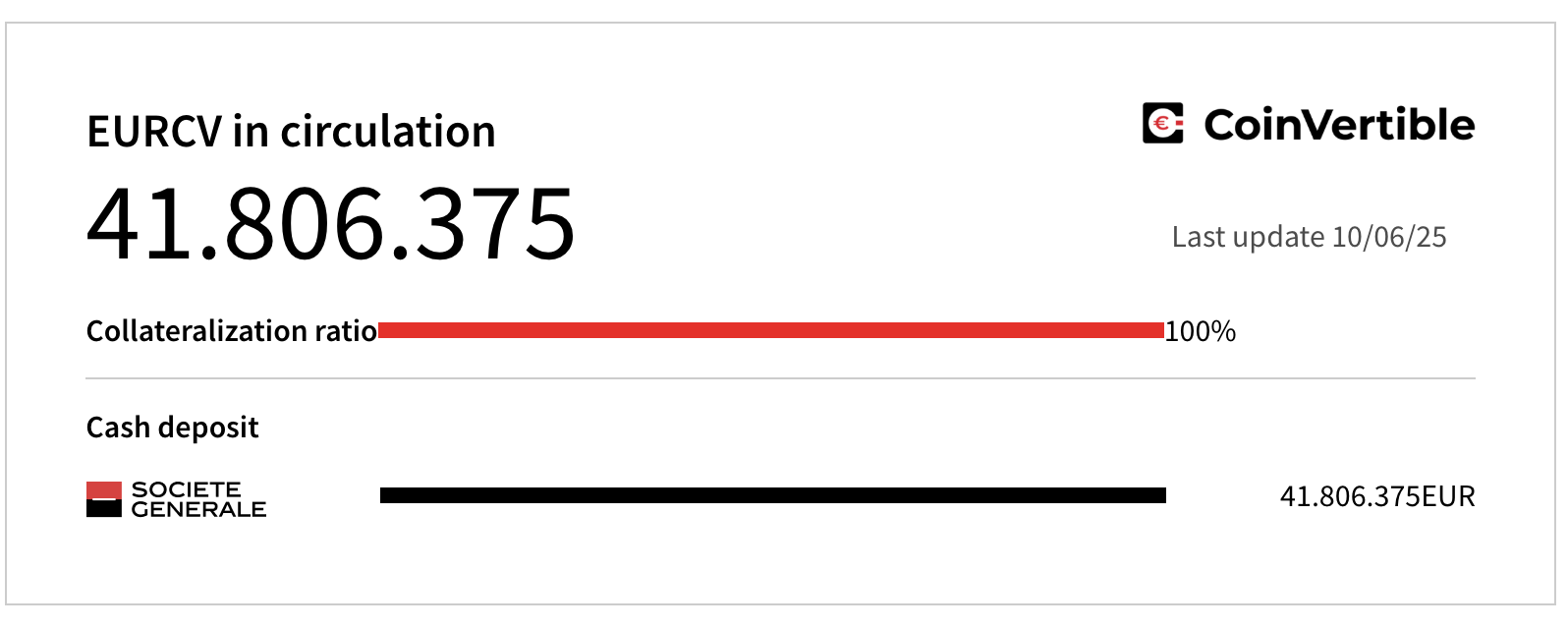

According to the June 10 announcement , Bank of New York Mellon, one of the oldest and most respected financial institutions in the United States, will serve as the custodian of the reserves backing the token. This launch builds on SG-Forge’s previous move in April 2023, when it introduced a euro-denominated stablecoin, EUR CoinVertible (EURCV), for institutional clients.

Source

: Société Générale-Forge

Source

: Société Générale-Forge

The firm states that both USDCV and EURCV aim to facilitate real-time transaction settlements and seamless 24/7 conversions between fiat currencies and digital assets . Use cases for the stablecoins span crypto trading, cross-border payments, foreign exchange, onchain settlements, and treasury management.

SG-Forge confirmed that the stablecoins would be listed on various crypto exchanges and accessible to institutional, corporate, and retail investors via brokers and payment platforms. Trading for USDCV is expected to begin in July. However, the firm clarified that neither USDCV nor EURCV will be available to U.S. residents.

The rollout comes at a time when stablecoins are experiencing rapid global adoption spurred by increased regulatory clarity. A recent industry report revealed that over $94 billion in stablecoin transactions occurred between January 2023 and February 2025.

Global developments underscore the momentum: South Korea is advancing legislation to support local stablecoin issuance, fulfilling a key promise from President Lee Jae-myung. Meanwhile, in the U.S., impending regulations are reportedly prompting tech giants such as Apple, X, and Airbnb to explore the integration of stablecoins.

Signs of adoption are emerging elsewhere as well. In Bolivia, airport shops have been spotted listing prices in Tether’s USDt (USDT), following a local bank’s move to offer USDT custody last year. Stripe rolled out stablecoin-powered accounts to users in over 100 countries, marking a major leap in digital finance adoption, especially in regions grappling with inflation and limited banking access.

If you want to read more news articles like this, visit DeFi Planet and follow us on Twitter , LinkedIn , Facebook , Instagram , and CoinMarketCap Community.

“Take control of your crypto portfolio with MARKETS PRO, DeFi Planet’s suite of analytics tools.”

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

New spot margin trading pair — HOLO/USDT!

FUN drops by 32.34% within 24 hours as it faces a steep short-term downturn

- FUN plunged 32.34% in 24 hours to $0.008938, marking a 541.8% monthly loss amid prolonged bearish trends. - Technical breakdowns, elevated selling pressure, and forced liquidations highlight deteriorating market sentiment and risk-off behavior. - Analysts identify key support below $0.0080 as critical, with bearish momentum confirmed by RSI (<30) and MACD indicators. - A trend-following backtest strategy proposes short positions based on technical signals to capitalize on extended downward trajectories.

OPEN has dropped by 189.51% within 24 hours during a significant market pullback

- OPEN's price plummeted 189.51% in 24 hours to $0.8907, marking its largest intraday decline in history. - The token fell 3793.63% over 7 days, matching identical monthly and yearly declines, signaling severe bearish momentum. - Technical analysts cite broken support levels and lack of bullish catalysts as key drivers of the sustained sell-off. - Absence of stabilizing volume or reversal patterns leaves the market vulnerable to further downward pressure.

New spot margin trading pair — LINEA/USDT!