- Hyperliquid hits an all-time high of $42.07, showing strong market growth and engagement.

- Open interest of HYPE hits $1.89B, with daily fees surpassing Ethereum and Solana.

- ADA struggles below $0.72 level while HYPE’s growth positions it as a top 10 contender.

Hyperliquid (HYPE) has been soaring high, and it has recently reached an all-time high of $42.07 on June 11, 2025. The token has experienced remarkable growth of 2.51% in a single trading session, with an upward trend. A week-long growth of 13.97% has characterized the current trend of HYPE. This places it in direct rivalry with other established cryptocurrencies such as Cardano (ADA).

HYPE’s Surge: Record High Futures and Skyrocketing Fees

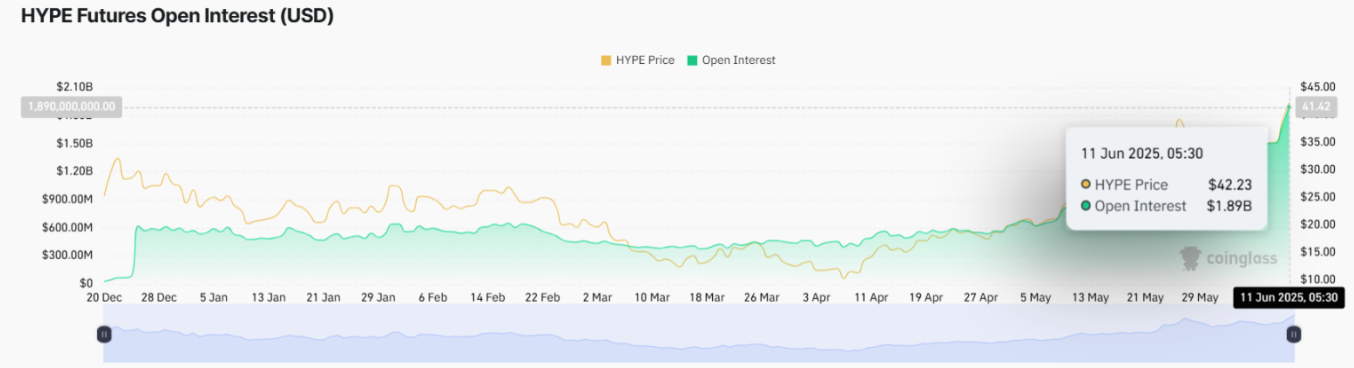

The emergence of HYPE is not accompanied by mere market speculation. The main contributors to this rise are high on-chain performance and growing user interest. According to Coinglass data, HYPE futures have reached a new record high, with open interest increasing to $1.89 billion, indicating growing speculative demand for the token.

Source: Coinglass

Source: Coinglass

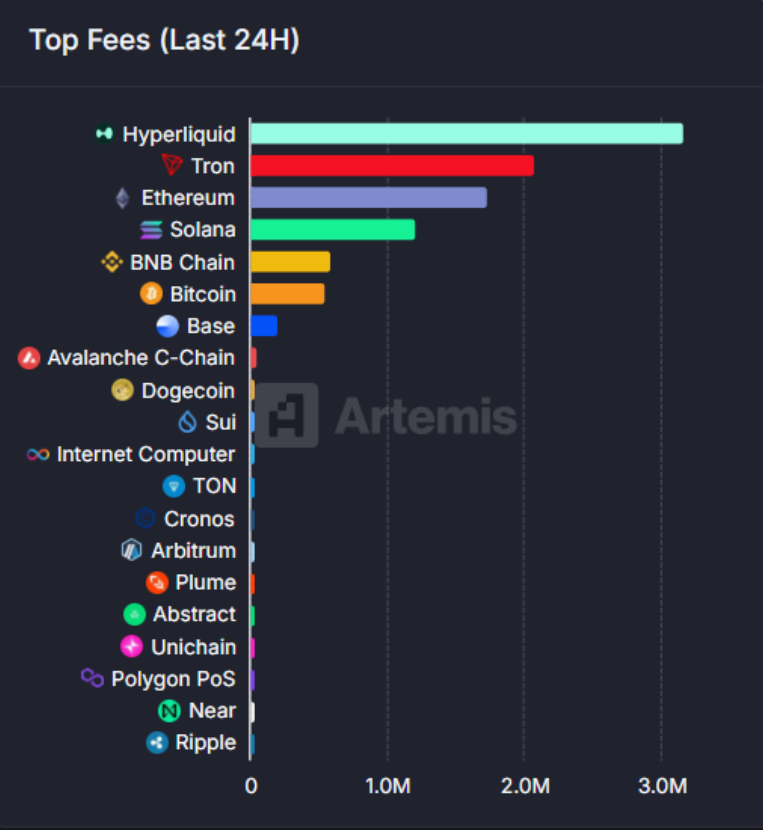

Furthermore, daily fees on the platform have skyrocketed to $2.99 million, surpassing those of Ethereum and Solana. Such an increase in fees signifies an increase in users and usage of the protocol and is another notch of credibility for the expanding ecosystem of Hyperliquid.

Source: Artemis

Source: Artemis

Cardano Struggles to Break $0.72 Resistance Despite Modest Gains

Meanwhile, Cardano (ADA) has experienced less impressive fluctuations. Despite the 3.38% increase over the last day, the price of ADA is yet to break above the important resistance areas. ADA is currently trading at approximately $0.71, indicating that it is having difficulty surpassing the $0.72 mark.

The technical indicators of Cardano are divergent. The price is currently above the 20-period and 50-period Exponential Moving Averages, indicating a short-term bullish trend. However, it remains below the 100-period MA, which acts as a resistance, signaling a potential challenge for further upward movement. The relative strength index (RSI) of ADA is 52.10, indicating that this is neither an overbought nor an oversold asset, and hence a period of consolidation.

Source: TradingView

Source: TradingView

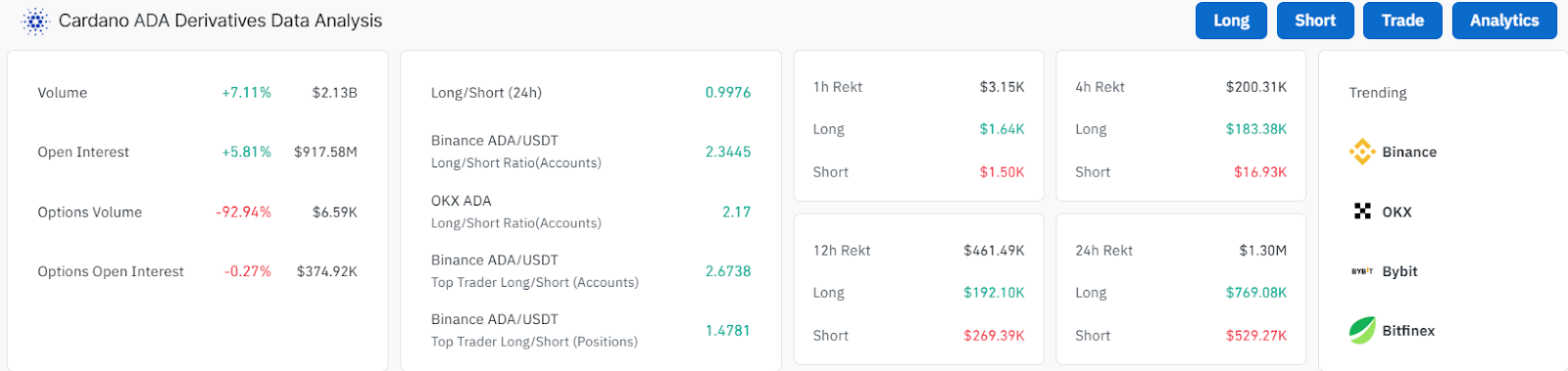

According to Coinglass data, the trading volume of ADA moderately increased, by 7.11%, to reach $2.13B, and its open interest also rose by 5.81% to $917.58M. Nevertheless, amid these advances, the price of ADA is still consolidating as it attempts to overcome crucial resistance areas.

Source: Coinglass

Source: Coinglass

Whereas ADA has registered relatively slight improvements, HYPE is growing steadily and has a high open interest and volume, making it a formidable competitor to ADA in the top 10. Considering the present momentum of HYPE , it may overtake ADA and become one of the top cryptocurrencies in the near future.

Disclaimer: The information presented in this article is for informational and educational purposes only. The article does not constitute financial advice or advice of any kind. Coin Edition is not responsible for any losses incurred as a result of the utilization of content, products, or services mentioned. Readers are advised to exercise caution before taking any action related to the company.